How Do I Get a Home Equity Loan?

- Published on

- 12 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

If you’ve owned your home for a while, there’s a good chance it’s gone up in value, maybe more than you expected. That increase means you could be sitting on a solid amount of home equity. Homeowners across the country are in the same boat, with trillions in total home equity. You might be wondering how to tap into that built-up housing wealth, asking yourself, “How do I get a home equity loan?”

If you’re planning to make home improvements, consolidate debt, or cover other expenses, a home equity loan can be a valuable source of funds. In this guide, we break down the steps you’ll need to take to tap into your home equity, explain how long it might take to get your money, and share some home equity pitfalls to avoid.

What is a home equity loan?

A home equity loan allows you to borrow against the value of your home minus what you still owe on your mortgage. Lenders typically provide these loans in a lump sum, which you then repay in fixed monthly installments over a set period, much like your primary mortgage.

The amount you can borrow is based on your home’s current value and the equity you’ve built, which increases as your mortgage balance goes down and property values rise.

How does a home equity loan work?

When you take out a home equity loan, the lender assesses the equity in your home. Generally, you can borrow up to 85% of your home’s value, minus your outstanding mortgage balance.

For example, if your home is worth $300,000 and you owe $200,000, your available equity may allow you to borrow up to $85,000. The loan is then repaid over a period of five to 30 years with a fixed interest rate, making it easier to budget your payments.

Some lenders may allow you to borrow more than 85% of your home’s value, depending on your property, credit history, and lending situation.

How do I get a home equity loan?

Getting a home equity loan involves several steps, but it’s a straightforward process. Here’s what to expect:

1. Assess your home equity

Start by calculating how much equity you’ve built in your home. Most lenders require you to have at least 20% equity to qualify. (Some lenders allow for 15%.) To estimate your equity, subtract your current mortgage balance from your home’s market value. The higher your equity, the more you can potentially borrow.

2. Check your credit score

Lenders will review your credit score to determine your eligibility and interest rate. A score of 620 or higher is generally needed, but a higher score (660 or 680) could help you qualify for better rates. If your score needs improvement, consider paying down debt or disputing any errors on your report before applying.

3. Gather financial documentation

Be prepared to provide documentation, such as proof of income, tax returns, and details of your existing mortgage. Lenders need to confirm your financial health and ability to repay the loan. Having these documents ready can speed up the application process.

4. Shop around for lenders

Different lenders offer varying interest rates and terms, so it’s smart to compare your options. Look at banks, credit unions, and online lenders to find the best deal. Pay attention to loan fees, terms, and customer service reviews.

5. Submit your application

Once you’ve chosen a lender, complete the loan application. Be honest and thorough with your information. The lender will review your application and order an appraisal of your home to verify its current value.

6. Review the loan terms

After approval, carefully review the loan’s terms, including the interest rate, repayment period, and any fees. Ask questions if anything is unclear, and make sure the loan fits within your budget.

7. Close the loan

If everything checks out, you’ll move on to closing. At this stage, you’ll sign the final paperwork, and the loan funds will be disbursed. The time between application and funding typically takes a few weeks.

How can I use my home equity loan?

Home equity loans offer flexibility in how you can use the funds, including:

- Home improvements: Renovate your kitchen, update your bathroom, or tackle larger projects that add value to your home.

- Debt consolidation: Pay off higher-interest credit card balances and streamline your debt into one manageable payment.

- Education expenses: Cover tuition or other educational costs for you or your family.

- Major purchases: Finance a large purchase, such as a vehicle or a second home.

- Your next home purchase: Get cash for a down payment or other expenses on your next home. This can make it easier to secure financing and cover upfront costs when buying a new property. Alternatively, you can use modern programs that also let you use your existing equity to buy before you sell, allowing you to move only once. (More on this later in our post.)

Top reasons people borrow against their home equity

A recent HomeLight survey of loan officers from 55 lending companies across the country revealed that the majority of U.S. homeowners who take out an equity-backed loan use the money to consolidate debt, cope with the rising cost of living, and deal with major life events, such as starting a family or getting a divorce.

Below is a table showing all the borrower-use responses from our 2025 lender survey:

| Reason for borrowing | Percentage of responses |

| Debt consolidation | 32% |

| Rising cost of living | 21% |

| Major life event (divorce, marriage, or starting a family) | 17% |

| Relocation or changes in employment | 9% |

| Greater need for supplemental retirement income | 2% |

Source: HomeLight 2025 Lender Insights & Predictions Survey

How much are homeowners borrowing with equity?

In our 2024 Lender Insights report, the majority of U.S. homeowners using an equity-backed loan borrow between $76,000 and $100,000. Here is a table showing the breakdown of all loan officer responses:

| Borrowed amount | Percentage of responses |

| $201,000 or more | 7% |

| $176,000–$200,000 | 7% |

| $151,000–$175,000 | 7% |

| $126,000–$150,000 | 7% |

| $101,000–$125,000 | 14% |

| $76,000–$100,000 | 32% |

| $51,000–$75,000 | 16% |

| $26,000–$50,000 | 8% |

| $10,000–$25,000 | 1% |

| Less than $10,000 | 1% |

Source: HomeLight 2024 Lender Insights Survey

How much does a home equity loan cost?

The average cost of a typical home equity loan is 2% to 5% of the total loan amount, butit can be as low as 1%, depending on the borrower, the lender, and the property.

The costs of the loan include:

- Interest: Your interest rate will be fixed for the life of the loan, but rates vary depending on your credit score and the lender.

- Fees: Common fees include application fees, appraisal fees, and closing costs.

- Insurance: You’ll need to maintain homeowners insurance, and in some cases, lenders may require title insurance or other protections.

Be sure to ask about any hidden costs or early repayment penalties before signing.

Cost example: In HomeLight’s recent survey of loan officers serving at over 85 top lending companies across the U.S., HomeLight found that on a $100,000 equity-backed loan, a typical homeowner borrower can expect to pay $2,416 in closing costs and fees, or about 2.4% of the borrowed amount.

How can I get a lower home equity loan rate?

To secure a lower rate, follow these tips:

- Improve your credit score: A higher credit score typically leads to better interest rates. Pay down debts and correct any credit report errors before applying.

- Compare multiple lenders: Don’t settle for the first offer. Compare rates from at least three lenders to find the best deal.

- Negotiate: Some lenders may be willing to lower their rates or fees if you ask. Don’t be afraid to negotiate.

How long does it take to get a home equity loan?

The timeline for getting a home equity loan can vary, but it typically takes two to six weeks. Here’s a general breakdown:

- Application processing: It takes about one to two weeks for the lender to review your financials and approve the loan.

- Home appraisal: This step can take an additional week or two, depending on how quickly the appraisal is scheduled.

- Loan closing: Once approved, the closing process usually takes one to two weeks, including signing documents and disbursing funds.

If you need the loan quickly, ask your lender about expedited options, but be prepared for higher costs.

Pros and cons of a home equity loan

Before tapping into your home’s value, it’s important to understand what a home equity loan offers. While it can be a smart way to access cash for major expenses, it also comes with risks worth considering. Here’s a quick look at the pros and cons to help you decide if it’s the right move for your financial situation.

Pros

- Fixed interest rate and payments: You’ll have predictable monthly payments with a fixed rate for the life of the loan.

- Lump sum payment: Receive the full loan amount upfront, which is useful for large projects or expenses. Home equity loans also offer larger borrowing amounts compared to other borrowing options.

- Lower interest rates: Home equity loans often have lower interest rates than credit cards or personal loans.

- Potential tax benefits: You may be able to deduct interest payments if you use the loan for IRS-qualified home improvements or repairs.

- Longer repayment timelines: Home equity loans typically provide extended repayment options spanning up to 30 years.

- Flexible use of funds: The loan can be used for a wide range of purposes, from home renovations to debt consolidation.

Cons

- Foreclosure risk: Since your home is used as collateral, failure to repay the loan can result in the loss of your property.

- Added debt burden: You’ll be taking on a second mortgage, adding to your overall debt load.

- Strict equity requirements: Lenders will hold the line on minimum equity requirements. You may need to wait and build equity before you can take out a home equity loan.

- Closing costs and fees: Expect to pay fees, such as closing costs and appraisal fees, which can add up to several thousand dollars.

- Long-term commitment: Repayment periods can last up to 30 years, tying you to long-term debt.

- Potential decrease in home equity: Borrowing against your home reduces the equity you’ve built up, which may limit future borrowing options.

Home equity pitfalls to avoid

- Fast-depreciating expensive items: Many investment experts advise their clients to avoid using home equity for purchases like cars or RVs that lose value rather quickly over time.

- Unnecessary luxury purchases: Financing items like designer clothes or high-end gadgets can lead to unnecessary debt with very little sustainable value.

- Extravagant holiday shopping: Using home equity for short-lived expenses like holiday gifts can leave you with long-term debt.

- Extreme expense vacations: Funding lavish trips with your home equity could mean paying for them long after the memories fade.

- Growing everyday expenses: If you rely on a home equity loan to cover monthly bills, it could be a sign of deeper financial issues.

- Stock market investment: Using home equity for speculative investments is risky, as market downturns can leave you with both a loan and losses.

- Inexperienced investment property purchase: Without knowledge of the real estate market, using equity for investment property could backfire.

- Educational expenses when other programs have lower costs: Explore scholarships, grants, and federal student loans before using home equity to pay for education.

How can I estimate my home equity?

To estimate your home equity, follow these steps:

- Check your home’s current market value: Use online valuation tools, such as HomeLight’s Home Value Estimator, for a preliminary estimate, or consult a professional appraiser or real estate agent for a more accurate assessment.

- Subtract your mortgage balance: Take the market value of your home and subtract the amount you still owe on your mortgage. The difference is your home equity.

- Consider recent sales in your area: Reviewing comparable home sales can help you estimate your home’s value more accurately and give you a clearer picture of your equity.

From online calculators to local market comparisons, knowing your property’s value is key to making informed financial decisions. To learn more ways to estimate your home’s current value, see our post, 9 Ways to Look Up the Property Value of a House.

How can I grow home equity?

Building home equity takes time, but here are a few ways to accelerate the process:

- Pay down your mortgage: The more you pay toward your mortgage principal, the more equity you build.

- Make extra payments: Adding a little extra to your mortgage payments each month can help reduce your principal faster.

- Increase your home’s value: Consider home improvements or renovations that boost your property’s market value.

- Wait for appreciation: As home values rise over time, so does your equity. Staying in your home for the long term can help maximize appreciation.

Increasing your home’s equity isn’t just about paying down your mortgage. It also involves boosting your property’s value over time. Strategic improvements and market trends both play a role. To learn more ways to grow your home’s equity, see our post, What Makes Your Property Value Increase? 12 Key Factors to Watch.

Can I use my equity to buy before I sell?

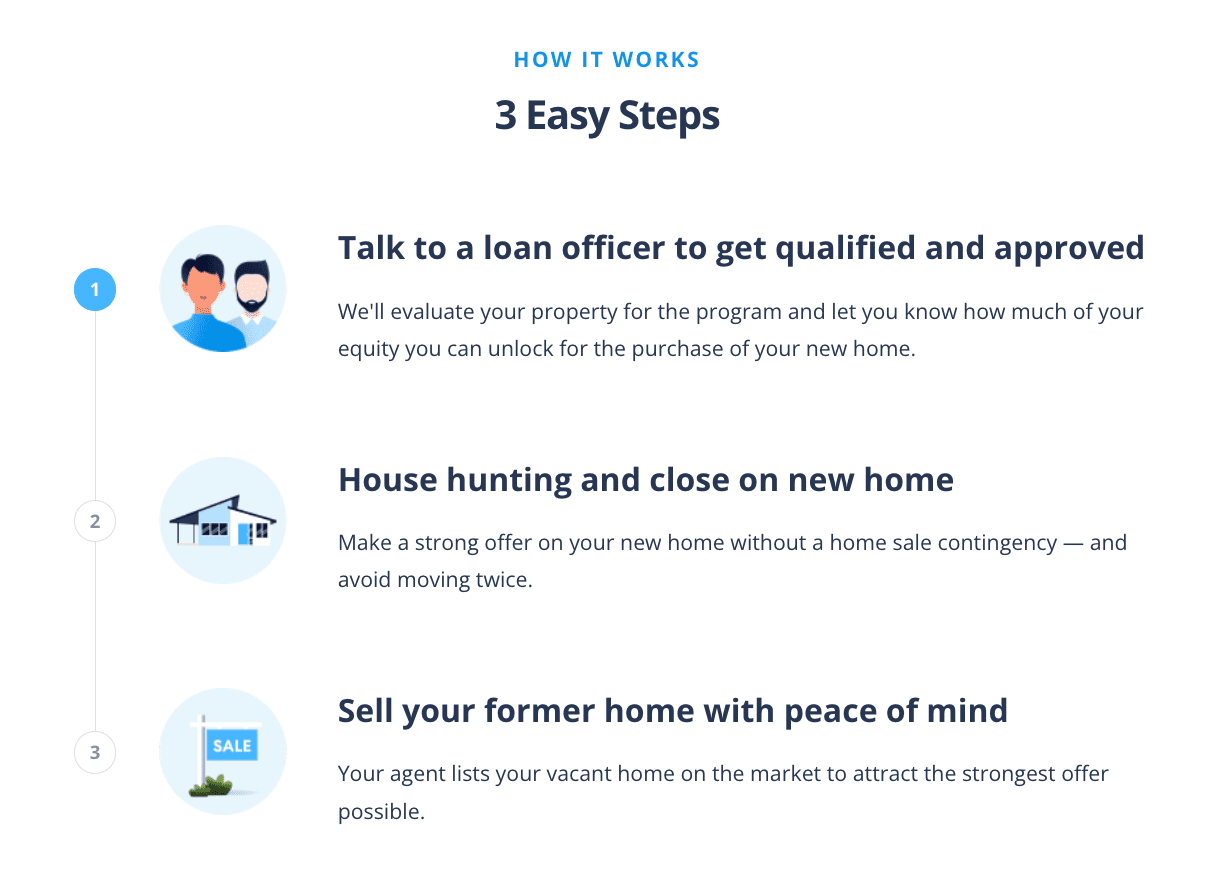

Yes, you can use your home equity to buy your next home before selling your current one with HomeLight’s Buy Before You Sell program. This option allows you to unlock your equity to make a strong offer on your new home while avoiding the stress of timing the sale of your current home.

HomeLight’s program can give you the financial flexibility to move only once and at your own pace, making the transition to your new home smoother and more convenient.

Here’s how HomeLight Buy Before You Sell works:

Other helpful tools offered by HomeLight:

- Find a Top Agent

- Home Value Estimator

- Agent Commissions Calculator

- Home Affordability Calculator

- Net Proceeds Calculator

- Best Time to Sell Calculator

Should I borrow against my home equity?

Borrowing against your home equity can be a smart financial move if you need funds for important expenses like home improvements or debt consolidation. However, it’s essential to borrow responsibly and consider the long-term impact on your finances.

Before making a decision, evaluate your financial situation, weigh the pros and cons, and consider whether the loan aligns with your goals. It’s also essential to understand how much your home is worth, since your equity and borrowing power depend on it.

If you’re unsure, consult with a financial advisor or lender to help you determine the best course of action. To get started, try HomeLight’s free Home Value Estimator to get a ballpark estimate in less than two minutes.

Header Image Source: (Demure Storyteller / Unsplash)