How Much Does It Cost to Rebuild a House? (Will insurance pay for it?)

- Published on

- 9 min read

-

Richard Haddad Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

Climate change and rising home insurance rates have forced many homeowners to ask a worst-case scenario question: “How much does it cost to rebuild a house?” The next dreaded domino question would be, “Do I have enough replacement cost coverage to rebuild my house?”

Whether you’re concerned about natural disasters or accidents or just curious about your home’s value, this guide provides helpful insights to answer these poignant questions.

Why the cost of rebuilding a house is making headlines

A good homeowners insurance policy contains a package of protection. One slice of that package is what’s called “dwelling coverage,” the part that covers the physical structure of your home, not its contents or the land beneath it. Within the industry, this is referred to as “Coverage A,” defined as “major property coverage that protects your house and attached structures if it is damaged by a covered peril.”

Dwelling coverage has been in the news more because of rising insurance rates brought on by climate change threats and increased building costs. In disaster-prone parts of the country (areas with hurricanes, floods, tornadoes, and wildfires), some homeowners are faced with reducing their dwelling coverage to make their premiums more affordable.

Essentially, this means they are lowering the amount of insurance money they would receive to rebuild their home from scratch. This is also known as “Replacement cost coverage.”

What if you don’t have enough dwelling coverage?

If your dwelling coverage amount is lower than the cost of rebuilding your home, your insurance claim won’t provide you with enough money to cover the entire cost of replacing your house. For example, if you have $400,000 in dwelling coverage, but it costs $480,000 to rebuild, you would have to pay the $80,000 difference or reduce costs by downsizing or downgrading.

Actual cash value vs. replacement cost

When establishing a homeowners insurance policy, you will typically be asked to choose between actual cash value coverage (ACV) and replacement cost coverage.

- Actual cash value coverage: This type of coverage pays out the value of your home at the time it was damaged or destroyed, taking into account depreciation. It provides less money than replacement cost coverage because it factors in the age and wear of the home.

- Replacement cost coverage: This coverage pays the amount needed to rebuild your home with similar materials and quality, without considering depreciation. It ensures you have enough funds to restore your home to its original state, offering more comprehensive financial protection.

How much does it cost to rebuild a house?

Based on available data, the cost to rebuild a typical U.S. home ranges between $135,787 and $523,885, with the average cost currently at $313,369. Your final costs will vary based on several factors, which we’ll outline below.

According to the experts at Angi, these costs break down to a range of $100 to $500 per square foot, with a national average of $150 per square foot. A typical expense split is:

- Labor costs: 40%

- Material costs: 60%

It’s important to note that labor can cost more when rebuilding an existing house because the remaining structure may need to be prepared and fitted, or the land may need to be cleared. This can add to the cost per square foot.

Cost to rebuild a house example

If your home is completely destroyed by a covered peril, your home insurance company will use a complex calculation to estimate the cost of rebuilding. Below is a simplified example that shows what you might expect to pay to rebuild an average home:

According to U.S. Census data, the average new single-family home in 2023 measured 2,233 square feet. While Angi estimates the current average cost to build a new house is $150 per square foot, we’ll use $200 in this example to account for the additional labor for demolition or structure preparations.

2,233 square feet x $200 = $446,600

Using this equation, it could cost as much as $446,600 to rebuild a 2,233-square-foot home.

Bigger homes mean bigger replacement costs

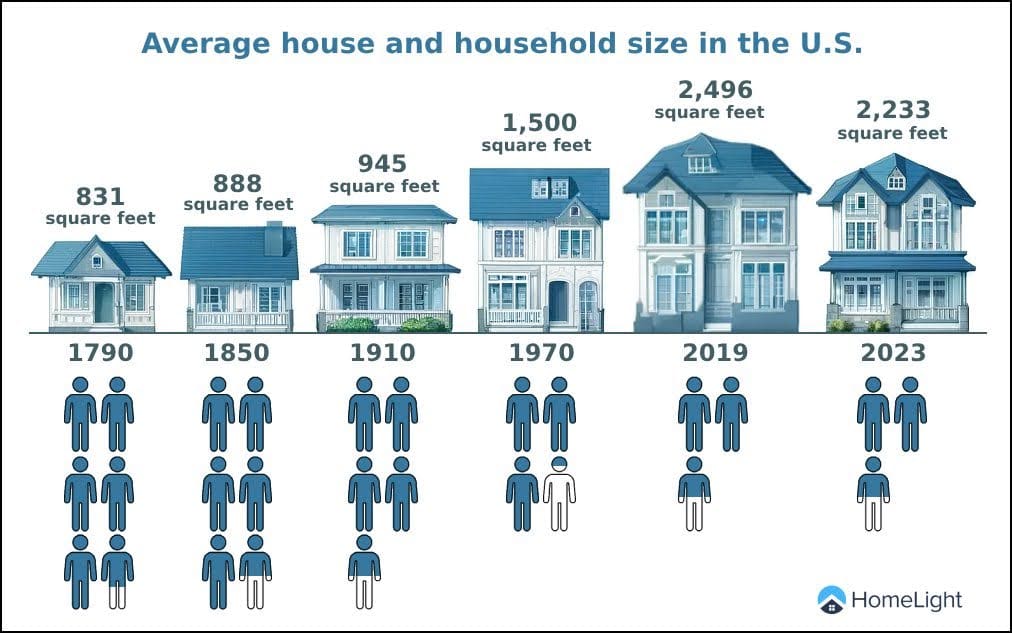

The average size of homes in the U.S. has steadily increased over the centuries but dipped slightly in recent years, according to U.S. Census data. The expansion has been substantial. For example, in 1790, a typical U.S. home was 831 square feet. By 2019, the average U.S. home was three times larger, measuring 2,496 square feet. As noted above, today’s new average U.S. home size is 2,233 square feet.

Here’s a historical timeline of average home sizes:

Additionally, the average number of people living in a home has decreased as home sizes have increased. That 831-square-foot home in 1790 housed an average of 5.75 people. Today, a 2,233-square-foot home houses an average of only 2.51 people.

As homes have grown larger, the cost to rebuild them has also increased. Larger homes require more materials and labor, contributing to higher rebuilding costs — and higher homeowners insurance premiums.

What impacts the cost of rebuilding a house?

Beyond the national averages we provided earlier, your final cost to rebuild a home will be influenced by a number of key factors. These include:

- Square footage: The larger the home, the more materials and labor are needed, increasing the overall cost.

- Location: Building costs vary by region due to differences in labor rates, material costs, and local regulations. Distance to transport materials and ease of access also play a role.

- Building materials: The quality and type of materials significantly impact costs. High-impact areas include:

- Framing: Wood, steel, or concrete framing materials come at different price points.

- Roofing: Choices like asphalt shingles, metal, or tile roofing vary in cost.

- Foundation: Slab, crawl space, and basement foundations have different expense levels.

- Upgrades and home features: High-end finishes, custom designs, and additional features like pools or extensive landscaping add to rebuilding costs.

- Labor costs: The availability and skill level of labor in your area affect rebuilding expenses.

The building company you select will also influence the cost. Reputable companies with a history of quality work may charge more but offer reliability and expertise that can save you money in the long run. Conversely, choosing a less experienced or lower-cost builder might lead to higher expenses due to potential mistakes or lower-quality work that requires future repairs.

What’s the home insurance 80% rule?

The home insurance 80% rule is a guideline used by insurance companies to determine the minimum amount of coverage you should have on your home to avoid penalties for being underinsured. It suggests that you must insure your home for at least 80% of its replacement cost value to receive full coverage for any partial losses.

For example, if your home’s replacement cost is estimated at $500,000, you should have at least $400,000 in dwelling coverage (80% of $500,000). If you have less than this amount, your insurance company may not fully cover partial damage. Instead, they will pay a proportionate amount based on the actual coverage you have.

80% rule example scenario

Imagine your home’s replacement cost is $500,000. According to the 80% rule, you should have $400,000 in coverage. However, if you only have $325,000 in coverage and your home suffers $100,000 in damage, the insurance company will only cover part of the loss. They would calculate the payout as follows:

- Home value: $500,000

- Home insurance policy limits: $325,000 ($75,000 less than required to be at 80%)

In the event of a covered claim — partial or total loss — your insurance company determines its payment based on the percentage of dwelling coverage in your policy, divided by the amount that would be required to be at 80%

$325,000 (what you have) / $400,000 (80%) = 81%

In this scenario, if you experience a loss of $100,000, your insurance would pay just 81% of the damage, which equals $81,000 (minus any deductible you owe). This would leave you to cover the remaining $19,000 out of pocket.

If you have made any significant upgrades to your home that have increased its value, or if you’re concerned about rising material and labor costs, it would be wise to review your replacement cost coverage using the 80% rule.

Some preemptive steps you can take include:

- Hire a home appraiser to get a clearer picture of your home’s value

- Research local construction and labor costs

- As your insurance company about extended replacement cost coverage

- As your insurance company about guaranteed replacement cost coverage

Ways to reduce costs when rebuilding a house

Rebuilding a house can be expensive, but there are several ways to reduce costs:

- Downsize your square footage: Building a smaller home can significantly cut down on material and labor costs.

- Simplify your floor plan: Opting for a simple, straightforward design can reduce architectural and construction expenses.

- Build with more affordable materials: Choose cost-effective construction materials, such as composite materials instead of hardwood.

- Hire licensed contractors: While it may be tempting to cut costs by hiring cheaper, unlicensed labor, licensed contractors ensure quality work, reducing the need for future repairs and additional expenses.

- Use energy-efficient materials: Investing in energy-efficient windows, insulation, and appliances can save money in the long run through reduced utility bills.

- Opt for prefabricated components: Using prefabricated walls, roofs, or floors can speed up construction and reduce labor costs.

Know your home’s current value and rebuild cost

Understanding your home’s current value is essential, whether you’re rebuilding, reviewing your insurance policy, or considering a sale. A top-rated local real estate agent can provide valuable insights into the local market and recommend reputable appraisers.

You can also use HomeLight’s free Home Value Estimator to get a ballpark estimate of your home’s current worth.

If you’re contemplating selling your home, an agent can offer a comparative market analysis (CMA) to help determine its market value. HomeLight can connect you with top agents in your market with our free Agent Match tool.

Header Image Source: (JOSHUA COLEMAN/ Depositphotos)

- "Homeowners insurance rates skyrocketed in these 10 states — here’s how to lower your premiums", CNBC Select (February 2024)

- "Residential Insurance: Homeowners and Renters", California Department of Insurance (May 2024)

- "2024 Cost to Build a House From Top to Bottom", Angi (December 2023)

- "How Much Does It Cost to Rebuild a House?", Angi (January 2024)

- "What is a peril in homeowners insurance?", Policygenius (October 2023)