How Long Does a Wire Transfer Take After Closing?

- Published on

- 6 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

When you sell your home, the proceeds are often part of your next move. The closing date marked on your calendar is like a door waiting to be opened — a door that leads to a big life change. Getting paid promptly is a top priority. But how long does a wire transfer take after closing?

In this post, we’ll explain the typical timeframe for wire transfers in real estate transactions, what might cause a delay, and tips to speed up the process.

What is a wire transfer in a home sale?

A wire transfer in a home sale is an electronic method of transferring funds from one bank or financial account to another. It is commonly used in real estate transactions to quickly and securely move large sums of money, such as the down payment, closing costs, and the final proceeds to the seller. This method ensures that the funds are transferred almost instantly once the transaction is initiated, reducing the risk of fraud and providing immediate access to the money. Wire transfers are handled differently in some states.

How does a real estate wire transfer work?

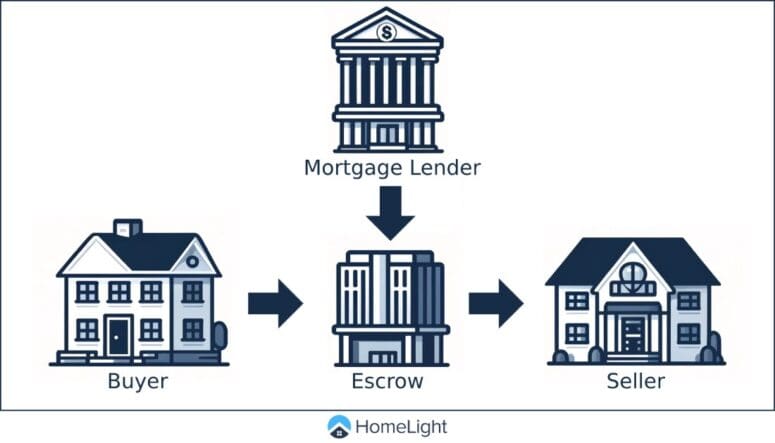

The wire transfer process at closing is typically completed in three steps:

- Buyer’s down payment and closing costs sent to escrow

The buyer sends their down payment and any required closing costs to the escrow account, a neutral third party that holds the funds until all conditions of the sale are met. - Buyer’s lender sends mortgage loan amount to escrow

The buyer’s mortgage lender wires the loan amount to the escrow account. This step ensures that all the necessary funds are available to complete the purchase. - Escrow company sends net proceeds to home seller

Once all conditions are satisfied and the transaction is finalized, the escrow company wires the net proceeds (the remaining funds after deducting fees and expenses) to the seller’s bank account.

How long does a wire transfer take after closing?

In most home sales involving a domestic wire transfer, you can expect to see the funds land within 24 to 48 hours. The exact timeframe can depend on several factors, such as the time and day the transfer is initiated, the banks involved, and any additional verification steps required by the institutions.

Most transfers initiated before the bank’s cutoff time will process on the same day, while those initiated later may process the next business day.

What might delay a wire transfer after closing?

- Day of the week: Transfers initiated on weekends or holidays may experience delays as banks do not process transactions on non-business days.

- The wire transfer network: Different banks may use different networks to process wire transfers, potentially causing delays if the networks have different processing times or requirements.

- The state where the closing takes place: Some states have specific regulations that can impact the speed of fund transfers in real estate transactions. (More on this below.)

- Domestic vs. international transfer: Domestic transfers usually process faster than international ones due to fewer regulatory hurdles and simpler verification processes.

Example timeline: From loan approval to closing

Here’s an example of a typical timeline from final loan approval to closing:

- Monday: The buyer’s mortgage loan is approved. The lender prepares the loan documents and wires the loan funds to the escrow account.

- Tuesday: The buyer wires their required funds to escrow, which typically includes the down payment and any closing costs that were not paid upfront.

- Wednesday: Closing day. The escrow company verifies receipt of the funds and confirms that all conditions of the sale have been met. All closing documents are reviewed and signed.

- Thursday or Friday: The escrow company disburses the net proceeds to the seller’s bank account via wire transfer. The seller’s bank processes the incoming wire transfer, and the funds are available in the seller’s account.

The speed of the wire transfer in this example scenario will depend on whether the closing is happening in a wet or dry funding state.

Wet vs. dry funding states

The terms “wet” and “dry” funding refer to different methods of handling the disbursement of funds in real estate transactions, influenced by state regulations. “Wet” represents that the funds are immediately liquid.

- Wet funding: In wet funding states, the seller typically receives the proceeds faster, often on the same day as closing.

- Dry funding: In dry funding states, there will be a delay of a few days for verification before the funds are released.

Dry funding states include:

- Alaska

- Arizona

- California

- Hawaii

- Idaho

- Nevada

- New Mexico

- Oregon

- Washington

How can a seller speed up the closing?

As a seller, there are several steps you can take to expedite the closing process and ensure a smooth transaction:

- Prepare documents in advance: Gather all necessary documents, such as the deed, title, and any inspection reports, before the closing date.

- Clear title issues early: Address any potential title issues as soon as possible to avoid delays.

- Communicate with all parties: Maintain open communication with your real estate agent, the buyer, the escrow company, and the lender to ensure everyone is on the same page.

- Be flexible with the closing date: If possible, be flexible with the closing date to accommodate the schedules of all parties involved.

- Choose a reliable escrow company: Work with an escrow company known for its efficiency and reliability.

- Use a wire transfer for funds: Some sellers may prefer to receive a physical check, which can add days to your timeline. A wire transfer is fast and secure.

Ultimately, having an experienced real estate agent by your side can make a significant difference. An agent can guide you through the process, help you avoid common pitfalls, and streamline the closing.

To find the best agent for your needs, try HomeLight’s free Agent Match platform. Connect with top-rated agents in your area who can help you achieve a swift and successful sale.

Header Image Source: (pyzata/DepositPhotos)