Hard Money Lenders Minnesota: Fast Approvals

- Published on

- 10 min read

-

Joseph Gordon EditorClose

Joseph Gordon EditorClose Joseph Gordon Editor

Joseph Gordon EditorJoseph Gordon is an Editor with HomeLight. He has several years of experience reporting on the commercial real estate and insurance industries.

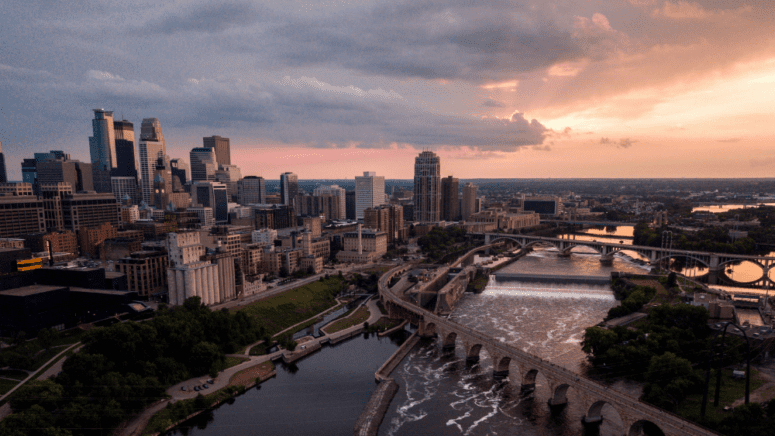

Are you looking to fund your next real estate venture in Minnesota with a hard money loan? Whether you plan to flip a classic home in Minneapolis or invest in a rental property in St. Paul, hard money lenders in Minnesota provide the speed and flexibility you need.

Hard money loans are an alternative to conventional loans, ideal for those with short project timelines, limited initial capital, or credit issues.

If you’re not a real estate investor but need to bridge the timing gap between buying and selling a home, we’ll share some alternatives to help you leverage your home’s equity. This article will guide you through the basics of hard money lending in Minnesota, helping you decide if a hard money lender is the right fit for you.

Editor’s note: This post is for educational purposes and is not intended to be construed as financial advice. HomeLight always encourages you to consult your own advisor.

What is a hard money lender?

A hard money lender is a private individual or company that offers short-term loans secured by real estate. Unlike traditional lenders, who focus heavily on the borrower’s creditworthiness and income, hard money lenders will prioritize the value of the property used as collateral. This can be a good fit for owners with strong equity but a poor credit score.

These loans are popular among real estate investors, such as house flippers and those buying rental properties, who need quick access to funds and flexible terms. Hard money lenders determine loan amounts based on the after-repair value (ARV), which is the estimated value of a property after renovations. They typically lend a percentage of the ARV to ensure the investment’s profitability and security.

Hard money loans generally have higher interest rates, ranging from 8% to 15%, and shorter repayment periods, usually between 6 to 24 months. Additional costs can include origination fees, closing costs, and points, which are a percentage of the loan amount paid upfront. If a borrower fails to repay a hard money loan, the lender can seize the property to recover the investment.

How does a hard money loan work?

If you’re a real estate investor looking for a financing option that provides speed and flexibility, connecting with hard money lenders in Minnesota could be beneficial. Here’s a quick rundown of how hard money loans work:

- Short-term loan: These loans usually have a repayment period of 6–24 months, unlike the 15- or 30-year terms of conventional mortgages. Some lenders may extend the term up to 36 months if needed.

- Faster funding option: When you need to close a deal quickly, hard money loans can be approved within days, compared to the 30 to 50 days typical for a mortgage loan.

- Less focus on creditworthiness: Approval relies less on your credit score or income history and more on the property’s value.

- More focus on property value: These loans require collateral, such as a home, and are based on the loan-to-value ratio of the property.

- Not traditional lenders: Individual investors or private lending companies usually provide hard money loans, not traditional banks.

- Loan denial option: These loans are often used by those with poor credit who have been denied a mortgage but possess significant home equity.

- Higher interest rates: Due to higher risk, these loans have higher interest rates than traditional mortgages.

- Might require larger down payments: Borrowers may need to provide a larger down payment, sometimes up to 20%–30%, depending on the property’s value and loan specifics.

- More flexibility: With less government regulation, hard money lenders in Minnesota can set flexible credit scores and debt-to-income (DTI) criteria, and loans can help avoid pre-foreclosure property sale.

- Potential for interest-only payments: Unlike traditional mortgages, hard money loans may allow for interest-only or deferred payments initially.

What are hard money loans used for?

Hard money loans address specific financing needs in the Minnesota real estate market. They’re often sought after by investors who require fast funding or may have difficulty qualifying for traditional bank loans. Let’s learn more about what hard money loans are typically used for:

Flipping a house: For Minnesota investors focused on flipping homes, hard money loans offer fast access to cash for purchasing and renovating properties. These quick-turnaround loans help flippers acquire properties in competitive markets, make necessary improvements, and resell them for profit quickly.

Buying an investment rental property: Investors seeking rental properties can use hard money loans to snap up properties fast, especially those needing immediate repairs. Compared to traditional bank loans, hard money loans allow landlords to complete renovations and start generating rental income more quickly.

Purchasing commercial real estate: Due to their flexibility and quick closing times, hard money loans are often used in commercial real estate transactions. They are particularly useful when timing is crucial, and a quick decision can mean the difference between securing a valuable investment or missing out altogether.

Borrowers who can’t qualify for traditional loans: Individuals with substantial home equity but poor credit or other disqualifying issues sometimes approach hard money lenders in Minnesota for assistance. With hard money loans, qualification is determined more by the asset’s worth than the borrower’s credit score.

Homeowners facing foreclosure: Homeowners nearing foreclosure may use hard money loans to refinance their debts or buy time to sell the property. This can provide a temporary solution to avoid losing their home or a foreclosure mark on their credit report.

How much do hard money loans cost?

Hard money loans generally cost more than traditional loans due to the higher risk for lenders and the convenience of quick, flexible funding. Typical costs include:

- Interest rates: 8% to 15% or higher, based on risk assessment.

- Origination fees: 1% to 5% of the loan amount.

- Closing costs: Legal, appraisal, and administrative fees.

- Points: A percentage of the loan amount charged upfront.

Online calculators can help estimate these costs.

Alternatives to working with hard money lenders

If you’re a homeowner, rather than an investor, who is looking for a way to leverage your current home’s equity, here are a few options to consider:

Take out a second mortgage: If you have substantial equity in your home, a home equity loan or home equity line of credit (HELOC) can provide the needed funds at a lower interest rate compared to a hard money loan.

Cash-out refinance: This option allows you to refinance an existing property, pulling out cash to finance your new investment. It often comes with lower interest rates than hard money loans.

Borrow from family or friends: A personal loan from family or friends can offer flexible repayment terms and potentially lower or no interest rates, making it a more affordable option.

Use a government-backed loan program: Programs offered by the FHA, VA, or USDA can help buyers purchase homes with lower down payments and reduced interest rates.

Peer-to-peer loans: These loans are provided by individual investors through lending platforms like Funding Circle. They function similarly to hard money loans but often have different terms.

Specialized loan programs: If you already have a hard money loan and want to replace it, consider specialized loans for fixer-uppers or investment property refinancing.

Request a seller financing option: Sometimes, sellers may agree to finance the purchase, resulting in lower closing costs and less stringent eligibility requirements.

How to buy before you sell

Sometimes, the perfect listing pops up when you’re least expecting it. Maybe it’s a rare mid-century modern home or a two-bedroom condo within walking distance of your job.

If you’re a Minnesota homeowner wanting to buy a new home before selling your current one, HomeLight offers an innovative solution that streamlines the process.

The Buy Before You Sell (BBYS) program allows you to leverage the equity in your existing home to make a stronger, non-contingent offer on a new property. If your home qualifies, you can get your equity unlock amount approved in 24 hours or less, with no cost or commitment required. Once approved, you can confidently purchase your next home and then sell your current one vacant, avoiding the hassle of moving twice.

Here’s how HomeLight Buy Before You Sell works:

Although there’s a flat fee of 2.4% of your current home’s sold price, the potential savings in other areas might outweigh the cost.

For example, you might save on moving expenses, temporary housing, and even the final purchase price of your new home. On top of that, HomeLight’s BBYS fees are typically much lower than the interest rates on bridge loans, which currently range from 9.5% to 12%.

3 top hard money lenders in Minnesota

Traditional lenders might not be the solution for every real estate investment. If you’re looking to move quickly and capitalize on an opportunity, explore Minnesota’s hard money lending options.

PrimeSource Funding

PrimeSource Funding, based in Rochester, Minnesota, offers a range of mortgage solutions tailored to meet the needs of homebuyers and homeowners. They provide various loan programs including conventional, FHA, VA, and USDA loans.

Lending clientele: They serve mostly residential clients, including homebuyers looking for purchase loans, homeowners seeking refinancing options, and individuals interested in government-backed loans such as FHA and VA.

Loan criteria: LTV up to 80% to 100% of ARV

PrimeSource Funding has a 5.0-star rating on Google with 1,025 reviews. Customer reviews note their efficient service, clear communication, and helpful guidance throughout the mortgage process.

507-389-8240

Jay Dacey Mortgage Team

Jay Dacey Mortgage Team, based in Minneapolis, Minnesota, specializes in providing tailored mortgage solutions to meet the diverse needs of their clients. They offer various loan programs, including conventional, FHA, VA, and jumbo loans.

Lending clientele: Residential clients

Loan criteria: LTV up to 80% of ARV

Jay Dacey Mortgage Team has earned a 5.0-star rating on Google with 290 reviews. Clients consistently highlight the team’s professionalism, communication, and ability to promptly close loans.

651-315-7681

Cashability

Cashability, based in Minneapolis, Minnesota, was established by real estate agents, flippers, and investors to provide quick, reliable cash funding solutions. They offer various loan programs tailored to the needs of real estate investors, including fix-and-flip, bridge financing, and quick-turn loans.

Lending clientele: Residential Investors

Loan criteria: LTV up to 80% of ARV

Cashability has a 5.0-star rating on Google. Customers praise their quick closing times, ease of use, and supportive staff. One reviewer noted, “They have been great to work with as a hard money lender.”

612-217-0577

Should I partner with a hard money lender in Minnesota?

Choosing a hard money loan in Minnesota depends on your real estate investment needs. These loans are perfect for investors seeking quick capital or those who find it challenging to get traditional financing. While they provide fast, flexible funding, the costs are higher, and the repayment terms are shorter.

For homeowners wanting to tap into their home’s equity, consider HomeLight’s Buy Before You Sell program. This option offers a low flat fee instead of high interest rates, making your move easier and your offer more competitive.

Evaluate your long-term goals and discuss your options with a financial advisor to ensure your choice supports your overall investment strategy. If you need to find real estate agents in Minnesota who are experienced with hard money lenders, HomeLight can connect you with top local professionals.

Hedear Image Source: (Nicole Geri/ Unsplash)