What Makes Mortgage Rates Go Down?

- Published on

- 8 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

In recent years, U.S. consumers watched as mortgage interest spiked until they hit a 23-year high of nearly 8% in October 2023. Now that rates have finally started declining, many would-be homebuyers and sellers are ready to climb off the fence and make a move.

But what makes mortgage rates go down? What are the signs to watch for to determine if they’ll keep going down?

In this post, we’ll look at eight key influences that can cause mortgage rates to go down so you’ll be better prepared to navigate the market and potentially save thousands on your next home purchase or refinance.

1. Slower economic growth

When the economy slows, mortgage rates often follow suit. Declining economic growth can reduce inflationary pressures and lead to less demand for borrowing. Lenders, in turn, may lower interest rates to encourage more borrowing and investment.

For homebuyers, this could mean an opportunity to lock in a lower rate, saving money over the long term. For sellers, a drop in rates might entice more buyers into the market, potentially speeding up the sale of your home.

2. Favorable government policy changes

Government policy can significantly influence mortgage rates. Central banks, like the Federal Reserve, may lower the federal funds rate to stimulate borrowing during economic slowdowns. Lower interest rates can trickle down to the mortgage market, reducing the cost of borrowing.

If you’re in the market for a mortgage, keeping an eye on government policy shifts can help you identify when rates are likely to drop. Timing your purchase or sale during these favorable periods may lead to significant savings.

3. Decreasing inflation rate

Inflation erodes the value of money over time, and when it’s high, lenders raise mortgage rates to protect their returns. However, when inflation begins to decline, it can signal lower costs for borrowing.

As inflation drops, interest rates typically follow, making it a good time to lock in a mortgage. Lower inflation can also increase home affordability, which is beneficial for buyers and sellers alike. Monitor inflation trends to better understand the potential direction of mortgage rates.

4. High borrower credit score

Your credit score is a major factor in determining your mortgage rate. Borrowers with higher credit scores are seen as lower risk, so they often qualify for lower interest rates.

If you’re aiming to secure the best possible rate, improving your credit score should be a priority. Pay down debt, avoid late payments, and check your credit report for errors. A strong credit score not only helps you get a better rate but also broadens your mortgage options.

5. Shorter loan term options

Choosing a shorter loan term can help reduce your mortgage rate. Lenders typically offer lower interest rates on 15-year mortgages compared to 30-year mortgages, as the shorter term means less risk for the lender.

If you can afford the higher monthly payments of a shorter loan, you’ll pay less in interest over the life of the loan. This option may appeal to buyers who want to build equity faster or sellers who are looking to finance their next home with minimal long-term interest.

6. Opting for adjustable-rate loans

Adjustable-rate mortgages (ARMs) often come with lower initial interest rates compared to fixed-rate loans. For buyers who anticipate selling or refinancing before the rate adjusts, this can be a way to secure lower payments in the short term.

However, ARMs carry the risk of rate increases later on. If you’re considering this option, make sure you understand the terms and are prepared for any future rate changes.

7. Increased housing supply and reduced demand

When more homes are available on the market and demand is lower, mortgage rates can drop. A larger housing supply gives buyers more negotiating power, which can push prices and mortgage rates down.

If you’re selling, this might not be the ideal scenario, but for buyers, it could be an opportunity to get a better rate and more favorable terms. Staying informed about housing market inventory trends can help you time your purchase or sale to your advantage.

8. Lack of investor confidence

Investor confidence also plays a role in mortgage rates. When investors are uncertain about the economy, they tend to shift their money into safer assets, like bonds, which can push bond yields down and, in turn, lower mortgage rates.

As a buyer, this could mean an opportunity to secure a lower rate when the market is turbulent. Sellers may also benefit, as lower rates could draw more buyers into the market.

No mortgage rate guarantees: It should be noted that lower interest rates aren’t guaranteed during times of recession or periods of weak investor confidence. Even when the Fed makes progress in taming inflation and guiding the market to the desired “soft landing,” interest rates can be volatile and change quickly.

How do today’s rates compare with history?

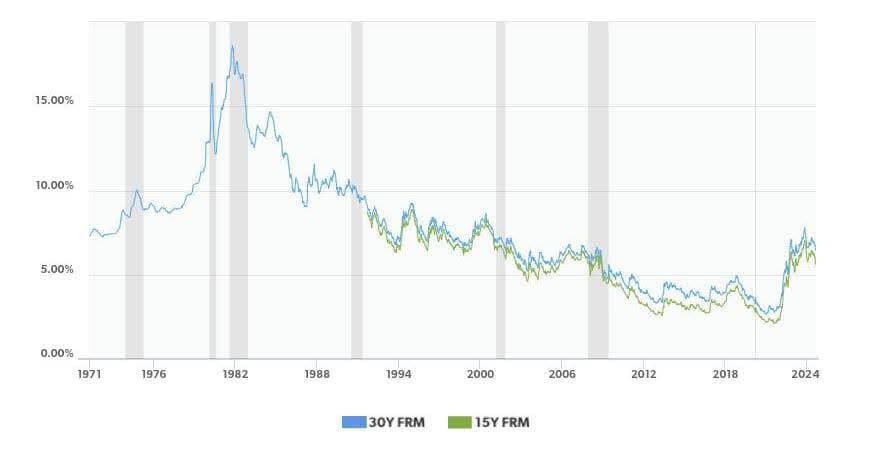

Watching mortgage rates go up these past few years, it might seem like it was always cheaper for your parents or grandparents to buy a house. However, looking back through the decades, you can see that this assumption may not always hold true. Even the recent mortgage rate peak of 7.79% in October 2023 was considerably lower than the peak of 18.63% in October of 1981.

Here’s a look at the 30-year-fixed mortgage rates in the U.S. since 1974:

Home mortgage interest rates from 1974 to 2024

| Year | Average 30-year rate | Year | Average 30-year rate | Year | Average 30-year rate | Year | Average 30-year rate |

| 1974 | 9.19% | 1987 | 10.21% | 2000 | 8.05% | 2013 | 3.98% |

| 1975 | 9.05% | 1988 | 10.34% | 2001 | 6.97% | 2014 | 4.17% |

| 1976 | 8.87% | 1989 | 10.32% | 2002 | 6.54% | 2015 | 3.85% |

| 1977 | 8.85% | 1990 | 10.13% | 2003 | 5.83% | 2016 | 3.65% |

| 1978 | 9.64% | 1991 | 9.25% | 2004 | 5.84% | 2017 | 3.99% |

| 1979 | 11.20% | 1992 | 8.39% | 2005 | 5.87% | 2018 | 4.54% |

| 1980 | 13.74% | 1993 | 7.31% | 2006 | 6.41% | 2019 | 3.94% |

| 1981 | 16.63% | 1994 | 8.38% | 2007 | 6.34% | 2020 | 3.10% |

| 1982 | 16.04% | 1995 | 7.93% | 2008 | 6.03% | 2021 | 2.96% |

| 1983 | 13.24% | 1996 | 7.81% | 2009 | 5.04% | 2022 | 5.34% |

| 1984 | 13.88% | 1997 | 7.60% | 2010 | 4.69% | 2023 | 6.81% |

| 1985 | 12.43% | 1998 | 6.94% | 2011 | 4.45% | 2024 | 6.4%-6.7%* |

| 1986 | 10.19% | 1999 | 7.44% | 2012 | 3.66% | 2025 | TBD |

Source: Freddie Mac (*2024 estimated average range as of September 12)

Monthly payment comparison: As mentioned earlier, in 1981, mortgage interest rates peaked at 18.63%. This significantly impacted house payments. For example, a $300,000 mortgage at 18.63% would require a monthly payment of $4,676. That same loan at a pandemic-era rate of 2.65% would only require a $1,209 monthly payment.

Here’s how the past 53 years of mortgage rates history looks on a chart:

Get started with a top agent

Understanding what makes mortgage rates go down can help you time your next real estate move, whether you’re buying or selling. Factors like declining economic growth, favorable government policies, and lower inflation all contribute to potential rate drops.

Additionally, your own financial standing — such as a high credit score — can lead to securing a better mortgage rate.

If you’re ready to make a move, you’ll get the best results when you partner with an expert. HomeLight’s free Agent Match platform connects you with top agents in your area who can guide you through the process.

Whether you’re looking to lock in a lower rate for a home purchase or sell your property at the right time, having the right agent by your side can make all the difference.

For buyers, here are a few tips:

- Get pre-approved for a mortgage: Having a pre-approved mortgage loan shows sellers you’re serious and helps define your budget.

- Save a larger down payment: With a larger down payment, you’ll pay less interest over time. Plus, it makes your offer more attractive to sellers. HomeLight’s down payment calculator can assist you with planning.

- Consider an adjustable-rate mortgage (ARM): If you don’t plan on staying long, this can help you secure a lower initial rate.

- Shop within your budget: Avoid overextending yourself by buying at the top of your price range. To shop with more confidence, try HomeLight’s Home Affordability Calculator.

If you’re buying and selling at the same time, check out HomeLight’s innovative Buy Before You Sell program. This unique buying solution unlocks the equity in your current home to simplify and streamline the entire home-move process. You can make a stronger, non-contingent offer on your new house, and you’ll only need to move once. Here’s how HomeLight Buy Before You Sell works:

HomeLight partners with top-rated real estate agents across the country. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs.

Header Image Source: (Curtis Adams/ Pexels)

- "Mortgage rates fall to lowest level since February 2023", CNN Business (September 2024)

- "‘The time has come’: The Fed just sent a crucial message about its next move", CNN Business (August 2023)

- "Here’s Everything You Need To Know About Investor Confidence", Inc42 (March 2024)

- "Housing Inventory: Active Listing Count in the United States", FRED (September 2024)

- "U.S mortgage rates soar to highest in more than 23 years", Reuters (October 2023)