2020 Housing Market ‘Frenzy’ Puts Sellers Firmly in the Driver’s Seat

- Published on

- 6 min read

-

Presley Attardo, Contributing AuthorClose

Presley Attardo, Contributing AuthorClose Presley Attardo Contributing Author

Presley Attardo Contributing AuthorPresley is a Seattle based writer covering interior design trends, home improvement, and market updates. She has lived in San Francisco, Los Angeles, Chicago, and Washington, D.C., giving her a unique perspective on the diversity of U.S. real estate.

-

Caroline Feeney, Former Executive EditorClose

Caroline Feeney, Former Executive EditorClose Caroline Feeney Former Executive Editor

Caroline Feeney Former Executive EditorCaroline Feeney was previously HomeLight's Executive Editor / Director of Content. With 7 years of real estate reporting and editing experience, she previously managed content for Inman News and co-authored a book on real estate leadership. The Midwest native holds a master's from the Missouri School of Journalism and was formerly a real estate contributor for Forbes.

Historically low mortgage interest rates, inadequate inventory, and pent-up buyer demand from the spring’s shelter-in-place orders have coalesced into a lightning quick seller’s market no one saw coming in a COVID-driven 2020.

“I’m actually busier this year than I was last year, and last year was very busy. This year, I feel like there’s almost a frenzy,” explains Missy Cady-Kampmeyer, a top real estate agent in Jacksonville, FL. “I did six listings in the last week to 10 days, and every single one of them has sold. I’m finding that they’re on the market for 24 to 48 hours, especially at the price points under $350,000.”

For the full story behind the 2020 housing market and what’s to come this fall, we interviewed four top real estate agents across the nation, all of whom reported bidding wars to sellers’ benefit. Fortified with national market data and survey analysis from our HomeLight’s Q2 Top Agent Insights report, we’ll break down how we got to now and how to take advantage of this unique real estate climate.

Already low inventory dropped in response to COVID-19 this spring

The latest numbers from the National Association of Realtors’ (NAR) Weekly Housing Report Monitor reveal that pending sales rose nearly 18% in the past four weeks ending on August 9 compared to the same time last year. The market’s moving fast with the average listing selling within 19 days compared to 31 days year-over-year, signaling strong buyer demand for a limited supply of listings.

The results? Bidding wars like you would never believe.

“I have a home listed at $150,000 right now. It’s had 18 offers on it and it’s been three days. It’s interesting to see the [influence of] very low-interest rates coupled with the pent-up demand from the shelter-in-place.” shares top Atlanta agent Janice Overbeck, who specializes in townhouses and single-family homes.

The nationwide spike in bidding wars is largely due to an overflow of buyers competing for a relatively low supply of houses. So, let’s start by analyzing this inventory deficit, going back to the pre-pandemic supplies at the start of the year.

In December 2019, Forbes reported that the housing shortage was nearing a historic low with 10% of markets seeing inventory growth, in contrast to an increasing number of buyers, including many first-time homebuyers.

When the pandemic hit in March, seller fear and hesitation curtailed new listings. Some markets saw new listings drop upward of 80%, further crunching an already short supply of options for buyers.

Fast-forward to the week ending May 27; three months into the “new normal” real estate transactions picked up across the nation with buyers notably returning quicker than sellers, likely motivated by exceptionally low mortgage rates. In HomeLight’s market pulse survey for the week, 79% of agents reported an increase in buyer activity, while only 55% of agents reported the same among sellers. June’s inventory reflected this disparity, with existing homes for sales down 18.2% annually, according to the National Association of Realtors.

COVID-19 spurred government moratoriums on evictions and foreclosures play a further role in the past five months’ inventory. As of July 21, an estimated 4.1 million homeowners have remained in place under COVID-19 forbearance plans, according to data from Black Knight, Inc. Representing 7.8% of all active mortgages, this is not an insignificant figure when contemplating factors behind the summer’s short housing supply.

Additionally, the supply of newly built homes declined over the spring, dropping 7.3% from April to May, down 9.3% year-over-year. In June, the supply of new-builds continued southwards, down 14.5% annually, according to the U.S. Census.

Mortgage rates drop to historic lows, heightening buyer demand

Now onto the other half of the market equation: strong buyer demand. The agents we interviewed attribute the summer’s buyer frenzy first and foremost to unprecedentedly low mortgage interest rates. With rates dipping below 3%, homebuyers urgently seek their next homes to lock in low rates which may result in significant savings over the lifetime of a mortgage.

“It’s just crazy how many people are in the market,” remarks Overbeck, who sells homes 53% quicker than the average agent in Atlanta. “I’m surprised that with all the ups and downs right now going on in the world, how much people are continuing to buy and sell. Honestly, I was pretty surprised by it, but the low-interest rates really helped, more so than I would’ve even thought.”

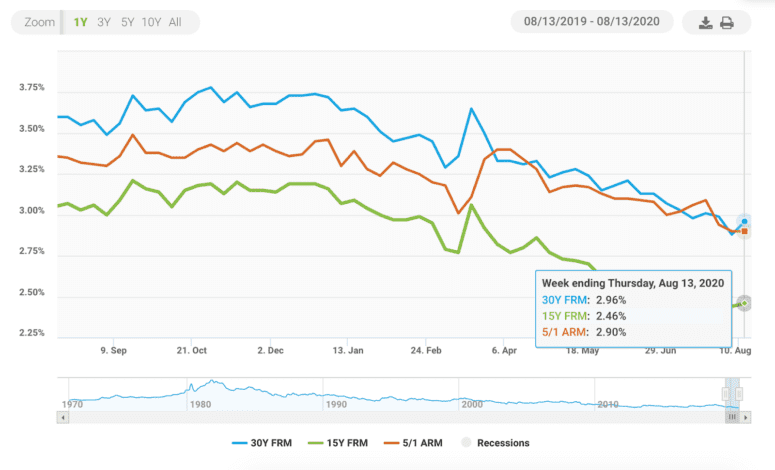

Back in March, the Federal Reserve cut the benchmark rate by 0.5% in an attempt to mitigate the pandemic’s impact on the economy. As mortgage rates are linked to the yield on the 10-year Treasury, the average 30-year fixed-rate mortgage fell to 3.29% and the average 15-year mortgage rate dropped to 2.79%, according to Freddie Mac.

In the week ending on August 6, mortgage rates reached new record lows in Freddie Mac’s nearly 50 years of survey: 2.88% for a 30-year fixed-rate mortgage and 2.44% for a 15-year fixed-rate mortgage.

Pandemic-related lifestyle shifts further stir market activity

Alongside low mortgage interest rates and pent-up demand, pandemic related lifestyle shifts continue to motivate buyers to step into the market.

“Because interest rates are still low and we have people that have been stuck in their homes for so long, if they were even remotely unhappy with them, they’re done,” Cady-Kampmeyer remarks, sharing that many of her recent clients are seeking larger houses with features to improve their work-from-home life.

“Pool homes are selling. We live in Florida and all the pools are shut down, and when the beaches shut down, it was like, get us pool homes!”

HomeLight’s Top Agent Insights 2020 Q2 Report shows buyers’ primary motivations for moving are a need for more space (44%), a desire to buy vs. rent (41%), and moving to the suburbs (37%). All four interviewed agents shared stories of clients who needed more space to comfortably work from home, finding that they could now afford it by moving farther from their central offices.

The agents reported an increase in buyers, particularly seniors, moving to more private residences to reduce contact with neighbors and lower contagion risk. Also out in the market in troves, investors seek to secure wealth in properties in light of the stock market’s volatility from the pandemic and upcoming election.

Heated bidding wars multiply as buyers compete for a limited housing supply

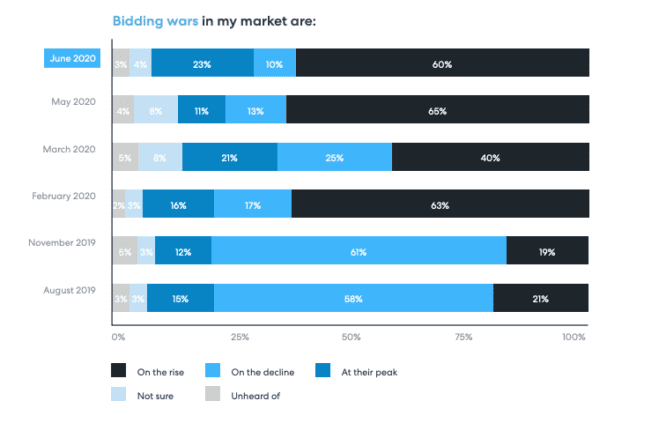

At the onset of summer, 60% of real estate agents surveyed in HomeLight’s Q2 2020 Top Agent Insights agreed that bidding wars were on the rise as the increased host of buyers outpaced the number of new homes hitting the market.

When we asked the agents interviewed for an update, all four agreed that bidding wars have been exceedingly common in their markets. Santa Ana, CA agent Hugo Pompa of The Adame Group emphasizes:

“We’ve been running around like headless chickens. The market has been very hot, bidding-war wise. We’re talking about, maybe, 10-plus offers on a home that’s been sitting on the market for only five days to seven days. It’s very competitive, very hot, and very aggressive.”

Pompa’s team has completed over 402 transactions in their 17 years of business, but say that the “COVID market” flipped the market sideways like they’ve never experienced.

“We’re seeing bidding wars on properties that are coming soon. Sometimes a home hasn’t even hit the market yet, it’s coming soon, and it receives multiple offers without people even showing the home,” Pompa shares.

Top real estate agent Pat Tasker has experienced a similar phenomenon in Milwaukee, WI:

“With the interest rates so low, we just have had more and more buyers. We have bidding wars like you won’t believe. Last year, my average was every buyer had to write 2.3 offers before they got a house. This year, most of them seem to write 3-5 offers before they get a house.”

Further heightening the competition, today’s buyers are more serious and more qualified than ever. In response to economic uncertainty brought on by the pandemic, many banks tightened their lending standards, with some lenders raising their minimum credit scores by 100 points. In this climate, buyers often must show up with a full-price offer, mortgage pre-approval, minimal contingencies, and even a personal letter to compete.

Sellers should act fast to capitalize on high buyer bids

High prices and competitive buyers spell success for homeowners looking to sell in the upcoming months. National median prices rose 4.2% year over year to $291,300 with 96% of the markets showing home price appreciation, the National Association of Realtors reports. Not all of the agents interviewed reported a significant rise in sale prices, with Pompa stating that prices in Santa Ana were high, but holding steady.

However, all agree that the current market presents a window of opportunity for sellers to capitalize on in one way or another:

“Buyers are so desperate to buy a house — they are buying stuff that in any other time would be hard to sell . . . So, if you live on a busy street or you have some weird floor plan that’s going to be hard to sell typically, it’s a great time to sell because buyers are so desperate, they’ll take it,” advises Tasker, claiming the current climate makes for one of the most unique seller’s markets in her 31 years of experience.

Bottom line from our agents: Sellers should act fast to take advantage of the hot market. There’s no telling whether buyer demand and prices will hold into 2021.

Header Image Source: (Pat Whelen / Unsplash)