Can a Successor In Interest Sell a House?

- Published on

- 9 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

You’ve been confirmed as a “successor in interest” on an inherited home attached to a mortgage. But what does that mean? Can a successor in interest sell a house?

Balancing logistics, grief, and family emotions while trying to figure out your next move can be challenging, especially if the inherited property is out of state.

In this guide, we explore what it means to be a successor in interest, the rights typically granted to you, and whether selling the house is an option. We’ll also provide expert insights and tips on how to sell your inherited home.

What is a successor in interest?

A successor in interest is a person who has acquired an ownership interest in a property from a previous owner. While a successor in interest may now own the property, they are not automatically responsible for the existing loan unless they specifically agree to assume the debt.

Examples of situations where someone might become a successor in interest:

- A child inheriting a house from a deceased parent with an outstanding mortgage.

- A spouse receiving a property in a divorce settlement or legal separation where a mortgage is still active.

- A living spouse or parent is transferring ownership of a home to a partner or child.

- A beneficiary of a living trust who receives a property with a mortgage upon the original owner’s passing.

- A co-owner of a mortgaged property has passed away.

“Unlike an executor, personal representative, or beneficiary, a successor in interest does not have to have any relationship with the prior owner,” explains Zachary D. Schorr, one of the top real estate attorneys in Los Angeles. “For example, if someone owns property and sells it to a stranger, then the stranger is still their successor in interest with respect to the property. They just follow in the chain of titles.”

Documentation is typically required to prove your ownership interest, but once you are confirmed as a successor in interest, the mortgage servicer must communicate with you to provide information about the loan and any potential options regarding the property.

More than one person can hold this designation on a property. For example, if two parents leave a family home to multiple siblings, each of the children can be a successor in interest with an ownership interest in the house.

What rights does a successor in interest have?

As a successor in interest, you typically gain certain rights tied to the property. Once the designation is confirmed, Schorr says, “A successor in interest is really just the person who owns the property, so they have a full bundle of property rights consistent with the previous owners’ rights.”

Common rights include:

- Occupancy or management: You may have the right to live in or manage the property. To exercise this right, you might have to buy out other heirs or coordinate an agreement with another successor in interest. Consult with a legal advisor to fully understand your options.

- Option of assuming financial responsibility: Becoming a successor in interest does not automatically make you liable for the mortgage and its payments. Liability remains with the borrowers named on the home loan. However, you have the right to assume financial responsibility. If payments are not kept current, the property could enter foreclosure, which can impact your ownership interest

- The ability to transfer ownership: Once you establish your legal interest, you may have the right to sell the property or transfer it to another party.

Can a successor in interest sell a house?

The short answer is yes, a successor in interest can sell a house — but certain conditions must be met first. Before you can legally sell the property, you need to fully establish your ownership rights. This often involves resolving any outstanding legal or financial issues tied to the home, such as clearing the title, addressing liens, or completing the probate process if required.

“A successor in interest is subject to liens, mortgages, and other financial restrictions that they agreed to take responsibility for when they take over ownership of a property,” Schorr explains. “This is determined at the time of the transfer from the former owner.”

Additionally, if the property has a mortgage, the lender may require you to prove your successor in interest status. Some lenders will allow a successor in interest to sell the property without refinancing the loan, while others may have specific requirements or restrictions in place.

The process can vary widely depending on the state’s laws, the property’s title situation, and the type of mortgage involved. Consulting with a real estate attorney can help you understand your specific circumstances and chart a path forward.

Check the value of your inherited property. If you’re curious about what your inherited house might be worth, try HomeLight’s Home Value Estimator. This free tool uses local market trends, transaction data, and public records to provide a preliminary value estimate in minutes. Simply answer a few questions about the property to get started.

Legal and financial considerations

Selling a home as a successor in interest involves navigating several legal and financial factors. Here are some of the key considerations to keep in mind:

- Title and ownership verification: As noted, you may need to prove your legal interest in the property by presenting documentation, such as a will, trust, or affidavit of heirship.

- Mortgage obligations: If the home has an outstanding mortgage, you’ll need to determine whether you’re required to continue payments or if the loan must be refinanced or paid off before selling. In some cases, you may be able to assume the mortgage.

- Liens and debts: Any outstanding liens, property taxes, or debts tied to the property must be resolved before the sale can proceed.

- Probate requirements: If the property is part of an estate that hasn’t gone through probate, this legal process may need to be completed before a sale can occur.

Experienced attorneys like Schorr caution their clients to pause and make a plan. Failing to address these issues can delay or complicate the sale, so it’s important to work with professionals, such as a real estate or probate attorney and a title company, to ensure a smooth process.

Steps to sell a house as a successor in interest

Selling a house as a successor in interest requires careful planning and execution. Here’s a step-by-step guide to help you navigate the process:

- Confirm your legal status: Gather all necessary documentation to prove your successor in interest designation, such as a will, death certificate, or court orders.

- Consult professionals: Work with a real estate attorney and a trusted real estate agent to understand your rights and obligations.

- Address financial obligations: Determine whether you need to continue mortgage payments, pay off the loan, or resolve any liens on the property.

- Clear the title: Ensure the property’s title is clear of any legal or financial encumbrances to facilitate a smooth sale.

- Prepare the property for sale: Make any necessary repairs or updates to maximize the home’s market value.

- List the property: Work with your real estate agent to market the home effectively and attract potential buyers.

- Complete the sale: Once you receive an acceptable offer, work with your attorney and agent to finalize the transaction and distribute the proceeds appropriately.

How to sell an inherited house fast for cash

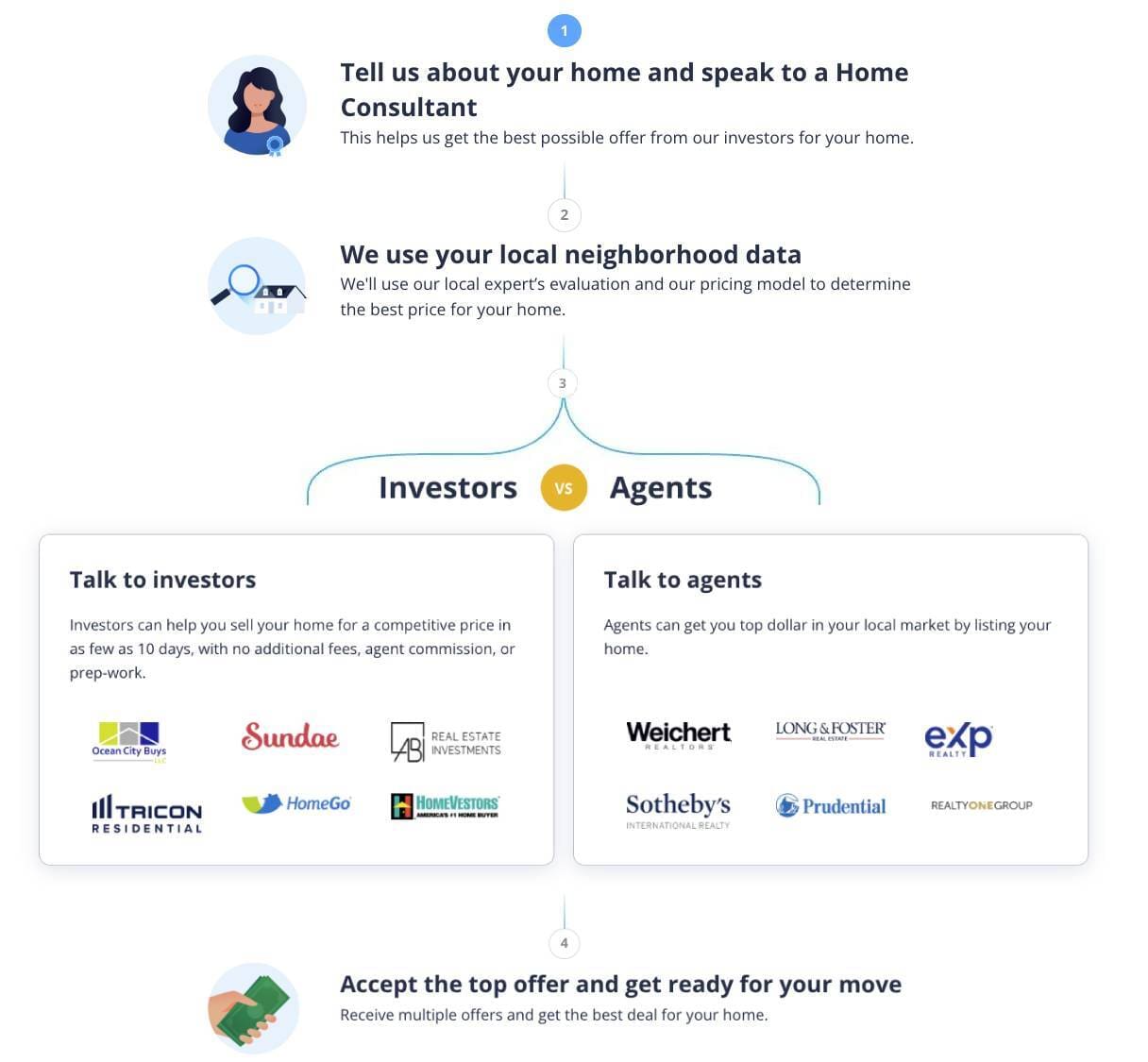

If you’re looking to sell an inherited house quickly, one of the fastest ways is to request a no-obligation cash offer through HomeLight’s Simple Sale platform. Simple Sale connects you with reputable cash buyers who make convenient, all-cash offers, often closing in as little as 10 days. This eliminates the need for costly repairs, showings, or extended negotiations.

Your Simple Sale offer will also include an estimate of how much a top real estate agent might be able to get for your home and recommendations for highly rated agents in your market. You can see both options before you move forward.

Here’s a quick look at the four easy steps in the Simple Sale process:

Receive a no-commitment cash offer within 24 hours by answering a few questions about your inherited home and your selling timeline.

When to seek professional help

There are times when selling a house as a successor in interest can become particularly complex, requiring professional guidance. You should seek help if:

- The property’s title is unclear or disputed.

- The home is tied up in probate or other legal proceedings.

- There are outstanding financial obligations, such as liens or unpaid property taxes.

- You’re unsure of the property’s market value or how to price it competitively.

Working with experienced professionals, such as a real estate attorney, title company, and knowledgeable real estate agent, can help you navigate these challenges and streamline the process.

Bottom line: Can a successor in interest sell a house?

Yes, a successor in interest can sell a house, but the process often requires addressing legal, financial, and logistical hurdles. By confirming your legal status, clearing the title, and resolving any financial obligations, you can prepare the property for a successful sale.

If you’ve decided to list your inherited house for sale, HomeLight’s Agent Match tool can connect you with a top-performing real estate agent in your area. We analyze over 27 million transactions and thousands of reviews to determine which agent is best for you based on your needs. These agents have the expertise to guide you through the selling process, ensuring you achieve the best possible outcome.

Editor’s note: This post is for educational purposes. If you need assistance determining your legal right to sell an inherited house, HomeLight encourages you to consult a professional advisor.

Header Image Source: (EyeMark/DepositPhotos)