Hard Money Lenders San Jose: Flexible Financing Solutions

- Published on

- 11 min read

-

Kelsey Morrison Former HomeLight EditorClose

Kelsey Morrison Former HomeLight EditorClose Kelsey Morrison Former HomeLight Editor

Kelsey Morrison Former HomeLight EditorKelsey Morrison worked as an editor for HomeLight's Resource Centers. She has seven years of editorial experience in the real estate and lifestyle spaces. She previously worked as a commerce editor for World of Good Brands (eHow.com and Cuteness.com) and as an associate editor for Livabl.com. Kelsey holds a bachelor’s degree in Journalism from Concordia University in Montreal, Quebec, and lives in a small mountain town in Southern California.

Are you searching for financing options for your next real estate investment in San Jose? Whether you’re eyeing a fixer-upper in Willow Glen or planning to invest in rental properties near Santana Row, hard money lenders in San Jose offer a speedy and flexible financing option. A hard money loan can be a lifeline for investors with tight timelines, limited upfront capital, or less-than-perfect credit.

This article will walk you through the essentials of hard money lending in San Jose, helping you understand if this financing method fits your needs. If you’re not an investor but still need to bridge the gap between buying and selling a home, we’ve also got some alternative solutions to help you make the most of your home’s equity.

Editor’s note: This post is for educational purposes and is not intended to be construed as financial advice. HomeLight always encourages you to consult your own advisor.

What is a hard money lender?

A hard money lender is a private entity that provides short-term, real estate-backed loans. Unlike traditional banks, hard money lenders in San Jose prioritize the value of the property over the borrower’s credit history, making them ideal for house flippers and rental property investors needing quick funding.

These lenders determine the loan amount based on the after-repair value (ARV), which is the projected value of the property after renovations. Typically, they lend a portion of the ARV to protect their investment. Interest rates for hard money loans are higher, ranging from 8% to 15%, and the repayment periods are shorter, usually between 6 and 24 months. Additional costs include origination fees, closing costs, and points. If the borrower defaults, the lender can take possession of the property to recoup their funds.

How does a hard money loan work?

If you’re a real estate investor in San Jose, understanding how hard money loans work can help you secure quick and flexible financing. Here’s a breakdown of the key aspects of hard money loans:

- Short-term loan: These loans typically have a repayment period of 6–24 months, unlike the 15- or 30-year terms common with traditional mortgages.

- Faster funding option: Hard money loans can be approved within days, compared to the 30 to 50 days it often takes for conventional mortgage approval.

- Less focus on creditworthiness: Approval depends less on your credit score and more on the value of the property being used as collateral.

- More focus on property value: These loans are based on the loan-to-value ratio of the property, meaning the property’s value is crucial in the approval process.

- Not traditional lenders: Hard money loans are provided by private individuals or companies, not traditional banks.

- Loan denial option: They can be a solid option for those with poor credit who have been denied a mortgage but have significant home equity.

- Higher interest rates: Hard money loans usually have higher interest rates due to the increased risk for the lender.

- Might require larger down payments: Borrowers might need to fork over a larger down payment, sometimes up to 20%–30% of the property’s value.

- More flexibility: These lenders can set flexible criteria for debt-to-income ratios and credit scores, offering more personalized loan terms.

- Potential for interest-only payments: Some hard money loans may offer the option of making interest-only payments initially, deferring principal payments to a later date.

What are hard money loans used for?

Hard money loans address specific financing needs in San Jose’s real estate market. They are particularly helpful for investors and individuals needing quick access to funds or who may not qualify for traditional loans. Here are five common uses for hard money loans:

Flipping a house: San Jose house flippers rely on hard money loans to secure quick access to cash for purchasing and renovating properties. These loans allow flippers to acquire properties, complete necessary renovations, and then sell them for a profit in a short timeframe.

Buying an investment rental property: Investors looking to purchase rental properties can use hard money loans to close on properties quickly, especially those needing immediate repairs. These loans allow landlords to make renovations quickly and start generating rental income faster than with traditional loans.

Purchasing commercial real estate: Hard money loans are a go-to choice for commercial real estate deals because they offer quick and flexible funding. They’re especially useful when you need to act fast to secure a lucrative investment opportunity.

Borrowers who can’t qualify for traditional loans: Individuals with substantial home equity but poor credit or other disqualifying issues often turn to hard money lenders for assistance. These loans are based more on the asset’s value than the borrower’s creditworthiness, making them accessible to more people.

Homeowners facing foreclosure: Homeowners at risk of pre-foreclosure property sale can use hard money loans to refinance their debts or buy time to sell their property. This temporary solution can help them avoid losing their home and the negative impact of foreclosure on their credit report.

How much do hard money loans cost?

Hard money loans generally cost more than traditional loans due to the added risk and speed of funding. Here are some of the typical costs involved:

- Interest rates: These can range from 8% to 15%, depending on the lender’s risk assessment.

- Origination fees: Lenders may charge 1% to 5% of the total loan amount as an origination fee.

- Closing costs: Additional fees at closing can include legal fees, appraisal fees, and other administrative costs.

- Points: Lenders might charge points (a percentage of the loan amount) upfront, which adds to the initial cost.

You can use online calculators to get an estimate of your hard money loan costs.

Alternatives to working with hard money lenders

If you’re a homeowner looking for ways to leverage your current home’s equity, here are several alternatives to consider:

Take out a second mortgage: If you have significant equity, a home equity loan or home equity line of credit (HELOC) can provide funds at lower interest rates compared to hard money loans.

Cash-out refinance: This option lets you refinance your existing property, pulling out cash to fund new investments, often with lower interest rates.

Borrow from family or friends: Loans from family or friends can provide flexible terms and potentially lower or no interest rates, making them a cost-effective solution.

Use a government-backed loan program: Programs like the FHA, VA, or USDA can help with lower down payments and reduced interest rates.

Peer-to-peer loans: Individual investors provide these loans through platforms like Funding Circle, offering an alternative with different terms than hard money loans.

Specialized loan programs: Look into loans designed for fixer-uppers or refinancing investment properties if you’re seeking to replace an existing hard money loan.

Request a seller financing option: Sometimes, sellers may agree to finance the purchase themselves, leading to lower closing costs and more lenient eligibility requirements.

How to buy before you sell

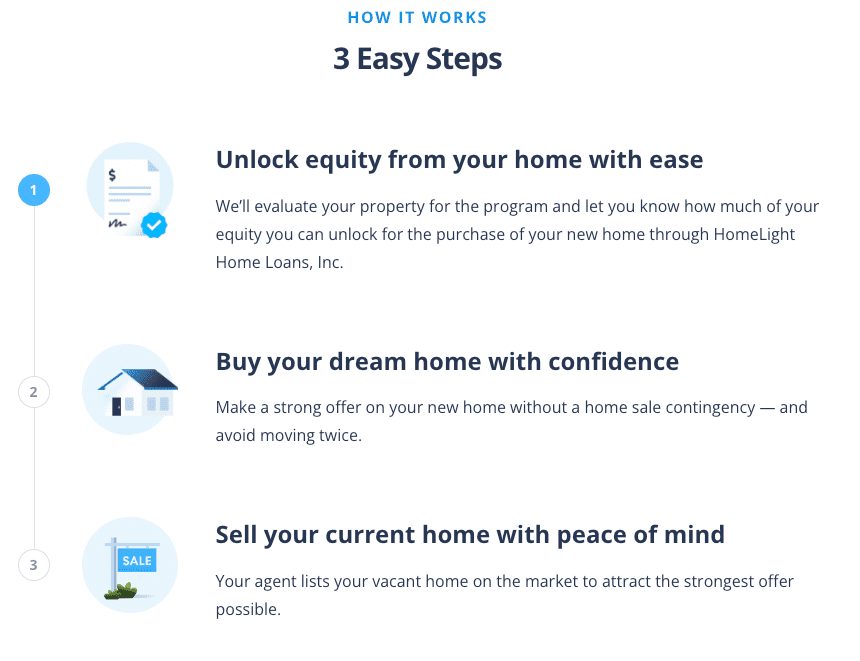

You never know when you might stumble upon your dream place, even when you’re not actively looking. Maybe it’s a rare 1930s Storybook home or a downtown condo with a wrap-around deck. If you’re suddenly wanting to buy a new home before selling your current one, HomeLight’s Buy Before You Sell (BBYS) program offers a streamlined solution. This innovative program allows you to use the equity in your current home to make a strong, non-contingent offer on a new property.

With Buy Before You Sell, you can get your equity unlock amount approved in less than 24 hours, without any cost or commitment. This approval allows you to confidently purchase your new home first and then sell your current one, avoiding the hassle and expense of moving twice. This flexibility not only simplifies the buying and selling process but also provides peace of mind.

Here’s how HomeLight Buy Before You Sell works:

While the BBYS program charges a flat fee of 2.4% of your home’s sold price, the potential savings in moving costs, temporary housing, and even the purchase price of your new home can make this fee worthwhile. Plus, HomeLight’s BBYS fees are generally lower than bridge loan interest rates, which currently range from 9.5% to 12%.

3 top hard money lenders in San Jose

Traditional lenders can be a reliable option for real estate financing, but they often don’t offer the speed and flexibility needed for quick deals. If you need to move fast on a real estate opportunity in San Jose, consider these hard money lenders.

PB Financial Group Corporation

California-based PB Financial Group Corporation provides a range of hard money loan programs for both residential and commercial properties. The company was founded in 2006 and has funded over 2,400 transactions to date. Their loans, secured by either a first or second lien, range from $50,000 up to $2 million. Borrowers can get approved within 24 to 48 hours, and closing can take place in as few as five days.

Lending clientele: Owner-occupiers, heirs of probate estates, trust beneficiaries, plus residential and commercial real estate investors

Loan criteria: Up to 60%–70% LTV

PB Financial Group Corporation boasts a 4.7-star rating on Google and is accredited by the Better Business Bureau (BBB) with an A+ rating. Clients commend the team for being efficient, helpful, and communicative. “Pouyan and Frank were so amazing to work with!” wrote a reviewer. “They established clear expectations for me and my client and brought us smoothly to a close. I look forward to bringing them in on many other tricky real estate transactions.”

877-700-3703

Wilshire Quinn Capital, Inc.

Wilshire Quinn Capital, Inc. is a direct portfolio lender for commercial and residential real estate in California and nationwide. The company was founded in 2004 and maintains an office in San Francisco. Loan sizes range from $500,000 to $20 million, and loan terms span six to 18 months. They accept a wide variety of investment properties, including single-family homes, multi-family properties, condominiums, retail centers, office buildings, hotels, and more. Pre-approval takes just 24 hours, and loans can typically be funded in five to seven days.

Lending clientele: Residential, commercial, and development real estate investors

Loan criteria: Up to 60% LTV and 60% of ARV for rehab loans, not to exceed 80% of the purchase price

Wilshire Quinn Capital, Inc. has a 5-star rating on Google based on over 60 reviews. Clients consistently highlight the company for being accommodating, professional, and supportive. “We just had a great experience working with Wilshire Quinn on a recent transaction,” reads one review. “Our team, led by Matt, was professional, communicative, transparent, and fast — they funded our loan in 5 days, exactly what we needed.”

415-881-3100

California Hard Money Direct

California Hard Money Direct offers a wide array of hard money loans across California. They serve homeowners, investors, and businesses, and loans can be used for residential or commercial real estate. In-house underwriting ensures quick closings, usually within seven to ten days. Additionally, their online loan tracking system allows you to monitor the approval process 24/7. Some of their most popular loan programs include bridge loans, fix-and-flip loans, owner-occupied hard money loans, and commercial hard money loans.

Lending clientele: Residential and commercial real estate investors, developers, and homeowners

Loan criteria: LTV up to 70% (residential), LTV up to 75% (commercial)

California Hard Money Direct has achieved a 4.9-star rating on Google from over 100 reviews. Clients praise the company’s prompt service, professional staff, and seamless transaction process. “Judy was extremely helpful and made the process easy,” reads a recent review. “She is always quick with correspondence and remembered many details regarding my transaction that I usually have to explain multiple times to other lenders. I will most definitely be calling her again soon for my next deal!”

310-736-1576

Should I partner with a hard money lender in San Jose?

The choice to use a hard money loan in San Jose should be driven by your individual circumstances and real estate investment plans. Hard money loans are particularly beneficial for real estate investors who need fast funding or can’t secure traditional loans. These loans provide the necessary speed and flexibility for quick-turnaround projects, despite their higher costs and shorter repayment terms.

Homeowners in San Jose looking to tap into their home’s equity might find HomeLight’s Buy Before You Sell program more suitable. Instead of dealing with high interest rates, this program offers a straightforward flat fee, enabling you to make a stronger offer on a new home while simplifying your move.

As with any major financial decision, it’s important to consider your long-term strategy and consult with a financial advisor to ensure it aligns with your investment goals. HomeLight can help you connect with top real estate agents in San Jose who are familiar with hard money lenders and can provide valuable guidance throughout the process.

Header Image Source: (aaronafinn@live.com / Depositphotos)

- "What is ARV and how is it calculated?," Rehab Financial Group (June 2023)

- "What Is Loan-to-Value and Why Does it Matter?," U.S. News, Ben Luthi & Rebecca Safier (March 2024)

- "Why Do Hard Money Lenders Require A Down Payment?," RCN Capital (April 2024)

- "A Comprehensive Guide to Common Terms Used in Hard Money Lending," LinkedIn, Joseph Walker (September 2023)

- "What Are The Costs Involved In A Hard Money Loan?," NorthWest Private Lending (March 2024)