How to Sell Your Parents’ House When They Can’t (For Any Reason)

- Published on

- 8 min read

-

Astrid Storey, Contributing AuthorClose

Astrid Storey, Contributing AuthorClose Astrid Storey Contributing Author

Astrid Storey Contributing AuthorAstrid Storey is originally from Panama and spent most of her early years traveling through Central and South America. She arrived in Denver in 2003, the day after graduating college. During the next decade-and-a-half, she’s juggled a career in a variety of creative and marketing roles while building her own studio, Storey Creative, with clients in real estate, health care, publishing, and tech.

-

Jedda Fernandez, Associate EditorClose

Jedda Fernandez, Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

If you’ve ever sold your own house, you know how stressful it can be — making all the repairs, deep cleaning, corralling kids and pets, staging, and photos… and then the endless, endless showings interspersed with endless, endless cleaning. Yes, selling a house is an enormous endeavor — and if it’s not your house but your parents’ house, then you probably have a slew of other issues to handle on top of the home sale.

We talked to Rita Shaw from the Rita Shaw Broker & Associates, Inc, a brokerage serving the Redlands, California, area and currently managed by Joseph Shaw. She walked us through the process of adult children looking to sell their parents’ home.

When parents are alive but somehow incapacitated

In these cases, older or infirm parents will move out of their homes and to either a nursing home or into an adult child’s home — possibly yours. Given the circumstances, it can take some time for you to get your ducks in a row before deciding to sell the house.

The first step after deciding you need to sell is to get power of attorney.

If your parents are still able to make decisions, it’s much easier to get this power of attorney executed — so have that conversation with them as early as possible.

If your parents aren’t capable of providing a power of attorney, you’ll have to apply for guardianship. The process involves filing a petition to the court stating that your aging relative lacks the mental capacity to make decisions and that you’re the best person to serve as guardian. The laws regarding guardianship vary from state to state, and you should consult with a family attorney about whether legal representation is necessary.

After they’re gone…

“I tell my clients they’ve received a gift from their parents when they have set up a living trust,” Shaw says. This means that parents have chosen a trustee and established an “inter vivos trust” or trust created while alive, which directs how property should be handled once they are gone.

The No. 1 reason it is generally considered best to set up a living trust is because — barring someone contesting any gift or transfer of property — a trust doesn’t usually require probate to transfer property to heirs. “You’ll still have a house full of things to manage, but some of the decisions have been made for you, and you generally don’t have to mess with the probate courts, which really simplifies things.”

The other, possibly most common way people bequeath property to their heirs is with a will and a named executor (i.e., a named person in charge of making sure the property included in the will is properly distributed). Wills are helpful because they outline how and to whom your parents wish to distribute their personal and real property, but unfortunately, a will still has to pass through probate courts before transfers can be properly made…and that can take a while and be very inconvenient.

In the worst-case scenario — when parents pass away unexpectedly without a will or trust — Shaw explains, “It goes to state law to determine who inherits and who’ll be in charge.”

Individual states’ probate laws can be found here courtesy of FindLaw, an award-winning free online legal portal.

Either way, you will usually find a referral for a probate real estate agent from your own agent or from a probate attorney.

Dealing with grieving family

There are a lot of feelings involved in a transaction like this. Regardless of the circumstances, Shaw says, “When someone passes away, either everyone is on the same page and getting along and loving and a pleasure — or you have the total opposite.”

“As the probate real estate agent, I deal directly with the person in charge,” she adds. “And if they can’t agree… I try to deal with their representatives.”

As part of their services, a probate real estate agent works with attorneys for all involved family members to sell property and assets in estates where the family relationships are distressed or broken. For example, two brothers living on opposite sides of the country trying to deal with a multimillion-dollar estate without talking or interacting with one another could get the house sold through a probate real estate agent.

Preparing for listing your loved one’s home

Your agent will help you with the research to determine the condition of the estate and decide on a fair price for the house. One of the first things that an agent should do in this situation is help you order a title report so that you can assess whether the mortgage has been paid in full, whether there’s a second mortgage on the house — or tax or other liens that simply aren’t on your radar.

“We want to be ready to close when we go under contract, so we get this part done as soon as possible,” Shaw notes.

In a typical transaction where the title status is not in question, the title search takes place when the property is under contract; however, in a transaction subsequent to a death, agents often prefer to make sure all the paperwork is in order before listing the house on the market to avoid potential delays at closing.

Keep, donate, toss

Adult children also have to deal with what Shaw calls “the stuff.” After living in a house for possibly decades, your parents have likely accumulated furniture, clothing, and possessions — things that you’ll have to sort through and clear out before you can sell your parents’ house.

Even if your parents aren’t deceased and living in a nursing home, “chances are they only took a box of personal items with them and everything else stayed in the house,” explains Shaw. She suggests that families host an all-hands meeting, so to speak, with everyone present at the house, and then decide together who’s going to take what.

“I’ve been in a situation where the heirs have all picked their piles and there’s a pile in the middle of the room they’re fighting about — and we just flip a coin,” she remembers. “That was a very contentious estate.”

Another suggestion: Every family member should bring a box and fill it with things that are meaningful or personally important to them — family pictures, a book, a vase.

In general, Shaw says, relatives have little use for larger pieces of furniture. Anything that doesn’t get selected by family members should be offered for charities or to a junk hauler.

It helps to get prepared for purging as much “stuff” as you can ahead of time, whenever possible. A good real estate agent can work with you, explaining to aging parents that children are not likely to want furniture and offering options for downsizing house.

Pricing to sell

If your scenario is a guardianship and your parents are infirm but living, the usual pricing process takes place: the real estate agent will identify fair-market value based on comparable properties and look at overall market conditions.

If your parents are deceased and did not leave their property in a living trust — and the house is thereby subject to the probate process — a probate referee will have the property appraised, and the final sale price needs to be within 10% of that price. “A probate real estate agent can work with you to prepare a market analysis and suggest a pricing strategy for the property,” Shaw says.

If the market analysis recommendation is lower than the probate referee’s assessment, you will have to list it at the recommended probate price; if the home doesn’t sell, the agent has to go back and request a new appraisal before cutting the price.

Repairs and staging

When it comes to deciding which repairs to make, or whether to sell your home as is, ask your real estate agent for a market analysis that considers each scenario individually, and then use the information presented to decide whether to invest in making improvements or not.

This is a personal decision; some sellers don’t want to take the time or expense to make any improvements and would prefer to list at a lower price. Shaw says that sometimes, she will organize any updates as the agent, and then the seller will reimburse her for the expenses at closing.

The most common repairs? Paint, stripping wallpaper, and pulling up carpet to show hardwood floors, says Shaw. “But these are recommendations we give any seller, regardless of whether it’s an estate or someone selling their own home.”

When it comes to actually performing the repairs, sometimes sellers opt to make those changes themselves to save money, but sometimes, it makes more sense to find a handyman or a contractor to get the job done. Your real estate agent can refer you to someone qualified.

Other items to keep in mind

Try to focus on the task at hand, which is the real estate transaction, and try to work through your personal feelings or past experience on your own. Also, try to remember that everyone in your family is dealing with the transition in their own personal way. The process can be “very divisive to a family,” according to Shaw.

When it comes to taxes and the implications of dealing with an estate, always consult a professional. The tax implications will differ for each individual heir and their situations, so each sibling in a transaction like this would be affected differently. You will also have to work with a CPA to prepare an estate tax return.

If you’re caring for elder parents, or foresee a situation in which you’ll be in charge of a real estate transaction on behalf of your parents in the future, working with them to prepare a plan while they’re still alive and in full command of all their faculties can save the estate money, help preserve familial bonds, and make the process less complicated for everyone.

Our estate planning and probate section includes tools to help you untangle the complexities, walk you through the basics, and help you find the best top agent who specializes in probate real estate.

Disclaimer: Information in this blog post is meant to be used as a helpful guide, not legal advice. If you need legal help with a probate sale, please consult a skilled lawyer.

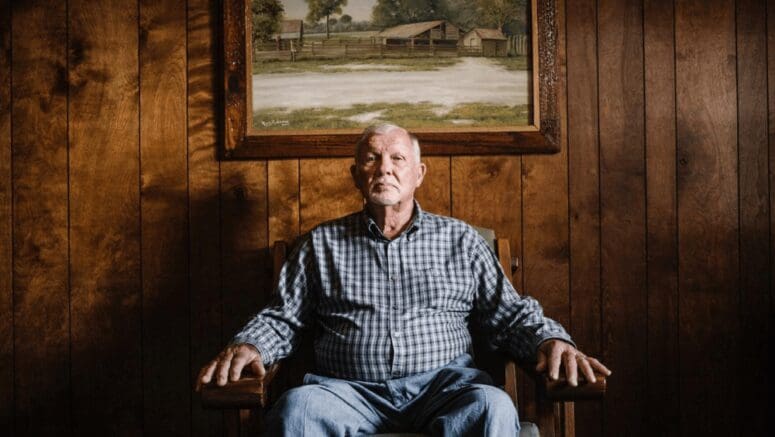

Header Image Source: (Wade Austin Ellis / Unsplash)