How to Get Your House Appraised in 7 Steps

- Published on

- 15 min read

-

Dorothy O'Donnell, Contributing AuthorClose

Dorothy O'Donnell, Contributing AuthorClose Dorothy O'Donnell Contributing Author

Dorothy O'Donnell Contributing AuthorDorothy O’Donnell is a writer based in San Francisco. She covers lifestyle, travel, real estate and other topics for publications such as the Los Angeles Times and 7x7.

-

Sam Dadofalza, Associate EditorClose

Sam Dadofalza, Associate EditorClose Sam Dadofalza Associate Editor

Sam Dadofalza Associate EditorSam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

If you’ve been meaning to figure out how to get a home appraisal, now’s a great time to do it. Since 2020, home prices have risen sharply nationwide. From Q1 2020 to Q1 2025, national prices surged by 55%. Over half of metro areas across the country saw price gains that exceeded the national average.

In May 2025, the median price for existing homes across all housing types reached $422,800, a 1.3% increase from $417,200 a year prior. This marks a record high for May and the 23rd straight month of annual price growth, according to the National Association of Realtors (NAR).

If you’re curious about how your home value has weathered the ups and downs of the market over the past few years, especially if you fall into one of the categories below, it may be time to consider an appraisal. Follow these steps on how to get a home appraisal in preparation for selling or whatever real estate needs you may have.

Why get a house appraised?

Getting a home appraisal can be helpful in different kinds of real estate situations. It gives you a clear idea of what your property’s worth is and help you make informed decisions. Let’s quickly look at some of the most common situations that may warrant an appraisal.

You plan to list your home soon

Sometimes, a pre-listing real estate appraisal is a helpful tool or supplement to a seller’s pricing strategy. For homes with unique features, like a detached in-law suite, tennis court, generator, solar roof panels, or even a basement bowling alley, it can be tougher to predict how the market will react. You’re unlikely to find recent sales of properties with those same characteristics as a benchmark.

Home appraisers are expertly trained to assess the value of real estate properties. The members of the Appraisal Institute, a global professional organization, have met rigorous educational, testing, and experience requirements to earn their certifications, which means homeowners can rely on these professionals’ property evaluations.

That said, an appraisal typically costs between $350 and $500 (sometimes more in high-priced markets), so sellers must consider whether the cost is worth it. A pre-listing appraisal isn’t always necessary to sell your home, and getting one doesn’t mean that a buyer’s lender won’t require a separate and independent appraisal before closing.

In addition, your real estate agent will help price your home using a comparative market analysis (CMA), a report that takes into account similar recently sold properties in your area. An agent’s CMA is usually free as part of their listing services.

You’re selling due to special circumstances

If you’re splitting up or selling property during a divorce, you’ll likely need to determine the value of any jointly owned real estate as part of the settlement. An appraisal gives you and your former spouse a better idea of whether one person can afford to buy out the other’s share in the home or if it should be sold.

Divorce isn’t the only special circumstance that may require an appraisal. You might need one for a home you inherited with your siblings or if you have multiple owners selling a vacation home, for example. In these scenarios, an appraisal can help determine each person’s share. It’s also necessary when deciding how to settle disputes among co-owners.

You want to refinance

To refinance your home, your lender will require a new appraisal to determine its current market value. This helps them calculate your equity, which is the difference between the property’s market value and the amount you still owe on your mortgage(s), including any unpaid liens.

These figures factor into your refinance eligibility, insurance requirements, interest rates, and ability to qualify for a cash-out refinance.

You’ve made home improvements (or plan to)

If you’ve made significant upgrades to your home, such as remodeling the kitchen or bathrooms, an appraisal can accurately assess the property’s post-renovation value. If you haven’t renovated your home yet but plan to in the future, an appraisal can help you pinpoint improvements that will yield the biggest return on your investment.

Review our list of what hurts a home appraisal to know the top home characteristics that may reduce property value. Certain home characteristics, like bad curb appeal, outdated systems, or foundation problems, can really hurt your home’s appraisal value.

Other factors, like a noisy neighborhood, not enough parking, or lack of nearby amenities, can also make your place less appealing to buyers. If you spot these issues ahead of time, you can fix them before the appraisal, helping you get the best value possible for your home.

Steps to get a home appraisal

Now that you know why a house appraisal is necessary, the next logical question is, how do you go about getting a house appraised? These are the steps to getting an appraisal:

1. Start with a free online home value estimate

No online home value estimator tool will be a substitute for a home appraisal, but a quick online price check can be a helpful starting point to orient yourself in the process.

Using recent sales records, market trends, and your home’s latest selling price, HomeLight’s Home Value Estimator provides a preliminary range of value for your property in under two minutes. Enter your address to get started. It’s fast, and it’s free.

2. Find a reputable appraiser

Hire a licensed and certified residential appraiser with experience appraising properties in your area. Check this guide on how to find a reputable appraiser.

Follow these steps as well:

Check with your lender

In the case of a refinance or mortgage loan application, the lender hires an appraisal through an appraisal management company (AMC). These companies provide third-party, outsourced appraisal contractors who are not affiliated with the lender or borrower.

Although the lender arranges for the appraisal through the AMC, it is usually the responsibility of the person refinancing or borrowing money to pay for the appraisal fees. Since lending firms often work closely with appraisers, it’s a good idea to ask them about trusted appraisers or companies they frequently work with. This helps streamline the search process and ensure you’re getting a qualified professional.

Search online

Need to find your own appraiser? You can search online. Check out the Appraisal Institute, a global organization for home appraisers that promotes high professional standards. Use its Find an Appraiser tool to search for an appraiser by designation, company, state, and ZIP code.

Get a referral

Ask friends, neighbors, coworkers, a local real estate agent, or others in your network for a referral. “Most of my clients are referrals,” says John Grichine, chief appraiser at Northstar Appraiser in Orange County, California. The best sources of referrals, he shares, are often friends and colleagues who have recently had their homes appraised, and real estate agents with experience in the area where the home is located.

Choose a local expert

No matter what route you take to find an appraiser, it’s critical to pick someone with deep knowledge of the area’s homes and price trends.

“You want someone who really understands the local market and what’s going on in your town,” says Eric Schuell, a leading real estate agent serving the New Haven, Connecticut area.

He recalled having a client who hired someone from Hartford to appraise a home in Milford. Although the two cities are less than an hour’s drive from each other, the appraiser lacked in-depth knowledge of the neighborhood and came up with a low value.

Ask the right questions

You can ask home appraiser candidates about their professional designations, whether they are licensed or certified in their state, and how long they have been in the business. Verify the appraiser’s license and credentials through your state’s licensing agency. Many agencies can confirm in writing that the appraiser is in good standing and may also disclose any past disciplinary actions.

Never hesitate to ask the appraiser about their experience, especially in specialized situations such as an appraisal process during a divorce or to verify assets. You should also ask about an appraiser’s experience with properties precisely like yours in style, age, and layout, such as split levels, bungalows, historical homes, and so on.

Wondering what appraisers look for when valuing your home? Understanding their criteria can make all the difference in getting the best appraisal value. Check out our simple guide What Appraisers Look for in a House to know which factors influence appraisal outcomes.

3. Get ready for the appraisers’ visit

Appraisers are trained to see beyond clutter and dirty dishes in the sink. So don’t stress if your house isn’t immaculate. That said, a little sweat equity and a couple of weekends’ worth of work can help to improve your home’s appraised value.

If time allows, consider tackling the following items before the appraiser’s visit:

Make minor repairs

The Uniform Residential Appraisal Report, a standardized form used by appraisers to evaluate a property, includes a section for noting any needed repairs, renovations, or remodeling.

Even if you plan to do nothing about cosmetic eyesores, address any broken items or fixtures, such as a leaking toilet, cracked floors, or missing door handles, as well as any issues that could pose a danger, if possible.

“Take care of things like broken windows, chipped paint, safety hazards like loose stair railings, and any FHA-stipulated items,” recommends Schuell. He says safety hazards that haven’t been repaired can raise red flags for an appraiser who might walk out and ask you to reschedule when the problems have been fixed.

Review HomeLight’s list of required appraisal repairs for additional guidance.

Improve curb appeal

Nearly half of top agents (48%) believe that enhanced curb appeal is one of the most compelling selling points in today’s market. You can’t necessarily price curb appeal using quantitative appraisal methods, but appraisers do take it into account qualitatively when reconciling that final value.

Got time? Invest in high-ROI projects

If you’re getting an appraisal to sell your home down the line, you may want to consider upgrades and renovations that will add substantial appraised value to your property. An example Grichine suggests to sellers in warmer climates is air conditioning.

“In an area like Palm Springs, lack of air conditioning will hurt marketability,” he shares.

And if your home hasn’t had a makeover since the Clinton administration, consider a new look: countertops, flooring, and cabinets are all things you can spruce up for a high ROI.

4. Gather relevant documents

You’ve refreshed your home, made essential repairs, and scheduled an appointment with your appraiser. Now, it’s time to gather key documents that will help the appraiser come up with an accurate assessment of your property’s value.

Be sure to have documentation of all home improvements made to the property over the past 10 to 15 years on hand, including remodels, upgrades, and new additions. If you’ve done your homework and analyzed house comps yourself, feel free to share your findings with the appraiser. Just make sure the comps you select are similar in size, location, and characteristics to your own home.

5. Make final preparations for the onsite visit

It’s a few days before the appraiser’s visit (or the day of, if you’re a last-minute kind of person). Be sure to handle the following tasks before they show up:

Deep clean and declutter

As we stressed earlier, appraisers aren’t going to mark you down for a messy space. But it’s still wise to spend a few hours deep-cleaning and decluttering the house, particularly the visible portions like floors and countertops.

Vacuum, give kitchens and bathrooms a once-over, and wipe surfaces of any dust and grime. This step is especially important if you haven’t regularly lived in the property over the past few months.

Provide easy access to all areas of the home

It’s not uncommon for residents to block entry to a basement or attic, especially if children or pets are present, but every room of the house should be easily accessible. Make sure the appraiser can move around, take measurements and photos, and check off all of the details easily.

Secure or remove pets

Keep pets out of the way. Put cats in a carrier and either crate dogs or take them out for a walk. Always let the appraiser know that they’ll be entering a house with a pet, says Grichine, adding that he likes dogs, but appreciates a warning.

Feel free to stay

Homeowners are welcome to be home for the appraisal, as they can also make sure the appraiser has access to what they need. It can be helpful to have someone there to answer questions or fill in information gaps, though you don’t need to follow the appraiser around the house.

Chatting up a storm could also cause the appraisal process to take longer than it needs to, and you don’t want to overwhelm the appraiser with a hard sell of what you believe your home to be worth.

If you’re working with a real estate agent, it’s customary for the agent to attend the appraisal and optional for the seller to do so. An agent will have more experience in these scenarios and can assist. If no one can attend the on-site visit, be sure to leave your list of upgrades and any other relevant materials in a visible place.

The appraisal process doesn’t have to be a mystery. Our blog How Long the Appraisal Takes breaks down the typical timeline, so you know what happens and when. It’s a quick, helpful guide to keep your sale or refinance on track.

6. Pay the appraisal fee

How much does it cost to get it appraised? The price of a full appraisal varies according to location. The World Population Review notes that appraisal costs typically range from $200 to $600, with prices varying based on your state and local cost of living. Here are some of the most expensive markets for getting an appraisal:

- Alaska ($900–$1,300)

- Hawaii ($900)

- Montana ($875–$1,000)

- Washington ($850)

- Oregon ($825–$1,000)

Typically, a home appraisal fee covers:

- The appraiser’s expertise

- The onsite home inspection, which can take anywhere from 30 minutes to several hours

- The appraiser’s analysis of recent comparable sales (or application of other appraisal methods, such as the cost approach or income method)

- The appraisal report, summarizing how the appraiser arrived at an independent opinion of value

- Any management fees that might be associated with procuring the appraisal

Curious about who is responsible for covering the cost of a home appraisal? Read our Who Pays for the Appraisal blog to learn how to plan for this expense and manage it with confidence.

7. Review the appraisal report

If a client is working with an agent, the appraisal and report will usually go directly to them rather than the homeowner, says Grichine, adding that customers rarely look at his actual report.

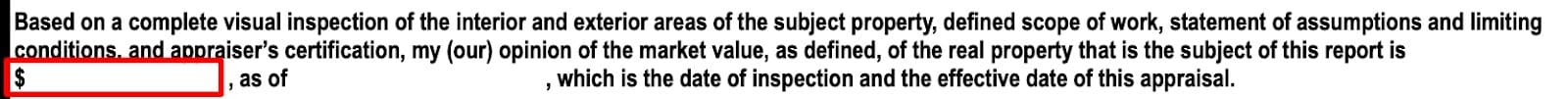

If you are the one to receive the report, the appraised value of your home will likely be listed in a section labeled “Reconciliation” on the appraisal report.

Look for the bolded text that reads:

“Based on a complete visual inspection of the interior and exterior areas of the subject property, defined scope of the work, statement of assumptions and limiting conditions, and appraiser’s certification, my (our) opinion of the market value, as defined, of the real property that is the subject of this report is $_______, as of ________, which is the date of inspection and the effective date of this appraisal.”

The dollar value that fills the blank is what the appraiser has determined your home to be worth. Learn more about how professionals come up with figures by checking our explainer on the anatomy of a home appraisal report.

Your appraisal is complete – what’s next?

You’ve reviewed your appraisal report, and you’re a happy camper. Or maybe you’re not. Read on to learn what happens after appraisal completion.

You are satisfied with the appraisal

In this situation, you’re pleased with the dollar value the appraiser came up with for your home. This doesn’t always mean that the number meets or exceeds your expectations.

In some instances, the client wants the dollar figure to be low, says Grichine. For example, if the assessment was done primarily to determine taxes on the property, the client would want a lower figure, he says.

If you are selling your home, reach out to your real estate agent and talk through the next steps. They will want to kick off the house’s pre-listing plan and do the groundwork for selling the house.

You are dissatisfied with the appraisal

If you’re unhappy with the results of your appraisal, you can submit what’s called a reconsideration of value, but your chances of success with this route are low. You’ll likely need to show that your home’s condition or quality was undervalued substantially or introduce new comps to prove your case.

That said, appraisers rarely change their original opinion of value unless they make a material error. This can happen, as was the case for one real estate agent who noticed that an appraiser had listed her client’s three-bedroom house as a two-bedroom on the report. But it’s rare.

According to Mike Ford, a longtime certified general appraiser in Southern California, an appraiser can back up their opinion of value around 85% to 90% of the time. He shares that often appraisers prove the new comparables proposed by the agent are not similar enough to the property to use.

Ready to get your house appraised?

Maybe you inherited a property with your siblings and are arranging for a sale or buyout. Or perhaps you’re ready to list your home, but after 20 years of ownership and several renovations, you wouldn’t begin to guess how to price it nowadays. You should now have a good idea of how to get a house appraisal if you need one.

If you want a quick ballpark idea of your home’s value, you can always input your address into HomeLight’s Home Value Estimator for a fast and near-instant check as a starting point.

For a more accurate valuation, contact a licensed and certified appraiser who knows the area well. If you’re borrowing money or refinancing, skip this step, as the lender will arrange for a third-party appraiser.

Improve your curb appeal and fix broken items around the house before the appraiser’s visit, and be sure to have a list of upgrades at the ready. Expect to pay a few hundred dollars for the appraisal, which will vary depending on the location and size of your home and other factors.

If you need a real estate agent for a comprehensive CMA report, HomeLight would be happy to connect you with a few top-rated real estate agents in your area.

Header Image Source: (Steven Ungermann/Unsplash)

FAQs on how to get your house appraised

A home appraisal is necessary for various reasons, including determining the property’s fair market value for selling or refinancing, setting an asking price, validating the purchase price, and ensuring the property meets lender requirements for a mortgage loan.

To find a qualified appraiser, start by contacting your lender for recommendations. You can also search online directories, consult with local real estate agents, or ask for referrals from friends or family who recently had appraisals done. Ensure the appraiser is licensed, experienced, and familiar with your local market.

To request a home appraisal, contact a licensed appraiser or your mortgage lender. Lenders often arrange appraisals for loan processing, but you can also hire an independent appraiser directly.

Online home appraisals can be accessed through platforms offering automated valuation models (AVMs), but they’re generally less accurate. For a precise appraisal, hiring a certified appraiser for an in-person evaluation is recommended.

While home appraisals typically cost money, you can try free online estimates using AVM tools or request a CMA from a real estate agent, which provides an estimate based on recent sales. You may also take advantage of lender-covered appraisal promotions. These methods are discussed in depth in our guide on getting a home appraisal for free.

Several factors affect a home appraisal, such as the property’s location, size, condition, amenities, recent sales of comparable properties, and market conditions. The appraiser will also consider factors like upgrades, renovations, and unique features that add value to the property.

To prepare your home for an appraisal, ensure it is clean, well-maintained, and clutter-free. Make any necessary repairs and consider enhancing curb appeal. Provide the appraiser with information on recent upgrades, renovations, or notable features that may positively impact the appraisal value.

Avoid offering personal opinions about your home’s value or the price you expect to receive. Let the appraiser assess the property objectively without any influence that could potentially skew their judgment.

Typically, the buyer pays for the appraisal as part of the loan process. But sellers may likewise cover the cost, such as when they opt for a pre-listing appraisal to help price the home accurately before listing it.

Yes, if you believe a low appraisal is inaccurate, you can challenge it. Gather any supporting documentation, such as recent comparable sales or details on property improvements, to present to the lender. Consult with your real estate agent or a professional appraiser to guide you through the process of challenging a low appraisal.

A home appraisal evaluates a property to determine its market value, often required by mortgage lenders to process loan or refinancing applications. On the other hand, an inspection assesses the home’s condition to identify potential issues that could affect safety and warrant repairs.