What Homebuyers Need to Know About Coronavirus Clauses

- Published on

- 3 min read

-

Kim Dinan Contributing AuthorClose

Kim Dinan Contributing AuthorClose Kim Dinan Contributing Author

Kim Dinan Contributing AuthorKim Dinan is a writer, journalist and author. She's the outdoor news editor at Blue Ridge Outdoors and writes regularly for her local paper in Asheville, NC, covering everything from the necessity of home inspections to trends in the local economy. Kim is also the author of "The Yellow Envelope," a memoir about the time she sold her house and traveled around the globe.

The pandemic has changed many things about homebuying — including how buyers shop for and do their due diligence on a home. Because of those changes, many homebuyers may find that the standard purchase agreement they enter into when buying a home has changed, too.

One of the biggest changes? If you buy a home during the pandemic, you may find there’s a coronavirus clause attached. So, what is a coronavirus clause? And what do you need to know to be an informed buyer?

We asked some top agents about what homebuyers need to know regarding coronavirus clauses. Here’s what they told us.

What is a coronavirus clause, anyway?

A coronavirus clause is an addendum to a standard purchase agreement, which usually covers the price, timeline, contingencies, earnest money, closing costs, and other typical real estate deal components.

Coronavirus clauses vary across the country because they are drafted by state or local real estate boards. “You can’t apply one coronavirus clause in Kansas to one in New York City to one in Atlanta,” says Shanan Steere, a top-selling agent with 24 years of experience in Johnson County, Missouri.

That’s because the coronavirus has impacted different areas of the country in different ways. For example, in some places, potential homebuyers are not allowed to physically tour homes due to stay-at-home orders. In other places, home tours are allowed with some restrictions. In other places still, home tours are taking place as they always have.

Because the coronavirus has muddied the way we shop for — and do due diligence on — homes, coronavirus clauses have been put in place to catch any hiccups that may arise while buying a home during the pandemic.

What does the coronavirus clause cover?

As mentioned above, items covered in the coronavirus clause will vary from state to state and even city to city.

Steere says that in her market, the coronavirus clause used by her real estate board is “a hold-harmless agreement for Realtors, inspectors, and others entering the property, releasing them in case something happens and you get COVID-19.”

Ashley Lay is a high-selling real estate agent with 15 years of experience in Winston-Salem, North Carolina, and says that in her market, the coronavirus clause she uses was created by the North Carolina Association of Realtors.

“The addendum says that the homebuyer can pay a fee to put the house under contract, sight-unseen, and then the buyer is allowed a certain timeframe to get into the house and decide if they are moving forward with the purchase or not.”

While Lay says that homebuying is moving ahead in her area and the coronavirus clause is no longer needed, next door in Greensboro, North Carolina, there was a long period of time when showings were not allowed. “The only way to put a home under contract was to do it sight-unseen with the COVID addendum,” she says.

In addition to the clauses already outlined, “some areas of the country have closing date clauses,” says Steere. These coronavirus clauses allow the purchase contract to be extended up to 30 additional days so that the buyer and seller have extra time to get the appraisal and inspection.

Extra time may be necessary because, in some markets, the virus has slowed the homebuying process. In Steere’s market, “appraisers are backlogged,” she says. The addendum may also specifically address additional time for title research.

Additionally, some condos or entire metro areas have banned moving in or out right now, so the clause might allow the buyer or seller some accommodation there, too.

While there’s not one standard coronavirus clause, guidance from the National Association of Realtors (NAR) advises real estate agents to consider including an addendum that specifically addresses potential delays to the coronavirus pandemic. NAR suggests the addendum may extend the closing date if necessary and address other issues including the unavailability of inspectors or appraisers; the inability to travel to sign documents; mandatory quarantine; and closings or delays resulting from the closing of lenders and title/escrow companies necessary to close the transaction.

Does the coronavirus clause go on all contracts?

Coronavirus clauses are not added to all contracts.

Whether or not a coronavirus clause will be included in your purchase agreement depends on a number of things, specifically the brokerage, says Steere. “Our board said that they would like us to include the coronavirus clause, but it’s not mandatory.”

Whether you’ll have a coronavirus clause in your contract also depends on whether or not your real estate agent is aware of the addenda available in your area. “Ask your agent about what coronavirus addendums are standard and available in your area,” advises Steere.

Does the coronavirus clause cover financing?

In some instances, coronavirus clauses might include details about buyer financing. If buyers lose their jobs or the mortgage lender changes the loan requirements, then the coronavirus clause may allow the buyer to get out of the contract without penalty.

That’s not the case in North Carolina, where Lay is licensed, but she says that’s because the due diligence period lasts until about five to seven days before the contract closes and “buyers in North Carolina can get out of their contract up until the due diligence period ends, and there’s no penalty except for loss of earnest money.”

Steere says that her local coronavirus clause does not address financing, either, but stresses that is not the case everywhere.

What if somebody gets sick?

If the buyer or seller has to go through a two-week quarantine because somebody in their household, or they themselves, has contracted the virus — or if the buyer is from out of state and is required to isolate for two weeks upon entering the seller’s state — some clauses include an additional date extension for this circumstance.

Even if this scenario isn’t addressed in the addendum, there may be alternatives to work around the quarantine issue, should it arise. The National Notary Association is tracking the states that have adopted remote notarization laws; many states enacted remote notarization through emergency executive orders, which may move the transaction forward and help buyers and sellers avoid an in-person meeting.

Other things to consider

Even once the details have been worked out, there are some other coronavirus-related considerations you may want reflected in your contract.

Moving can become more complicated during the pandemic. Some homebuyers and sellers have found it difficult to hire movers during this time. The Feds have deemed moving an essential service, but delays are common.

If you can’t move in right away, or the seller can’t move out, you might want to create a separate rent-back clause in the homebuying contract. A rent-back clause essentially means that the new owner (you — the buyer) rents the home to the past owner (the seller) for a short period of time, until the move can be made.

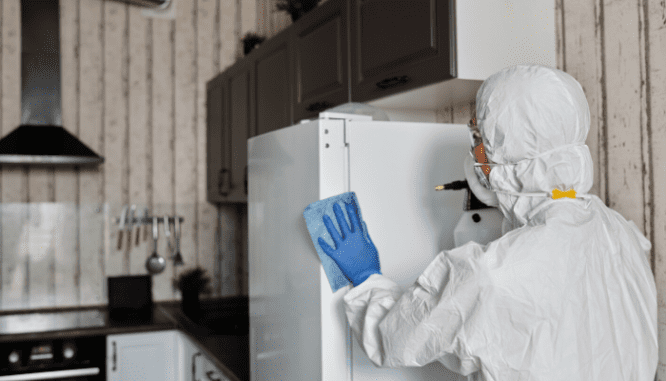

Cleaning is another coronavirus clause that can be added to the contract. During the pandemic, some buyers are requesting that sellers deep-clean the house upon move-out. “Several times, we’ve seen buyers ask for the homes to have a professional deep cleaning after the sellers move out,” says Lay.

In some instances, like when there are multiple offers on a home, that request is being negotiated out, she says; however, “buyers themselves are paying for it as soon as the previous owners move out.”

When buying during the pandemic, it is imperative to ask your agent what, if any, coronavirus clauses are available in your area. “There are a lot of agents that don’t get the right training and may not know about coronavirus clauses,” says Lay.

Steere agrees, adding that, while a good real estate agent will understand all the intricacies of coronavirus clauses, buyers should still educate themselves. “Buyers need to be aware of and find out about what agreements and addendums they have based on where they are in the country,” she says.

While buying a house during the pandemic will certainly look different than buying a home in pre-pandemic times, there’s no reason you should let it stop you. Coronavirus clauses are in place to protect you from any bumps in the road the virus may cause, so you can move into your new home safely and swiftly.

Header Image Source: (fizkes / Shutterstock)