5 Top Agents Share Their No. 1 Piece of Advice for Downsizing Your Home

- Published on

- 3 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Knowing in your heart that the time is right to downsize doesn’t make this drastic lifestyle change any less overwhelming. That’s why too many people put off downsizing until it’s too late.

Data on home buyer and seller generational trends from the National Association of Realtors shows that 67% of people who move between the ages of 53 and 92 do so in response to a household member’s health. Only 25% of individuals in that same age group are motivated by the intentional choice to downsize.

With so much uncertainty involved in this major decision, it’s natural to look for guidance on it.

Short a psychic, we’ve rounded up an expert downsizing property advice panel: 5 real estate experts who’ve collectively handled 3,754 transactions over the course of a combined 89 years. Some are retirement specialists while others work with downsizing clients on a daily basis—here are their no. 1 recommendations.

Tip #1: Use a home equity line of credit to buy your smaller home first

Downsizing when the bulk of your retirement savings is tied up in 401ks, retirement accounts, and home equity is a complex process.

Without cash to make a hefty down payment on the smaller home, you’ll wind up with a high interest rate on the mortgage. The alternative is waiting until your current residence sells before buying—and that could leave you living in limbo for months while you search for the right downsized home.

Those aren’t your only two options, though. If your current home mortgage is paid off, you can use home equity to simplify the home buying process.

“If a seller has a tremendous amount of equity, it’s an easy thing to take out a home equity line of credit on their existing home,” says Ken Carpenter, one of the top 1% of sellers’ agents in Plymouth, Minnesota.

“Then we purchase a property that’s going to work for them, and now they know where they’re going to move. Then they can take their time moving while we work on selling their existing home. Once it’s sold, then they pay off the equity line. It’s a less stressful way to deal with it.”

By using your home equity line of credit as a large down payment (or payment in full if your downsized home is that affordable), you’ve got the time you need to find a smaller home that has all the amenities you need to age in place.

Tip #2: Look for a property that will let you age in place longer

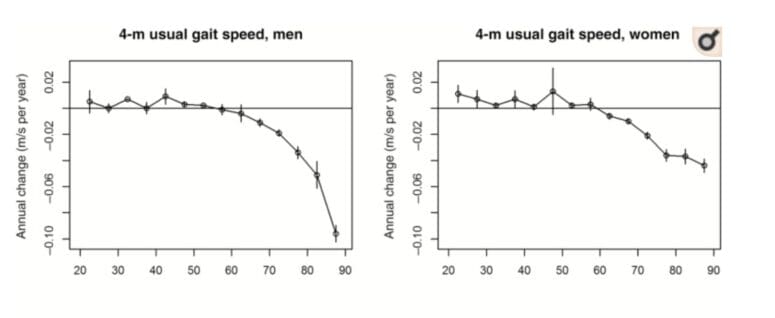

There’s no way around it—time takes a toll on your body no matter how healthy your lifestyle.

Studies prove that the impact of mobility on the quality of life is huge for retirees—so the easier it is to navigate around your downsized house, the longer you’ll be able to live at home without assistance.

“About a year ago, we surveyed 5,000 folks that wanted to downsize to find out what their final home looked like. Most folks said they don’t want the headache of stairs or cleaning a big home,” explains Zack Morris of the Huff Group, a top-selling real estate team in Olathe, Kansas.

“We didn’t have the inventory for downsizers in Kansas City, so we ended up buying some land and developing a maintenance-free community of 40 units all on slabs. All of the villas are zero entry and no stairs. So there are no tripping hazards or different elevations anywhere on the property.”

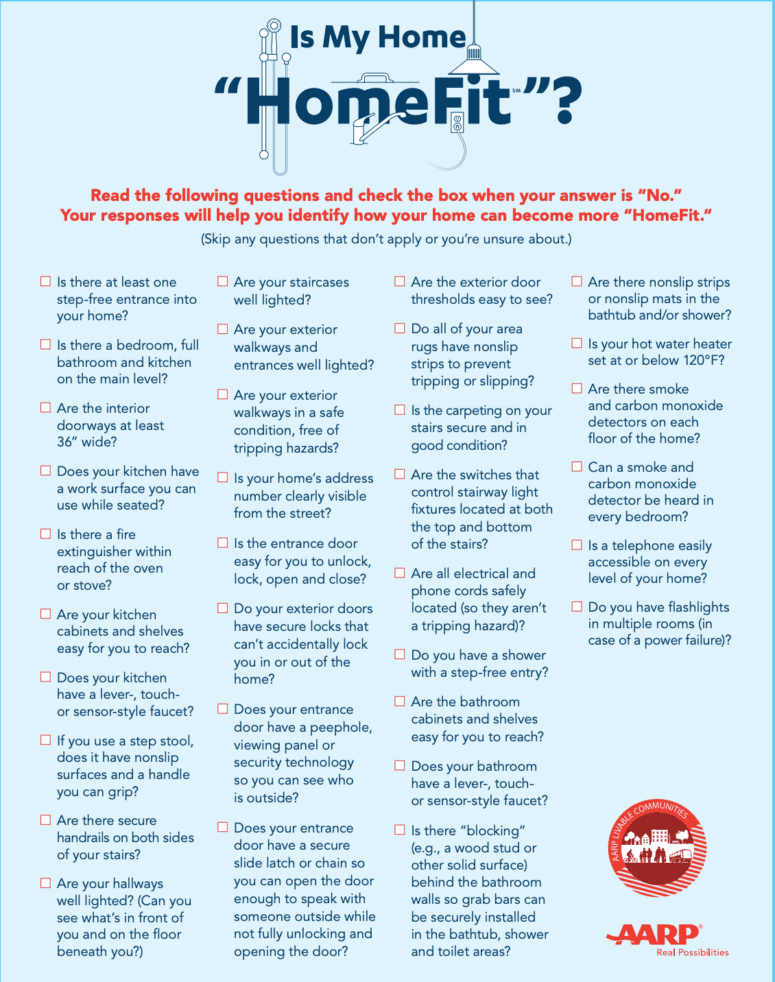

Of course, zero entry and single-story aren’t the only things you need to make sure your smaller home remains accessible as you age. Think about other features like hallways and doors wide enough for wheelchair access, and whether you can easily install grab bars, shower benches, or walk-in tubs in the bathrooms.

And make sure you review your plans with your financial planner before you commit to anything—or downsizing could wind up costing you more in the long run.

Even though utilities like water and electricity are typically cheaper in a smaller house, paying the homeowners association fees and assessments in a maintenance-free community can get expensive.

Plus, if you’re not careful, you could wind up purchasing property in a city or state that has higher utility prices and taxes than you’re used to paying.

That’s why it’s always best to work with a real estate agent who knows how to help retirees plan for their financial future.

Haven't found a real estate agent yet?

We analyze millions of home sales to find top agents in your area.

Tip #3: Partner up with a real estate professional who has proven expertise in downsizing and retirement

When you’re selecting a real estate agent, you not only want one who’s the best at what they do, you want one who’s right for you.

When you’re a retiree looking to downsize, you need one who’s been trained to know the type of home and mortgage that’s the best fit for your retirement plan and makes sense for this next stage of life.

One option is to hire a real estate agent with the Seniors Real Estate Specialist (SRES) designation.

“Seniors Real Estate Specialists are agents who have received training that’s specific to the needs of seniors with regard to purchasing and selling real estate,” says SRES-certified agent Mike Robinson, who ranks in the ranks in the top 3% of 2,068 agents in the south Atlanta, Georgia market.

Under the umbrella of the National Association of Realtors, the SRES Council offers SRES certification as a training course for licensed Realtors who want to better serve the needs of retirement-aged homeowners.

“Downsizing is a big issue for a lot of people. And sometimes seniors aren’t good about bringing up the specific needs that they have,” explains Robinson. “I would recommend that they work with an agent that might be closer to their age. Someone who is over 60 is much more likely to be able to identify with the specific needs of a senior.”

Our best advice? By entering your address on our homepage, you can tailor your search for an agent specifically to your property and get additional help from a live, trained concierge. Mention that you’d like to work with a Seniors Real Estate Specialist or someone with proven experience helping seniors successfully downsize, and your concierge will hand match you with several agents who meet your needs.

Tip #4: Set a gone-by date

“Downsizers want to live more simply,” says Angela Kittner, a top St. Louis agent who’s sold over 73% more properties in her area than the average agent. “But the hardest part is what to do with all the extra stuff.”

Do you know how much stuff you own?

Between closets, cupboards, shelves, cabinets, and dressers, you’ll be surprised by all the belongings you find that you didn’t even know you owned. It’s probably more than you think, and a whole lot more than you need.

Organizing all you own is a huge undertaking that requires you to make the “keep, toss, or donate” decision thousands of times. It’s enough to stall the downsizing process for months.

So how do you keep your belongings from indefinitely delaying your downsizing plans? Simply commit to a date where Everything. Must. Go.

This includes any items you’re passing on to friends or family.

“We tell everyone, ‘We’re going on the market February 1st, so anything you want has to be picked up by January 24th. After that, it’s all going.’” Kittner explains. “Anything that’s left, either goes to an estate sale, or an auction, or it’s donated.”

The extra cash you get for selling your belongings at yard sales, estate sales, or at auctions is a great motivator to help you let go of stuff—and it’ll defray some of the moving expenses.

But that money doesn’t make it any easier to give up possessions that carry treasured memories.

Tip #5: Create a memory book of beloved belongings that you’ve let go

Say the word “decluttering” to some people, and they immediately take offense—as if you’ve just said all of their cherished pieces are junk. But this simply isn’t the case.

“Decluttering doesn’t mean that your stuff is bad, it’s just that you don’t have purpose for it anymore,” Laura Sanders, a 17-year veteran agent who’s sold over 71% more properties in the Coral Springs, Florida region than the average agent. “It makes you feel lighter, and a little more organized. It just makes you feel better when you have less stuff.”

Space is limited when you downsize, so it’s more important to bring the things you need into your home as opposed to the things you love. Plus, are you really sure you still “love” everything you own anymore?

Tastes change as we age, so you might find that the loud-patterned lounge chair and gaudy, gold-trimmed china that you loved 20 years ago no longer reflects your more mature style preferences.

Sanders discovered this fact when she asked a client about a less-than-attractive vase. “I had one client who had a vase she bought in Greece. And I asked her if she liked it or ever used it. She said, ‘No, it’s actually pretty ugly, but it has memories.’”

So she came up with a clever way for her client to ditch the vase while still holding on to those memories, “I said, ‘Let’s take a picture of it.’ Everything that you give away because you’re not going to use it, if it has a memory, take a picture of it. Then we can create a photo book with everything in it.”

An album filled with photos of treasured belongings is easy to move and store. Plus, you’ll have a keepsake that you can flip through with friends and family—and share the stories of how you acquired each piece.

Downsizing your home and your belongings is a momentous and stressful undertaking. But if you come prepared with a plan, expert help, and the knowledge that letting go doesn’t mean you need to leave your memories behind—you’ll find yourself living a smaller, carefree lifestyle in no time.