How Does a Short Sale Affect Your Credit Score? (And Can You Rebuild It?)

- Published on

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

If you’re financially underwater, upside down in your mortgage and facing a foreclosure, you may be considering a short sale. A short sale when a lender allows the homeowner to sell the property for less than is owed on the home.

When considering a short sale, one of the big questions you need answered is how much damage it will do to your credit score and for how long.

Does a Short Sale Affect Your Credit Score?

In short, the bad news is that a short sale will have a significant negative impact on your credit score. And contrary to popular belief, the damage is almost as bad as a foreclosure. You also won’t be able get another mortgage for a new home for several years. The good news is that there are steps you can take to mitigate that damage and rebuild your credit once the transaction is complete.

In fact, short sale expert Brad Wallace, who ranks in the top 9% of 8,627 agents in the Philadelphia area says, “If you continue to pay your other bills and you keep everything on time, you can generally get your credit back up in a couple of years.”

How Much Damage Can Short Sales Do to Credit?

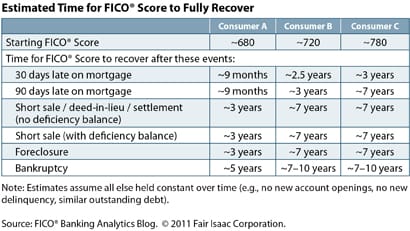

According to Fox Business, a short sale can lower your credit score by 85 to 160 points. In fact, the better your credit score is, the more damage a short sale can do to your credit.

This same FICO Banking Analytics study found that rebuilding credit took longer for short sellers who started with higher scores.

Don’t panic just yet. This timeframe is based on a full recovery, which means rebuilding your credit back up to its previous high score. So it makes sense that the higher the score, the longer it takes to rebuild.

Even if it does take seven to ten years for your credit to fully recover, that doesn’t mean you need to wait that long before getting another mortgage on a new home. Depending on the specifics of your short sale situation, you may be able to get another mortgage within two to four years once your credit score starts to recover.

In most cases, recovery starts as soon as the short sale transaction is complete. It all depends on if your lender forgives the amount of money you were short on the mortgage, or if you still owe that debt.

What If I Still Owe Money After The Sale?

If you owe $300,000 on your home, and your short sale netted only $275,000, then you technically still owe your mortgage company $25,000. When a lender agrees to a short sale, they may or may not forgive the deficiency debt that the sale didn’t cover.

If your lender has agreed to forgive the deficit, they’ll issue a 1099-C form, also known as a cancellation of debt. This form clears you of that $25,000 debt and—as the damage is already done—you can begin rebuilding your credit as soon as the short sale is completed. As an added bonus, in most situations that forgiven mortgage debt is not considered taxable income by the IRS.

The other option your lender has is to issue a deficiency judgment. This means that your mortgage company still expects you to repay that $25,000 once the short sale is completed. As Wallace notes, “When you have a deficiency judgment, you can’t really start rebuilding your credit until you pay that money. Until it’s all cleared up, you have that hanging over your head.”

In some states, there are laws that prohibit deficiency judgments after a short sale. But even if you cannot avoid one, you still have options.

How Can I Build My Credit Score Back Up?

The first step in recovering your credit is to get that 1099-C from your lender instead of a deficiency judgment. That’s why hiring an expert short sale agent early on in the process is so important. Your realtor can assist you in negotiating debt forgiveness as part of the short sale agreement.

If your lender refuses to waive their rights to pursue a deficiency judgment, you’re not out of options. Your next step is to request that your lender accept a settlement offer. In other words, if your lender won’t agree to forgive the entire amount, they may agree to forgive some. If your lender refuses the settlement offer and you cannot afford to pay, you can file for a Chapter 7 personal bankruptcy to completely discharge the deficiency judgment debt.

Once you’re completely clear of that short sale debt, the process of re-establishing a good credit history is relatively straightforward. First, request a

free credit report to review it for any errors. Better yet, request a report from all three credit bureaus to check for inconsistencies. After all, more than 80% are proven to have inaccuracies.

The next step is paying all of your bills on time. After about twelve months of consistent, on-time payments you’ll see your credit score begin to rise.

Just don’t let the trauma of a short sale scare you into cancelling all of your credit cards. You’ll need to restore your good credit history by demonstrating your ability to keep your current on the payments and your debt low.

If you’re unable to get a traditional credit card, you may qualify for a secured credit card. Secured credit cards require the cardholder to deposit the funds available on the card—so if you open your secured credit card with $500, your credit limit will be $500. Although they share similarities to a debit card that’s linked to a checking or savings account, a secured credit card reports the card activity to credit bureaus to help build your credit back up.

Rebuilding credit isn’t the only step you need to take to recover from a short sale if obtaining buying another home is your goal. You should also start saving for the down payment you’ll need to obtain another mortgage. The size of your down payment plays a big role in how soon you’ll be able to get that new loan. Although the guidelines are constantly changing, typically with a 20% down payment or more, you can get a mortgage within two years after the short sale. With 10% or less, you’ll have to wait at least four to seven years.

While you may be able to get a new mortgage within a few years, that does not erase the short sale damage from your history. Just like any other credit debt, any delinquent payments to your mortgage account will stay on your credit report for seven years.

Selling a home is always stressful, but it’s even worse when you know the sale will hurt you financially. While a short sale will significantly dent your credit score, the damage is recoverable and you’ll soon be able to buy a new home again.

Article Image Source: (Lukas/ Pexels)