How Much Equity Can I Borrow From My Home?

- Published on

- 12 min read

-

Richard Haddad, Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

-

Jedda Fernandez, Associate EditorCloseJedda Fernandez Associate Editor

Jedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

As a homeowner, your home equity represents one of your most valuable financial assets. It’s the difference between what you owe on your mortgage and what your home is worth today. With home values growing by nearly 50% in the past four years, you may be asking, “How much equity can I borrow from my home?”

In this post, we review your options for tapping into your home equity and how to estimate the maximum amount you can borrow.

We’ll also share factors that increase the amount you can access, and provide some interesting survey data about how Americans are using their equity loans.

What equity borrowing options do I have?

There are three common ways homeowners can access money from their home equity:

- Home equity loans: A home equity loan gives you a lump sum of cash upfront, which you repay over time with fixed monthly payments. It’s often used for large, one-time expenses like home renovations or debt consolidation.

- Home equity line of credit (HELOC): A HELOC acts like a credit card secured by your home. You can borrow money as needed during a set draw period, and you only pay interest on what you use. It’s a flexible option for ongoing expenses or projects.

- Cash-out refinancing: With cash-out refinancing, you replace your current mortgage with a new one that’s larger than what you owe. The difference is paid to you in cash. This option might be useful for homeowners who want to take advantage of lower interest rates while accessing their equity.

How do I estimate my home equity?

Estimating your home equity is fairly straightforward. To get an estimate:

- Find your home’s current market value: You can do this by looking at recent sales of similar homes in your area, using online tools like HomeLight’s Home Value Estimator, or getting a professional appraisal.

- Subtract your outstanding mortgage balance: Check your most recent mortgage statement to find out how much you still owe.

The difference between your home’s value and your mortgage balance is your available equity.

How much equity can I borrow from my home?

The amount of equity you can borrow depends on the type of loan you choose, your credit score, and the lender’s terms. Most lenders allow homeowners to borrow up to 80% to 85% of their home’s value, minus what they still owe on their mortgage. Some lenders may allow up to 90%.

Here are three real-world examples using a U.S. median home value of $420,000 with an outstanding mortgage balance of $280,000:

- Home equity loan: If your lender allows you to borrow 80% of your home’s value, you could borrow up to $100,000 in a home equity loan if you have $140,000 in existing equity.

- HELOC: Suppose you need a smaller loan, like $30,000, for home improvements. A HELOC would let you borrow that amount and only pay interest on what you use during the draw period.

- Cash-out refinance: You refinance your home for $336,000, cashing out $56,000 of your equity. This replaces your existing mortgage balance of $280,000, allowing you to access some of your home’s value while keeping a new mortgage in place.

Most lending companies provide helpful online home equity and cash-out refinance calculators that make it easy to determine how much you can borrow against your home.

Refinance insight: To avoid paying private mortgage insurance (PMI), you need to have at least 20% equity in your home. This means that your loan balance needs to be 80% or less of your home’s value. For example, if your home is worth $420,000 and your loan balance is $336,000 or less, you have 20% equity and can avoid PMI.

What factors increase the amount I can borrow?

The amount you can borrow through an equity-backed loan depends on several factors. Here are some ways you can increase your borrowing capacity and potentially secure a larger loan.

- High credit score: A high credit score indicates to lenders that you are a responsible borrower. This can lead to lower interest rates and higher loan amounts.

- Low Debt-to-Income Ratio: A low debt-to-income ratio (DTI) shows that you have a manageable debt load relative to your income. Lenders prefer borrowers with a lower debt-to-income ratio, as it suggests a greater ability to repay the loan.

- Significant equity: The more equity you have in your home, the more you can borrow. Equity is the difference between the current market value of your home and the outstanding mortgage balance.

- Stable income: A consistent and reliable income stream demonstrates your ability to make regular loan payments. Lenders are more likely to approve larger loans to borrowers with stable employment and income.

- Strong property value: A home with a high appraised value can increase your borrowing capacity. Lenders are more willing to lend against properties that are likely to appreciate in value over time.

- Shop around for lenders: Comparing offers from multiple lenders can help you find the best terms and conditions. Different lenders may have varying criteria for loan approval and borrowing limits.

Understanding CLTV: Why it matters if you have more than one loan

When lenders determine how much home equity you can borrow, they don’t just look at your current mortgage — they look at all outstanding loans secured by your home. That’s where Combined Loan-to-Value (CLTV) comes in.

CLTV is a ratio that includes the total amount of all loans tied to your property — such as your primary mortgage, a home equity loan, or a HELOC — divided by your home’s appraised value.

How CLTV works

Let’s say your home is worth $400,000 and you:

- Owe $220,000 on your mortgage

- Want to borrow an additional $60,000 in a home equity loan

Your total loans would be $280,000. Divide that by your home’s value:

CLTV = ($220,000 + $60,000) / $400,000 = 70%

Lenders typically cap CLTV at 80% to 90%, though some are more conservative. If your CLTV exceeds that range, you may not qualify for the loan amount you want — or at all.

Why CLTV Matters

If you already have a HELOC or another lien on the home, your CLTV could limit how much more you can borrow, even if your LTV (loan-to-value) from the first mortgage looks good. It’s a key risk metric lenders use to assess your total leverage on the property.

How your credit score affects how much you can borrow

Your credit score doesn’t just determine whether you qualify for a home equity loan — it can also influence how much you can borrow and at what interest rate.

Minimum credit score requirements

While requirements vary by lender, most home equity loans and HELOCs require a credit score of at least 620. However:

- Scores of 700+ may unlock higher borrowing limits and better interest rates.

- Scores under 680 could result in higher rates or reduced maximum loan amounts.

Credit score impact example

Consider two homeowners with identical homes worth $300,000 and $150,000 in equity:

- Borrower A has a credit score of 760

- Borrower B has a credit score of 640

Borrower A is more likely to qualify for 90% CLTV and a lower rate, while Borrower B may only be eligible for 75–80% CLTV, and will likely pay a higher interest rate — reducing their effective borrowing power.

What lenders look for

In addition to your score, lenders may examine:

- Payment history

- Credit utilization

- Debt-to-income (DTI) ratio

- Recent credit inquiries

Improving your credit before applying can increase your approval odds and help you borrow more at a lower cost.

How much equity are U.S. homeowners borrowing?

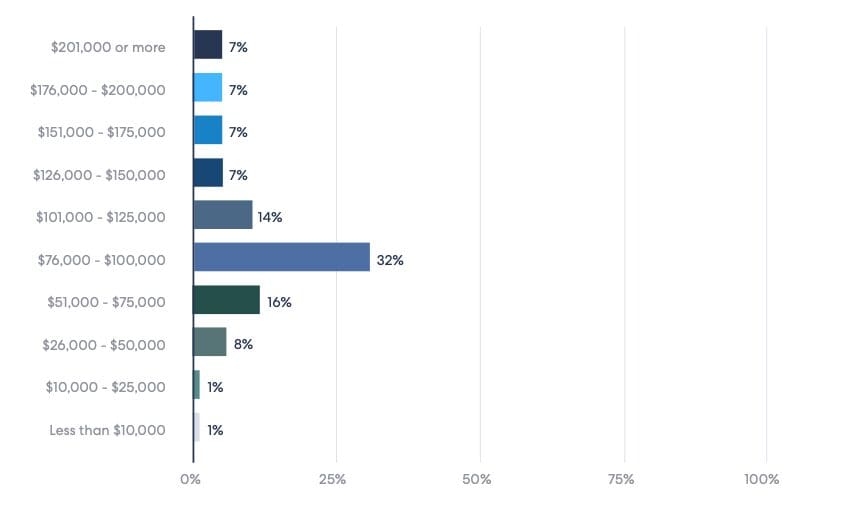

According to ICE Mortgage Technology, a typical U.S. homeowner has about $212,000 in tappable equity. However, based on data from a recent HomeLight lender survey, the most common home equity loan borrowing range is $76,000 to $100,000.

What are common reasons homeowners use equity?

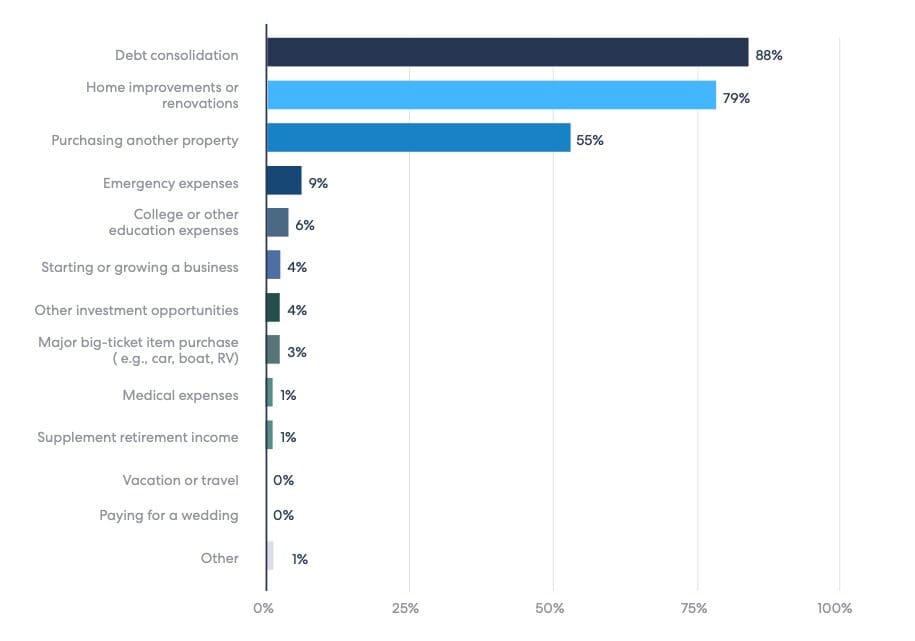

The funds from your equity-backed loan can be used for any purpose you choose. In HomeLight’s 2024 survey of loan officers throughout the U.S., 88% say that the top reason homeowners choose to borrow against equity is debt consolidation.

Accessing money for home improvements and purchasing another property where the next two most common responses.

What might not be a good use of my equity?

While tapping into your home equity can provide financial flexibility, it’s important to consider how you use it. Not every expense is worth financing with home equity, as some purchases could leave you with long-term debt without offering lasting value.

Here are a few things that might not be a smart use of your equity:

- Purchasing items that lose value quickly: Big-ticket items like cars, RVs, or boats depreciate rather quickly. Using home equity for these purchases could leave you owing more on a loan than the item is worth in a few years.

- Unnecessary luxury purchases: Splurging on designer goods or the latest high-end electronics may be tempting, but it can result in debt with little long-term benefit.

- Holiday shopping sprees: Using equity to finance a season of extravagant gift-giving could lead to lingering debt long after the festivities are over.

- Lavish vacations: While memories of a dream trip may last, paying for it with home equity could mean facing a financial burden long after the vacation is over.

- Covering everyday expenses: If you find yourself needing home equity to pay for monthly bills, it could be a sign of a deeper financial issue that home equity may only mask.

- Risky investments: Using home equity to invest in stocks or other speculative ventures can be risky. A market downturn could leave you with both a loan to repay and potential financial losses.

- Purchasing investment property without experience: If you’re not well-versed in real estate investing, using home equity to buy a rental or investment property could backfire if the market doesn’t perform as expected.

- Paying for education without exploring other options: Before tapping into home equity to cover educational expenses, look into scholarships, grants, or federal student loan programs, which may offer more affordable ways to finance education.

Pros and cons of borrowing against equity

Borrowing against your home equity can be a smart way to access funds, but like any financial decision, it comes with both advantages and risks. Here’s a look at the pros and cons to help you weigh your options:

Pros

- Lower interest rates: Home equity loans and lines of credit typically offer lower interest rates compared to credit cards or personal loans since they’re secured by your home. This can make borrowing more affordable over time.

- Large borrowing amounts: Because your loan is secured by your home, you can usually borrow a significant amount, making it ideal for big expenses like renovations or consolidating high-interest debt.

- Potential tax benefits: In some cases, the interest paid on home equity loans may be tax-deductible if you use the money to substantially improve your home. Be sure to consult a tax professional to see if this applies to your situation.

- Flexible use: Unlike some loans, borrowing against your home equity gives you the freedom to use the funds however you choose, whether it’s for home improvements, medical expenses, or educational costs.

Cons

- Risk of losing your home: Since your home is collateral, failing to make payments on a home equity loan or line of credit could lead to foreclosure. Therefore, it is crucial to borrow only what you can confidently repay.

- Potential for long-term debt: Home equity loans often have repayment periods of 10-30 years. Taking on this debt for short-term expenses could mean you’re paying for it long after the benefit has faded.

- Fees and closing costs: Borrowing against your equity can come with upfront costs, including application fees, appraisals, and closing costs, which might offset the financial benefit, depending on how much you need to borrow.

- Market fluctuations: The value of your home could decrease, leaving you with less equity than expected or even “underwater” if your loan exceeds the home’s value.

FAQs about ‘How much equity can I borrow?’

How long does it take to get a home equity loan?

The process of getting a home equity loan typically takes two to six weeks. This timeline includes the application, approval, home appraisal, and closing. The exact timing can vary depending on the lender and how quickly you provide the necessary documentation.

How do I qualify for a home equity loan?

To qualify for a home equity loan, you’ll generally need at least 15%-20% equity in your home, a solid credit score (usually 620 or higher), a stable income, and a low debt-to-income ratio. Lenders will also consider your home’s value and your outstanding mortgage balance.

How can I grow my home equity?

You can grow your home equity by paying down your mortgage and increasing your home’s value. Making extra payments on your mortgage reduces the principal balance faster, and home improvements or rising property values in your area can also boost equity.

How much does a home equity loan cost?

The cost of a home equity loan varies, but you’ll typically pay interest, along with closing costs, appraisal fees (if required), and application fees. Average total costs for a home equity loan are 2%–5% of the loan amount, but can be as low as 1%. In most cases, the more you borrow, the higher the fees will be.

How do I get a home equity loan?

To get a home equity loan, you’ll need to apply with a lender who will assess your home’s value, your mortgage balance, and your credit. If approved, you’ll receive a lump sum of money that you’ll repay over a set period, usually at a fixed interest rate. The HELOC application process is the same, but you’ll be approved for a revolving credit account similar to a credit card and have an adjustable interest rate.

Can I use my equity to buy before I sell?

Yes, you can use your home equity to help finance a new home before selling your current one. HomeLight’s Buy Before You Sell program allows you to unlock your equity and buy your next home without the pressure of selling first. You can make a stronger, non-contingent offer on your new home and only move once. Learn more by watching this short video:

Is borrowing against my home equity right for me?

Deciding whether to borrow against your home equity depends on your financial goals and how you plan to use the funds. It’s a powerful tool for homeowners who need access to cash for major expenses, but it’s important to consider the risks. Borrowing against your home means putting your property on the line, so only take out a loan if you’re confident you can repay it.

Some questions to ask before borrowing against equity might include:

- Do I need a lump sum or smaller, intermittent amounts?

- Can I afford the loan payments throughout the term?

- Am I confident that my job or income will remain stable?

- Are there other lending options I should consider?

- How soon do I need the funds?

- Is this the best use of my equity?

Before moving forward, review your financial situation, explore all your options, and consult with a lender or financial advisor. Understanding the pros and cons will help you make the best decision for your needs.

If you are looking to buy or sell in the future, HomeLight partners with top-rated real estate agents across the country. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

Editor’s note: This post is for educational purposes only, not financial advice. HomeLight encourages you to reach out to an advisor.

Header Image Source: (lmphot/ Depositphotos)