A Homebuyer’s Guide to What Adds Value to a Home

- Published on

- 5 min read

-

Melissa Holtje Contributing AuthorClose

Melissa Holtje Contributing AuthorClose Melissa Holtje Contributing Author

Melissa Holtje Contributing AuthorMelissa enjoys using her experience as a house flipper, investment buyer, and waterfront home owner to help buyers and sellers thrive in the housing market. When not scouting real estate, you’ll most likely find her at the beach.

When you’re shopping for a new home, the price variation within your town can be staggering. In fact, the differences can be downright confusing. What makes the house on First Street worth so much more than the same sized house on Second Street?

In order to answer that question, we pored over national valuation surveys, consulted an expert appraiser, and gained perspective from a top real estate agent. The results may surprise you, but they’ll also help you make a more informed real estate purchase.

Home value basics

Comparable listings

Cory Brandt, a real estate agent with over 20 years of experience in the Seattle, Washington, area, says that having a trained agent in your corner is the best course of action when it comes to determining the value of a home. While buyers are pulling up to a home and experiencing an emotional reaction, a good agent is pulling up to a home and evaluating the structure, location, and comparable listings (comps).

And that’s important because the listing agent for the home has looked at those very same qualities with the seller. In fact, that’s how they developed the listing price. The agent researched what other properties sold for and what other properties were listed for in order to determine an objective value for the home.

Comps help provide a baseline or a range for pricing. For example, in a neighborhood where houses have recently sold for $210,000, $225,000, and $230,000, the seller would be hard-pressed to think they could list their home for $275,000 without some significant reason. However, those reasons do exist; we’ll discuss things that can dramatically increase value below.

Appraisals

A real estate appraisal is the final say on home valuation, especially from a financing perspective. The listing price and even the agreed-upon purchase price won’t mean much without an official appraisal to back it up.

Fred Collins, an Orlando, Florida, appraiser with over 25 years of experience, says that pulling fair comps in the same neighborhood is the key to accurate appraisals. The real estate appraiser will research nearby properties that have recently sold and then make adjustments based on the features of the property.

If an appraisal comes in lower than the purchase price, the mortgage company will likely deny the buyer’s loan unless the buyer can work out a deal with the seller or come up with the difference between the purchase price and the appraised value. According to a survey done by the National Association of Realtors, 16% of all home closing delays are due to disputes about the appraisal.

So, when it comes to determining the value of a home as a buyer, it’s best to think about it from the perspective of the real estate appraiser and the listing agent. But keep in mind there will be subjective things that add or subtract value for you personally as well.

Valuation adjustments

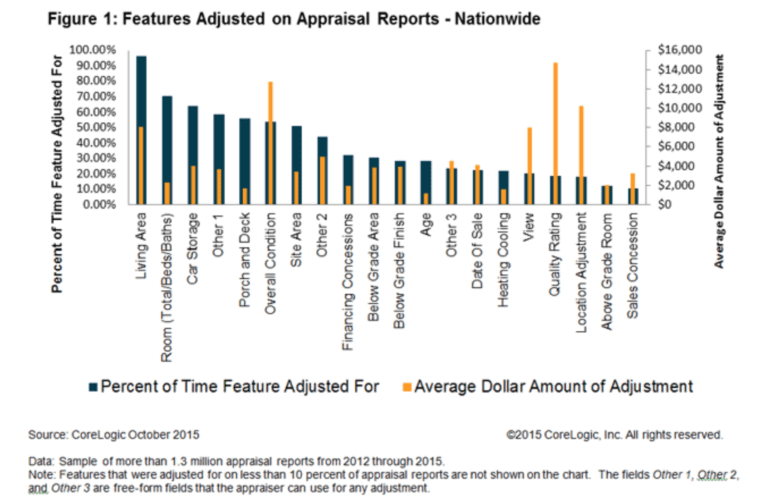

Understanding how real estate appraisers adjust for value can help when determining a property’s true value. A survey by CoreLogic indicates that 99.8% of all appraisals undergo some type of adjustment. Results displayed on this chart tell us that living area is the most common adjustment made (teal bars), but that quality rating has the most significant impact on price (yellow bars).

Let’s break down some common adjustments in order to think like an appraiser and a listing agent when it comes to buying a house.

Home layout adjustments

Gross living area (GLA) and number of bedrooms and bathrooms are the most common adjustments. That means if a comp in the area has less square footage than the house you are buying, there will be an increased valuation for your home. Likewise, if a comp has four bedrooms and the house you’re buying has three, there will be a decrease in your home’s valuation.

Other additions can affect value as well. Finished basements and attics (with legal egresses) contribute to the overall GLA and therefore increase value. Properly permitted additions or detached apartments add value. However, garage conversions may subtract value, depending upon the locale.

The layout inside the home also affects the price point and value. Homes with popular layouts (such as the open kitchen and living room) will typically be priced higher than homes with closed layouts. Single-level floor plans are also highly prized by people who want to age in place.

Of course, layouts can be changed, to a certain extent. We’ve all seen the remodeling shows that are keen to knock down walls. But Brandt says, “There are some homes that are more difficult from a layout standpoint to do modifications on.” Split-level homes (bi-level, tri-level, quad-level) are trickier to convert.

At the end of the day, you’ll have to put your own value on the layout and total room numbers in a home. If you really want a formal dining room or a separate office space, then determine how much you’re willing to spend to get them.

Interior finishes adjustments

Adjustments for interior finishes can be a much more subjective portion of the appraisal. Basically, the appraiser is going to be looking at the quality of the home, not the design elements. But that doesn’t mean an updated design wouldn’t have value to you as the buyer.

From an appraiser’s perspective, high-quality wood floors will have more value than cheap carpet. Ceramic tile has more value than laminate. They’re looking at materials over aesthetics, provided everything is in good condition. And they’re much more concerned with the plumbing beneath that bathroom sink (PVC is better than copper is better than lead) than they are with the design of the faucet.

However, just because a light fixture is functional doesn’t mean you have to like it. Listing agents know this, and therefore they may mark up the listing price based on the way a home looks. Whether or not you are willing to pay that price is up to you; it depends on how much you as the buyer value the style of the finishes. A few things that could contribute to a listing price increase might be:

- Crown moulding

- Ceiling style (popcorn versus knockdown)

- Flooring

- Lighting

- Paint (both colors and how recently it’s been done)

- Wood beams

- Kitchen and bathroom hardware

- Bathroom tile

That being said, a major remodel, such as a kitchen or bathroom renovation, will add value even from an appraiser’s perspective. As long as the renovation was properly permitted and done well, the appraiser will see it as increasing the quality, according to Collins. Stainless steel appliances, along with solid, natural countertops and new cabinetry, all add to the value because it’s an increase in material quality. Whether you like the brand-new mint green backsplash is another story — that’s a value judgment you’ll have to make on your own.

Outdoor features adjustments

“Location, location, location,” Brandt says. “It’s the oldest rule of real estate.” And it’s another important thing to consider when it comes to the valuation of a property.

Real estate appraisers will make adjustments based on a home’s proximity to top-rated schools, attractions, and other conveniences. As you can see from the chart above, location adjustments greatly affect the price.

Appraisers will also be looking at the overall quality, major systems, and general maintenance of the exterior. A new roof or HVAC system adds great value, according to Collins, as does a deck or patio. New siding, irrigation, systems, and landscaping can also affect the price.

Some other attributes are location-specific, too. For example, if you live in a warmer state, like California, Arizona, Florida, or Hawaii, a pool will likely add value (again, based on condition). But in northern states, a pool could decrease value.

An appraiser is not going to get caught up in color choices or design when valuing a house. But listing agents know how much the curb appeal of a home affects its salability, and they will usually set the price accordingly. Your real estate agent can help you look past the appearance of the exterior to evaluate the house’s true value.

Brandt tells the story of a buyer who was uninterested in a certain house due to the color of the exterior paint. He told her, “Look, this house is $35,000 below everything else in the neighborhood, and I can get it painted for $7,000.” The buyer saw his logic and ended up purchasing the “ugly” house.

Energy and tech adjustments

Appraisers will value new, energy-efficient windows and doors higher than those that are older. Again, it comes down to the quality that it adds to the home — provided the condition is good. They’ll also add value for newer insulation and energy-efficient heating and cooling systems.

But a lot of “smart home” adjustments are location specific, just like pools. Solar panels are seen as a perk in sunny locales and a detriment in states that tend to be more rainy. Similarly, Brandt says that smart home technology (automated thermostats, smart appliances, tankless water heaters, audio) can add value in neighborhoods where the price point tends to be higher, whereas in lower-priced areas, these extras may be seen as unnecessary.

Bottom line: a home’s value depends on a combination of objective and subjective elements. But if you understand how sellers, appraisers, and agents think in regards to valuing a home, it’ll help you understand how much to offer and determine whether you think a price is fair.

Header Image Source: (Daria Shevtsova / Pexels)