DIY Housing Market Predictions: How to Forecast a Perfect Sale

- Published on

-

Lindsay VanSomeren Contributing AuthorClose

Lindsay VanSomeren Contributing AuthorClose Lindsay VanSomeren Contributing Author

Lindsay VanSomeren Contributing AuthorLindsay VanSomeren specializes in personal finance topics like budgeting, credit, credit cards, and savings and has written for over a dozen clients, including Credit Karma, Lending Tree, and LearnVest.

“When is the right time to sell? Should I hang on to it? Everybody wants to have those conversations,” says Tom Schieber, the number 3 seller’s agent in Brentwood, California.

If only you could forecast the ebb and flow of the housing market and cash out at just the right moment. But even the CNBC pundits and Freakonomics economists have a hard time getting it exactly right.

In an effort to close the gap and help you make more informed housing market predictions of your own, we picked the brains of top-performing real estate agents who keep their finger on the pulse of their local market every day and spoke to a handful of real estate economists who have their binoculars pointed toward the future of real estate.

Making housing market predictions is a serious science, but even as an amateur homeowner, you can step into the shoes of the experts and see the way they see.

1. Look at Housing Inventory to Measure Supply and Demand

Remember learning about supply and demand way back in Econ 101? For the real estate market, a lot of the “supply” part of the equation can be summed up with one simple metric: housing inventory.

Months of supply

One way economists measure housing inventory is in terms of “months of supply—i.e., how many months it would take to sell all the homes currently on the market in your area.

“I like to see a market somewhere between four and five months of supply. Right now in Seattle, for example, we haven’t got four weeks, let alone four months,” says Matthew Gardner, the chief economist with industry-leading Windermere Real Estate.

What does this mean for you?

If you live in an area with limited housing inventory, “you’re going to continue to see very excessive price growth. Homes in Seattle, [for example] were up 16% year over year. Anything double digits is not sustainable,” says Gardner.

Inventory also drives whether we’re in a buyer’s or seller’s market.

Low inventory means advantage, seller. On the flip side, if you’re seeing a rise in inventory, or inventory in your market is already higher than that four to five month supply range, buyers are at an advantage because supply outweighs demand. This has the effect of driving home prices downward.

Total inventory

The experts also measure inventory based on the total number of existing homes (meaning not newly built, but up for resale) that are currently on the market.

Every month the National Association of Realtors (NAR) puts out an existing-home sales report that relays numbers on total housing inventory. In addition to months of supply, you’ll see an inventory number expressed in the low millions range. For example, in June 2018, total inventory grew 4.3% to 1.95 million.

That might seem like a big percentage jump, but it’s still a historically low inventory reading. You see inventory ebb and flow over the past five years for free using YCharts.com, which pulls data from NAR and puts it into handy charts.

Tips for using inventory to predict the housing market:

- Historical context matters.

A rise in inventory month over month might still be down on a annual basis. Check “year over year” changes for the bigger picture. Compare today’s numbers with the market when it was at historically high (2006-2007) and low points (2008) for context. For example, economists agree that about a five months supply of inventory is considered a balanced, healthy market. After the housing market crash, inventory spiked and remained at an 8-10 month supply even years into the recession. With the market in a recovery period, inventory’s shifted to a low supply level far below 5 months in some markets. - Don’t spook at every small change.

Little fluctuations in inventory month to month are normal and won’t drastically impact your home sale, but look for overarching trends—how has inventory fared for the past few months, or even two to three years? For signs of a market turn, watch for evidence of inventory rising or dropping consistently over three to six months time before you draw conclusions. - Expert interpretations of the data will help you tie everything together.

Take this reading from NAR Chief Economist Lawrence Yun from the June 2018 existing-home sales report:“There continues to be a mismatch since the spring between the growing level of homebuyer demand in most of the country in relation to the actual pace of home sales, which are declining. The root cause is without a doubt the severe housing shortage that is not releasing its grip on the nation’s housing market.

2. Check Pending Home Sales to Predict Market Activity

While NAR’s existing-home sales report gives economists a good idea of current real estate market activity, its monthly pending home sales report measures the number of homes that went under contract. That makes it a forward-looking indicator of existing-home sales, as most home sales close a month or two after the contract is signed.

NAR measures increases and decreases in pending home sales on a monthly and year-over-year basis as a percent drop or rise.

Tips for using pending home sales to predict the housing market:

- Pending home sales tell the tale of buyer demand.

Lagging pending home sales could indicate an affordability problem meaning buyers are having a hard time finding a home to buy, making it a good time for you to put your starter home on the market and upgrade. - Real estate is local, and pending home sales drill down on a regional basis.

So you can get an idea of how sales activity is faring in the West versus the South, for example. Weak pending home sales growth in your region could be an indicator of a housing shortage and increased buyer demand. If pending home sales start to pick up, it could indicate a shift back to a more balanced market as prices soften.

3. Gauge New Construction For Signs of a Shifting Market

In addition to the already existing homes that homeowners put on the market, an important piece of housing inventory is the pace at which new construction is going up. How many newly built homes are coming on the market every month to add onto the housing supply?

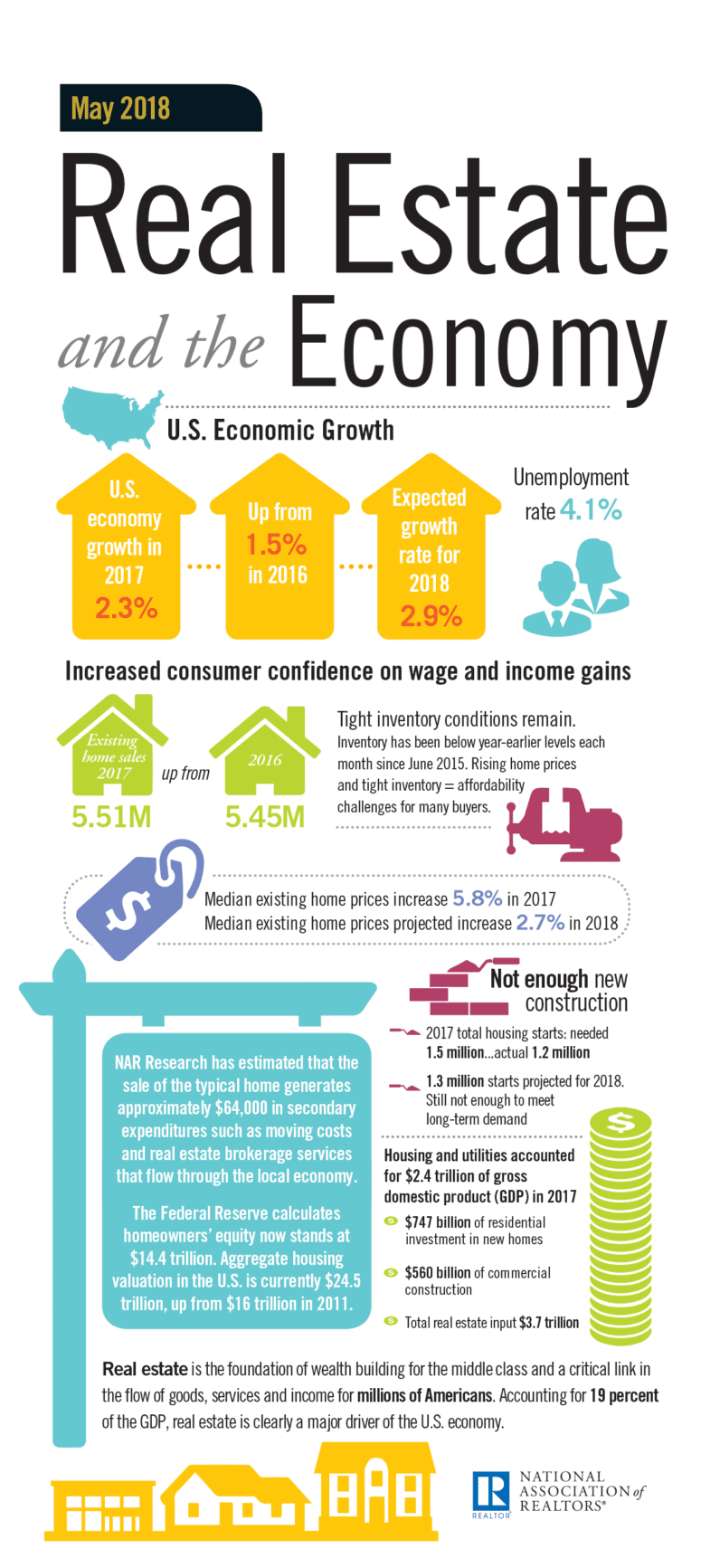

In fact, economists in part blame the slow rate of new construction for the chronic inventory shortage we’ve experienced in 2018 and the past few years.

Anyone can keep tabs on new-home stats. The Census Bureau’s puts out data on new residential construction every month.

It covers:

- Building permits: measuring the number of housing units that were authorized to be built

- Housing starts: measuring the number of new construction projects that begun that month

- Housing completions: measuring the number of finished privately owned housing projects and as a separate stat, the number of completed single-family homes

You can think of building permits as your most forward-looking indicator—an onslaught of authorizations would likely pan out as a boost in completed new housing a few months down the line. Same with starts, with an even more immediate impact on finished units.

More completed new housing = a boost in inventory = with a big enough swing, a shift in market dynamics from advantage seller to advantage buyer.

But new construction is also very localized. In some areas, like San Francisco or Seattle, developers are just clean running out of space.

There’s nowhere left to build. But even in other areas, new construction can be limited by zoning regulations or building codes.

“In Oregon, California, Washington, we have these boundaries. They’re called urban growth boundaries. If you do that, you’re essentially limiting land supply. What does that do to home prices? Pushes them higher.”

Alternatively, if your community has plenty of wide open space and few restrictions, you’ll probably see builders constructing more new homes.

Gardner says one good example of this is Boise. “Boise allows builders to build. And so because of that, you’re adding on more supply. That will, to a degree, limit the prices you can achieve for housing.”

Tips for using new home construction data to predict the housing market:

- The historical average for housing starts is a rate of 1.5 million starts a month.

Anything lower than that is considered a slow pace, meaning inventory will stay low or continue to shrink, maintaining a seller’s market. - To play catch up from a three-year inventory shortage like we’re in right now, housing starts would need to pick up pace to a rate of about 2-3 million.

4. Track Home Prices to Strike When Your Market’s Hot

We’ve talked a lot about housing supply, but demand is also important. After all, the great phrase “if you build it, he will come” only works unconditionally in the movies.

One of the biggest factors economists and real estate experts look at when making housing market predictions is home prices and whether they’re affordable or not. To get a sense of this, Gardner and other economists look at one specific number for a given area: the ratio of median home price to the median average income.

For example, in San Francisco right now, the median home sale price is $1,650,000, and the median household income is $87,701. If you divide those numbers, you come up with a ratio of about 19.

Why is that ratio important?

“If the median home price is six times median income, that’s not affordable,” says Gardner. “If it is three to three and a half, maybe three to four, that is kind of a sweet spot.”

In other words, the San Francisco real estate market is certainly not affordable, and that impacts the number of buyers out home shopping.

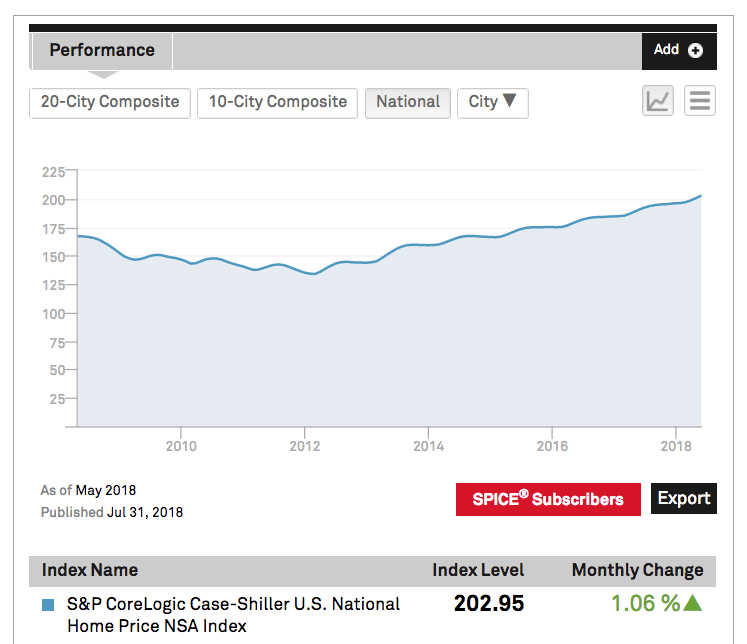

Known as the gold standard of home price measurements in the real estate industry, the S&P CoreLogic Case-Shiller Home Price Indices date back to 1987 and are released monthly.

They include a national index, and a 10-city and 20-city composite index. It also breaks down the 20-city composite into 20 individual metro area indices, so if you’re in one of the major cities in the U.S. you can get a local market price reading from Case-Shiller every month. You have to register for an account to access historical data, though it is free.

The Case-Shiller indices will tell you how home prices across the country fared month over month and year over year, which cities experienced the highest year-over-year gains, and offer an analysis of the data from David M. Blitzer, the Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

Tips for using home prices to predict the housing market:

- Inventory and home prices are closely intertwined and inversely related.

Expect low inventory to push prices higher and higher, and when inventory rises, you’ll see prices go down. As a homeowner, if you see inventory in your market start to soften, it means a few months down the road your house could sell for less—in line with home price trends in your area. - Strike while the market’s hot if you’re motivated to sell.

If home prices in your neck of the woods are on a steady climb, put your home on the market—don’t hedge your bets on gaining astronomical value by waiting around. “You never know when the market could come to a screeching halt,” says real estate agent Mike Cirillo, who ranks in the top 1% of real estate agents for selling homes in Philadelphia.

5. Use the Jobs Market and Unemployment Rate As a Measure of Economic Health

Another key factor that real estate experts look at when coming up with housing predictions is what the job situation looks like on the ground in your area.

“The bottom line is you’ve got to look at the local economy’s growth,” says Gardner. “Are you adding jobs? When you add jobs, you add demand for housing.”

As an example, the U.S. Census Bureau says more people moved to Maricopa County (home to Phoenix) in 2016 than any other county in the United States. And according to The Arizona Republic, 2017 was a great year for housing, with almost one-third of ZIP codes in the Phoenix metro area posting double-digit increases.

Some cities are exceptions to this rule. Yuma, Arizona, for example, is a retirement hotspot for seniors looking to bask in the abundant sun. As a result, the area has a 15.7% unemployment rate (compare that to the entire nation, at just 3.8%).

In retirement communities like Yuma, the number of jobs won’t really affect home prices that much.

But if you live in a techie hotspot like Seattle or San Francisco where jobs are being added on faster than popcorn in a movie theater, job growth will have a huge impact on how much you can get for your home when you sell it.

The Bureau of Labor Statistics releases a monthly Employment Situation Summary Report looking at unemployment rates nationally. Another way to get a reading on the jobs market: the monthly ADP Employment Report shows the number of new jobs by company size and industry.

Tips for using the jobs market to predict the housing market:

- A healthy economy translates to a strong real estate market.

When people have jobs and save money, they buy houses, pushing up demand for housing and raising property values. If you’re hearing about an influx of new residents to your city getting jobs, you can expect real estate to be on the up and up. - On the other hand, as put by The Brookings Institution, “When real estate crashes, the economy goes into a tailspin.”

That’s because real estate and its related industries make up 35% of the economy’s asset base. Real estate accounts for 19% of GDP, is the biggest middle-class wealth builder, and serves as “a critical link in the flow of goods, services and income for millions of Americans,” according to NAR. So real estate is also a predictor of the economy.

6. Pay Attention to Mortgage Rates and Their Impact on Affordability

Maybe you’ve heard about how the Federal Reserve is starting to increase interest rates in recent years. It’s true; right after the 2008 financial crisis, the Fed took a seven-year hiatus from messing with interest rates. But now, they’re starting to go up.

What’s more, this has a serious impact on home buyers.

“There’s a very simple calculation and I call it the ‘1 in 10 rule,'” says Gardner. “For every 1% increase in mortgage rates, that decreases buyers’ buying power by 10%. [So, you] can buy 10% less house. As interest rates rise, you’d see a slower rate of price growth.”

In other words, let’s say you’re selling your house for $400,000. If interest rates go up by 1%, now all of a sudden a potential buyer who could afford to buy your house at the top of their budget now can only afford a $360,000 house.

And because more buyers will be able to afford less overall, that means you might have a harder time finding someone who is able to afford your house. It’s possible you might even have to lower your asking price.

Curious about where mortgage rates stand? Every Thursday, government-sponsored mortgage loan company Freddie Mac releases the Primary Mortgage Market Survey, reporting on averages for the 30-year fixed, 15-year fixed, and adjustable rate mortgages.

When the Fed meets to talk about things like interest rates, it releases an FOMC (Federal Open Market Committee) report explaining how much its boosting rates (if at all) and its reasoning for the increase. The Fed usually hikes rates in quarter percentage point increments.

Tips for using mortgage rates to make housing market predictions:

- A rise in interest rates often creates a “lock-in” effect.

That means buyers who were on the fence see the opportunity to lock in a low rate slipping away, so they pounce and get an offer under contract. This can create an immediate surge in buyer demand, followed by a softening as some buyers get priced out. - Mortgage rates put pressure on affordability, but context is critical when you’re looking at mortgage rates as a market indicator.

Even as the Fed hikes rates this year, mortgage rates remain at historic lows at around 4.57%. Compare that to July of 1984, when rates were averaging 14.47%.

7. Watch for Major Stock Market Movement

“I don’t look at the stock market primarily,” says Gardner. “But, what I do see is that when you are at periods of contraction in the equity markets, people are not going to overextend. They’re going to stay put. At that point, you’re becoming fear driven.”

In other words, when the stock market is taking a nosedive, things like layoffs, reduced hiring, and delayed raises also become more common. That all impacts a potential home buyer’s bottom line. A healthy stock market and healthy real estate market go hand in hand.

For a bird’s-eye view of the stock market, you can look to the Dow Jones Industrial Average, which is a price-weighted reading of 30 major stocks on the Nasdaq and New York Stock Exchange.

Tips for using the stock market to make housing market predictions:

- The stock market is an overall indicator of the health of the U.S. economy.

With real estate and the economy so interconnected, a stock market tumble could have a number of impacts on real estate by hurting consumer confidence, making loans more expensive and forcing homebuyers to put forth bigger down payments. - The stock market is a comeback kid.

Even a major stock market plunge, like the one that happened on Feb. 5, 2018, did no long-term or serious damage to the real estate market brought on over inflation concerns. You should only worry if the stock market goes way down, then stays down.

8. Time Your Sale Based on Local MLS Transaction Data

At the end of the day you want to know if now is a good time to sell your home.

The answer to that question largely depends on your location and the cycles of your local real estate market—you want to put your home on the market at a time when homes are typically selling in less time for more money in your local market.

Using real estate data points such as days on market and selling price that help account for things like seasonality, HomeLight’s Best Time to Sell Calculator crunches MLS transaction numbers in cities across the U.S. so homeowners can time their home sale perfectly.

Simply type in your city and state to get the best and worst months to sell your home in your market, then make plans accordingly.

Article Image Source: (the happiest face =)/ Pexels)

9. Look at the Real Estate Cycle for a Long-Term Lens

Hoping to sell your home more than three years from now?

According to Gardner, the sweet spot for accurate housing market predictions is between one and three years. Past that point, the housing market forecasts start to get murkier. “I’ll do a year, and I’ll do two years and I will occasionally try three, but that’s real crystal ball stuff,” he says.

It’s just like the weather. Tomorrow’s forecast might be pretty accurate, but two weeks from now, who knows?

As far when the next major bust will happen, economists say the real estate cycle has run in a “steady 18-year rhythm” since the year 1800 with “remarkable regularity,” according to an article by the Harvard Extension School. It moves through four phases:

- Recovery

- Expansion

- Hypersupply

- Recession

If that holds true, we’ll be hitting a recession phase again around 2026.

10. The Biggest Housing Market Predictor Will Always Be People

“Everybody wants to talk about the market—what the market’s doing, and where the market’s going—but I don’t think those market factors drive most decisions,” says Schieber. “Most buying and selling decisions have to do with something going on in your life. A new job, a loss of job, a job transfer, a growing family, a empty nester.”

In other words, most people are motivated to sell for reasons outside the current state of the real estate market.

If you are thinking about selling your home and don’t have any pressing need to sell right this minute, then it might be worth talking to your real estate agent about housing market predictions to see when the best time to sell might be.

But even then, trying to time the market can be risky business.

“We don’t know it’s the top until it’s behind us, until it’s in the rear view mirror,” says Schieber. “We can identify the peaks and valleys of the market, but only in hindsight.”