What Is the Average Home Value Increase Per Year?

- Published on

- 9 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

In recent years, U.S. homeowners have enjoyed a remarkable surge in home values. In the past four years, home prices have jumped by nearly 50%. But not every year produces the same appreciation growth. So what is the average home value increase per year?

In this post, we’ll look at average yearly increases, explore the factors driving home appreciation, how to calculate your home’s value, and how to leverage your equity as you plan your next financial move.

What is home appreciation?

Home appreciation refers to the increase in a property’s value over time. It’s driven by a combination of market conditions, buyer demand, and property improvements. It can be beneficial for homeowners and investors, as it can lead to:

- Higher equity: A higher home value can increase the amount of equity in a home.

- Larger profits: When a home is sold, a higher value can lead to a larger profit.

- Increased rental income: For investors, a higher home value can lead to increased monthly rental income.

While most homes naturally appreciate over the years, factors like location, nearby developments, and overall economic conditions also play a significant role.

What is the average home value increase per year?

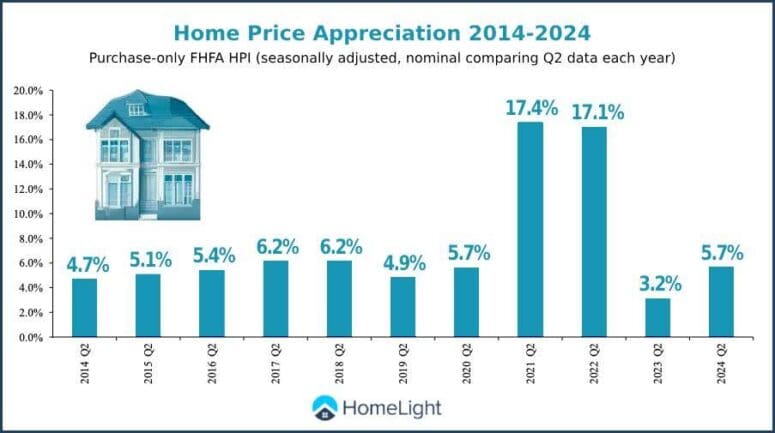

On average, U.S. home prices have risen at a rate of about 5% annually over the past decade, and at a faster average of about 8% per year over the past five years, according to data from the Federal Housing Finance Agency (FHFA) and the U.S. Department of Housing and Urban Development (HUD). However, appreciation can vary significantly from year to year. For example, while mid-year home prices surged by over 17% in 2021 and 2022, they slowed to 3.2% in 2023 before rebounding to 5.7% so far in 2024.

The chart below shows the percentage of home price appreciation for the past 10 years using second-quarter data from the FHFA’s House Price Index (HPI).

Market conditions, buyer demand, and inflation all impact these fluctuations. By keeping an eye on yearly appreciation trends, you can get a better sense of how much your home may have increased in value and what that means for your financial goals.

How do I estimate my home value?

Estimating your home’s value involves considering factors like recent sales in your area, the condition of your home, and local market trends. You can start by checking online real estate platforms that offer free home value estimates, or you can consult a local real estate agent for a more accurate assessment through a comparative market analysis (CMA).

Additionally, if you’ve made significant improvements to your home, those upgrades may further increase your property’s value.

Home value estimates are a good starting point, but keep in mind that an official appraisal will provide the most reliable figure when you’re ready to sell or tap into your home equity.

How do I estimate my current home equity?

Home equity is the difference between what you owe on your mortgage and the current market value of your home. To estimate your equity, subtract the remaining balance on your mortgage from your home’s estimated value.

For example, if your home is worth $500,000 and you owe $300,000, your equity would be $200,000. As your home appreciates, your equity grows, allowing you to borrow against it or sell the property for a profit. Keep in mind that calculating home equity is just one step — lenders will typically require a formal appraisal if you’re applying for a loan or home equity line of credit (HELOC).

How are homeowners using their equity?

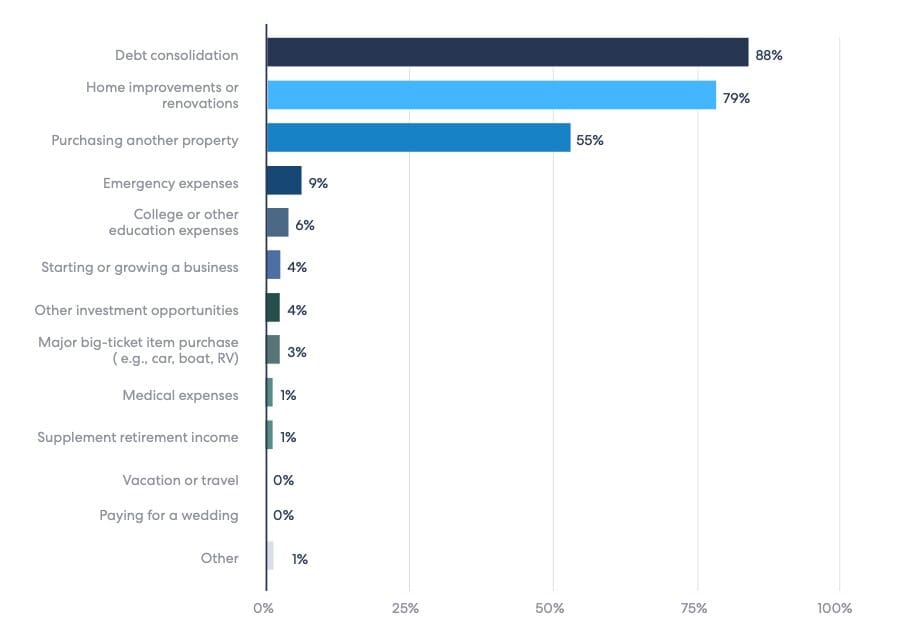

According to a recent HomeLight survey of loan officers from 85 lending companies across the country, 88% say that the top reason homeowners choose to borrow against equity is for debt consolidation. Getting money for home improvements and purchasing another property are the next two most common responses.

-

Source: 2024 HomeLight Lender Survey

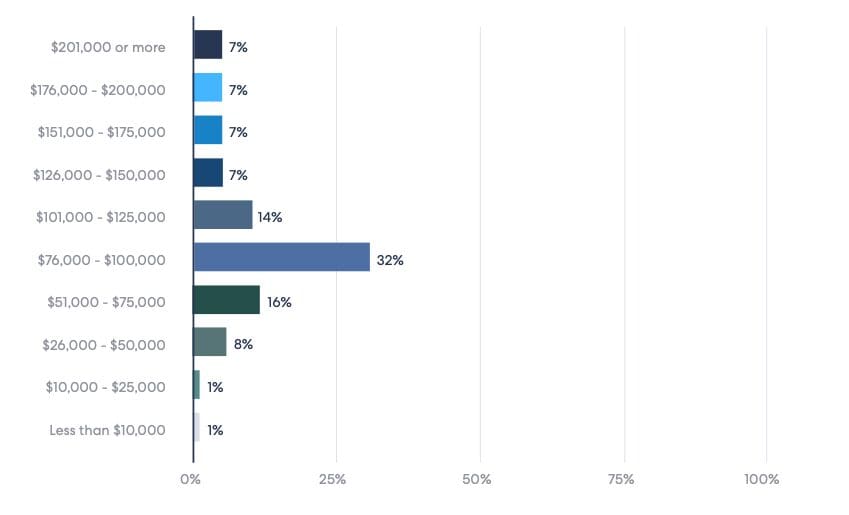

According to ICE Mortgage Technology, a typical U.S. homeowner has about $206,000 in tappable home equity. Based on data from HomeLight’s lender survey, the most common home equity loan amount range is $76,000 to $100,000.

-

Source: 2024 HomeLight Lender Survey

What factors affect home appreciation?

Several factors influence how much a home appreciates in value over time. The most significant include:

- Location: Desirable neighborhoods, proximity to good schools, job opportunities, and low crime rates can cause property values to rise faster.

- Local market conditions: High demand and low housing inventory typically lead to stronger home price appreciation. On the flip side, if there are more homes for sale than buyers, appreciation rates may slow down or even decline.

- Economic factors: National and local economic health, including interest rates, inflation, and employment rates, impact home values. Strong economies often boost home prices as more buyers enter the market.

- Home improvements: Upgrading your property with renovations or energy-efficient systems can boost its value. However, not all improvements lead to significant appreciation, so it’s essential to invest wisely.

How can I increase the value of my home?

Boosting your home’s value typically involves making strategic improvements that appeal to potential buyers. Here are some popular ways to increase home value:

- Curb appeal: First impressions matter. Simple updates like landscaping, painting your front door, or upgrading your garage door can make a big difference.

- Kitchen and bathroom remodels: These are two of the most valuable spaces in any home. Modernizing kitchens and bathrooms with new countertops, fixtures, and appliances tends to provide a high return on investment.

- Energy efficiency: Upgrading insulation, windows, or HVAC systems can not only lower utility bills but also attract eco-conscious buyers.

- Additional living space: Finishing a basement, converting an attic, or adding a room can dramatically increase your home’s usable square footage, which in turn raises its value.

- Smart home features: Tech-savvy buyers are drawn to homes with smart thermostats, security systems, and lighting controls.

How much equity can I borrow from my home?

The amount of equity you can borrow is typically capped at a certain percentage of your home’s appraised value, minus what you still owe on your mortgage. Most lenders allow you to borrow between 80% to 85% of your home’s equity. For example, if your home is worth $400,000 and you owe $200,000 on your mortgage, you could potentially borrow up to $170,000 in equity.

Lenders will look at factors like your credit score, income, and current debt levels to determine how much equity they’re willing to lend. Keep in mind that tapping into your home equity adds another layer of debt, so it’s essential to have a clear plan for how you’ll use the funds and repay the loan.

How do I get a home equity loan?

Here are the typical steps you can expect to get a home equity loan:

1. Check your home’s value: Start by estimating your home’s value using online tools or getting a professional appraisal. This will help you understand how much equity you have available to borrow.

2. Review your finances: Lenders will assess your credit score, income, and debt-to-income ratio. Make sure your credit is in good shape and that you have a steady income to qualify.

3. Shop around for lenders: Compare loan offers from various banks, credit unions, and online lenders. Pay attention to interest rates, fees, and loan terms to find the best deal.

4. Submit an application: Once you’ve selected a lender, you’ll need to provide documentation, such as proof of income, tax returns, and your mortgage details.

5. Complete the appraisal: The lender will typically require a formal appraisal to determine your home’s current market value and finalize your loan amount.

6. Close the loan: If everything checks out, you’ll attend a closing meeting to sign the final loan documents, after which you’ll receive the funds.

How can I estimate my home sale proceeds?

Estimating your home sale proceeds can help you when planning your next steps. Your proceeds are what you’ll walk away with after accounting for expenses like your remaining mortgage balance, agent commissions, and closing costs.

To get a quick preliminary estimate, try HomeLight’s Net Proceeds Calculator. This tool breaks down the numbers and gives you a clearer picture of your sale’s profit potential.

Can I use my equity to buy before I sell?

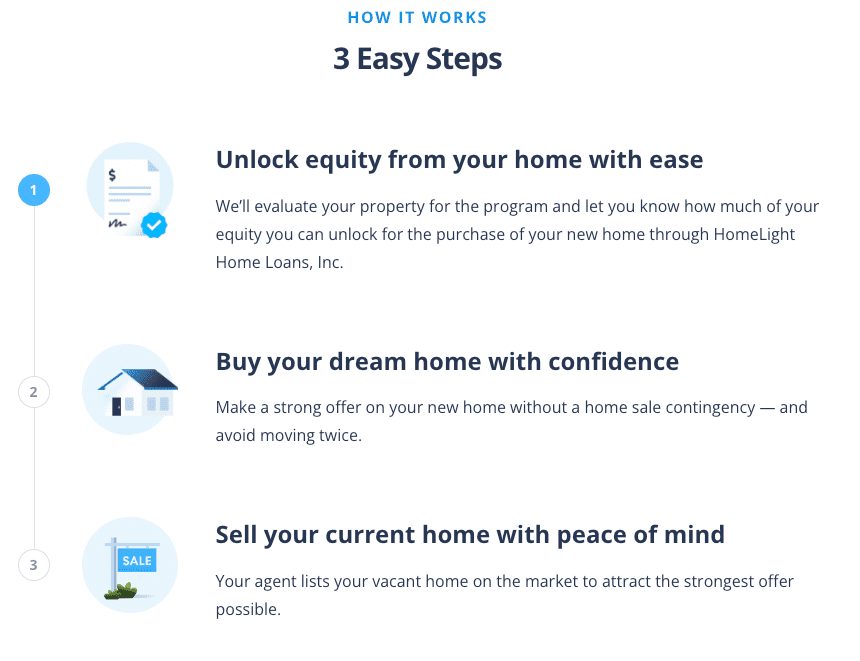

HomeLight’s Buy Before You Sell program uses your equity to buy your next house before selling your current one. This modern option allows you to unlock your equity to make a strong, non-contingent offer on your new home while avoiding the stress of timing the sale of your current home. This innovative solution allows you to only move once.

Here’s how HomeLight Buy Before You Sell works:

Partner with a top agent to buy and sell

Whether you’re looking to sell your home and cash in on years of appreciation or considering leveraging your equity for your next real estate investment, working with a top real estate agent can make all the difference.

A seasoned agent can help you accurately assess your home’s value, market it to the right buyers, and negotiate the best possible sale price.

They’ll also guide you through the complexities of buying your next property, ensuring a smooth transition.

Ready to get started? Use HomeLight’s free Agent Match platform to connect with a top-performing agent in your area who can help you navigate every step of the buying and selling process.

Other tools offered by HomeLight

Header Image Source: (iriana88w/ Depositphotos)