Hard Money Lenders Oklahoma: What You Need to Know

- Published on

- 11 min read

-

Kelsey Morrison Former HomeLight EditorClose

Kelsey Morrison Former HomeLight EditorClose Kelsey Morrison Former HomeLight Editor

Kelsey Morrison Former HomeLight EditorKelsey Morrison worked as an editor for HomeLight's Resource Centers. She has seven years of editorial experience in the real estate and lifestyle spaces. She previously worked as a commerce editor for World of Good Brands (eHow.com and Cuteness.com) and as an associate editor for Livabl.com. Kelsey holds a bachelor’s degree in Journalism from Concordia University in Montreal, Quebec, and lives in a small mountain town in Southern California.

Thinking about using a hard money loan for your next real estate venture in Oklahoma? Whether you’re restoring a mid-century modern home in Midwest City or investing in a rental property in Stillwater, hard money lenders in Oklahoma can offer the speed and flexibility that traditional loans often lack. Hard money loans cater to those with short project timelines, limited startup capital, or credit issues, providing a practical alternative for financing.

For Oklahoma homeowners needing to bridge the gap between buying and selling, we’ll explore other effective ways to leverage your home’s equity. This article will cover the basics of hard money lending in Oklahoma, helping you decide if this financial strategy suits your real estate or home-buying plans.

Editor’s note: This post is for educational purposes and is not intended to be construed as financial advice. HomeLight always encourages you to consult your own advisor.

What is a hard money lender?

Hard money lenders, which can be private individuals or companies, provide short-term loans backed by real estate. Unlike traditional banks, which prioritize the borrower’s credit score and income, hard money lenders in Oklahoma focus on the property’s value as collateral. These loans are often used by real estate investors, including house flippers and those purchasing rental properties, due to their quick funding and flexible terms.

Lenders use the after-repair value (ARV), which is the estimated value of a property after renovations, to determine loan amounts. They typically offer a percentage of the ARV to ensure the investment remains profitable. Hard money loans often come with higher interest rates, typically between 8% and 15%, and shorter repayment terms, usually from 6 to 24 months. Additional expenses may include origination fees, closing costs, and points. If the loan is not repaid, the lender has the right to repossess the property to recover their funds.

How does a hard money loan work?

Oklahoma hard money lenders can be your secret weapon for unlocking fast, flexible financing on real estate investments. Here’s a brief overview of how hard money loans work:

- Short-term loan: Repayment periods typically range from 6 to 24 months, contrasting with the 30-year terms of standard mortgages. Some lenders may allow for extensions of up to 36 months.

- Faster funding option: Hard money loans can be secured in just days, much faster than the usual 30 to 50 days for conventional loans.

- Less focus on creditworthiness: These lenders are less concerned with your credit score and more focused on the value of the property.

- More focus on property value: These loans require collateral — typically your investment property — and are based on the property’s loan-to-value ratio.

- Not traditional lenders: These loans come from private lenders or individual investors rather than traditional banks.

- Loan denial option: People with bad credit but significant home equity sometimes turn to hard money loans after being denied traditional mortgages.

- Higher interest rates: These loans carry higher interest rates due to their increased risk compared to traditional mortgages.

- Might require larger down payments: Borrowers may need to make a larger down payment, often around 20%–30%.

- More flexibility: Hard money lenders in Oklahoma offer more flexible terms and less stringent debt-to-income requirements.

- Potential for interest-only payments: These loans may include initial interest-only payment options, unlike traditional mortgages.

What are hard money loans used for?

Hard money loans serve various needs within the Oklahoma real estate market. These loans are often sought by those needing quick funding or who face challenges qualifying for traditional loans. Here are some common scenarios where hard money loans can be particularly useful:

Flipping a house: For Oklahoma investors involved in flipping homes, hard money loans offer fast funding to purchase and renovate properties. This allows flippers to make needed renovations and resell for profit in a short period of time.

Buying an investment rental property: Investors looking to buy rental properties can use hard money loans to secure and upgrade properties quickly. This allows them to begin generating rental income without waiting for lengthy loan approvals.

Purchasing commercial real estate: Hard money loans are ideal for commercial real estate deals due to their flexibility and speed. They are beneficial in situations where quick decisions are needed to secure valuable investments.

Borrowers who can’t qualify for traditional loans: People with substantial home equity but poor credit histories might find hard money loans a viable option. These loans focus more on the property’s value than on the borrower’s credit score.

Homeowners facing foreclosure: Hard money loans can help those nearing pre-foreclosure property sale by refinancing their debt or providing time to sell the property. This solution helps avoid the severe consequences of foreclosure.

How much do hard money loans cost?

Hard money loans tend to be more expensive due to their high-risk nature and speedy approval process. Here’s a breakdown of typical costs:

- Interest rates: Usually range from 8% to 15%.

- Origination fees: Generally, 1% to 5% of the loan amount.

- Closing costs: Includes various fees, like legal and appraisal fees.

- Points: Points, a percentage of the loan amount, typically range between 2% and 4%.

You can use online calculators to estimate your total loan costs.

Alternatives to working with hard money lenders

If you’re a homeowner searching for ways to leverage your home’s equity, consider these alternatives:

Take out a second mortgage: A home equity loan or HELOC allows you to borrow against your home’s equity, often with lower interest rates than hard money loans.

Cash-out refinance: Refinancing your existing property lets you pull out cash to finance new investments, usually with lower interest rates than hard money loans.

Borrow from family or friends: Personal loans from family or friends can provide flexible repayment terms and potentially lower interest rates, making them more affordable.

Use a government-backed loan program: Programs like FHA, VA, or USDA loans help purchase homes with lower down payments and reduced interest rates.

Peer-to-peer loans: These loans are funded by individual investors through platforms like Lending Club or Prosper, providing terms that can be more flexible than traditional loans.

Specialized loan programs: Specialized loans can be useful for those looking to refinance an existing hard money loan, especially for investment properties or fixer-uppers.

Request a seller financing option: Some sellers might agree to finance the purchase directly, which can result in lower closing costs and simpler qualification criteria.

How to buy before you sell

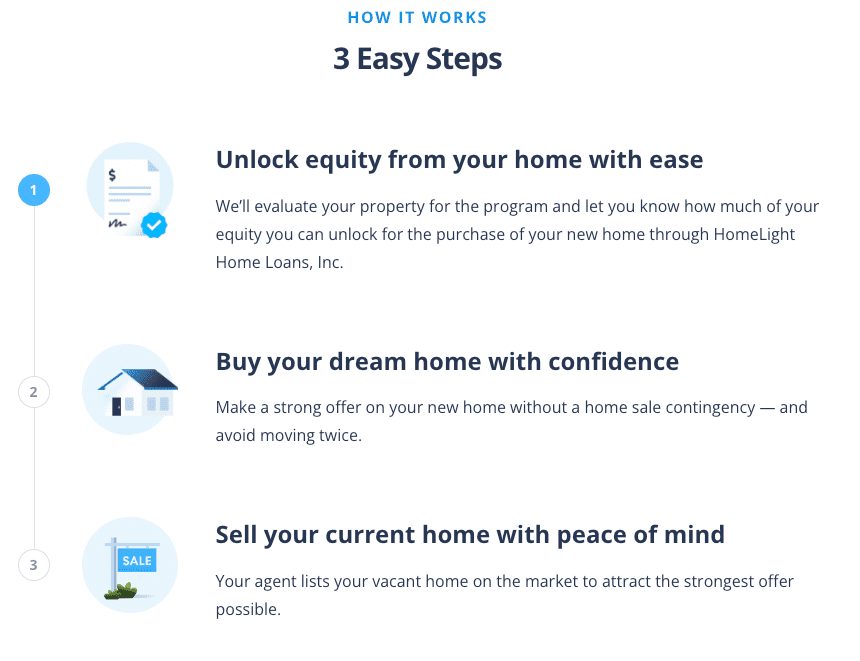

Imagine finding your dream home when you least expect it — maybe it’s an upscale townhouse in Midtown OKC, or a timeless Tudor in Tulsa. For Oklahoma homeowners wanting to buy a new home before selling their current one, HomeLight’s Buy Before You Sell program is a game-changer.

The Buy Before You Sell (BBYS) program lets you use the equity in your current home to make a strong, non-contingent offer on a new property. If your home qualifies, you can get your equity unlock amount approved in less than 24 hours without any upfront costs or commitment. This approval lets you purchase your new home confidently and then sell your current one vacant, avoiding the stress of moving twice.

Here’s how HomeLight Buy Before You Sell works:

While there’s a flat fee of 2.4% of your current home’s sold price, the savings from avoiding temporary housing, additional moving costs, and even securing a better price on your new home can outweigh this fee. Plus, HomeLight’s BBYS fees are significantly lower than bridge loan interest rates, which currently range from 9.5% to 12%.

3 top hard money lenders in Oklahoma

Traditional lenders might not work for every real estate investment. If you need to move quickly and take advantage of an opportunity, look into the hard money lending options available in Oklahoma.

Hard Money Partner

Based in Oklahoma City, Hard Money Partner is a a full-service hard money lender serving Oklahoma City, Tulsa, and, the Dallas/Fort Worth area. The company helps local real estate investors fix and flip properties, cash out on investment properties, or buy commercial buildings. Borrowers can get approved in as little as 24 to 48 hours, and loans can often be funded in less than a week. Hard Money Partner only lends on commercial or investment properties, not primary residences. Eligible properties include those with 1-4 units, smaller apartment buildings, small retail shops or office buildings, small bars or restaurants where there is real estate, single-family homes, and strip shopping centers.

Lending clientele: Residential and commercial real estate investors

Loan criteria: Max LTV 70% of the ARV

Hard Money Partner has earned a 4.9-star rating on Google. Customers appreciate the company’s responsiveness, fast funding, and helpful advice. “Since he is an investor himself, Rodney can analyze your deal fast and understands what you need to get it done,” shared a client. “Great company!”

405-913-6664

Wildcat Lending

Wildcat Lending specializes in providing hard money loans for real estate investors. Located in Plano, Texas, they extend their services to multiple states, including Oklahoma. Their loan options include fix-and-flip loans, rental property loans, and Wildcat Zero loans, which feature no origination fees and require 16% interest-only payments. Known for their speedy processing, Wildcat Lending can close loans in under a week and sometimes even within hours.

Lending clientele: Residential real estate investors (properties with 1-4 units)

Loan criteria: Up to 80% LTV purchase or 75% LTV cash-out refinance

Wildcat Lending has been operating for nine years and holds a 4.8-star rating on Google based on over 150 reviews. Customers often praise their exceptional customer service, quick closings, and frequent communication. “I’ve been referring loan clients to Caitlyn and the Wildcat team for over five years,” wrote one reviewer. “She is responsive, knowledgeable, and overall a great person to work with. She knows her loan terms and her team’s capabilities like the back of her hand.”

405-972-8143

Easy Street Capital

Easy Street Capital, a private real estate lender based in Texas, operates in 47 states, including Oklahoma. They provide three distinct hard money loan programs: EasyFix for flippers, EasyRent for landlords, and EasyBuild for builders. Serving real estate investors of all experience levels and specialties, Easy Street Capital can close loans in under 48 hours.

Lending clientele: Residential real estate investors

Loan criteria: Depends on the in-house valuation of the property; in most cases, the max LTV is 70% for EasyFix loans

Easy Street Capital boasts a 4.6-star rating on Google from nearly 200 reviews. Clients value their competitive rates, smooth and efficient process, and willingness to answer questions. “Thanks to Zach and Eli, we have had another successful closing,” reads a recent review. “We were able to navigate through some tricky situations to get the deal done.”

866-828-0062

Should I partner with a hard money lender in Oklahoma?

Deciding whether a hard money loan is right for you in Oklahoma depends on your specific situation and investment goals. Hard money loans are best suited for real estate investors who need quick funding for projects that traditional financing won’t cover. If you can handle the higher costs and shorter repayment terms, a hard money loan might be the right choice for your next investment in Oklahoma.

For homeowners looking to access their equity without the high interest rates, HomeLight’s Buy Before You Sell program is a compelling alternative. This program allows you to pay a small flat fee while making a more competitive offer and simplifying your move.

As with any major financial decision, it’s important to consider your long-term strategy and consult with a financial advisor to make sure it aligns with your investment goals. If you’re looking to connect with investor-friendly real estate agents in Oklahoma who have access to trusted hard money lenders, HomeLight can introduce you to top professionals in your area.

Header Image Source: (Justin Prine / Unsplash)

- "What is ARV and how is it calculated?," Rehab Financial Group (June 2023)

- "What Is Loan-to-Value and Why Does it Matter?," U.S. News, Ben Luthi & Rebecca Safier (March 2024)

- "Why Do Hard Money Lenders Require A Down Payment?," RCN Capital (April 2024)

- "A Comprehensive Guide to Common Terms Used in Hard Money Lending," LinkedIn, Joseph Walker (September 2023)

- "What Are The Costs Involved In A Hard Money Loan?," NorthWest Private Lending (March 2024)