6 Top iBuyer Companies That Want to Buy Your Home in 2026

- Published on

- 15 min read

-

Valerie Kalfrin, Contributing AuthorClose

Valerie Kalfrin, Contributing AuthorClose Valerie Kalfrin Contributing Author

Valerie Kalfrin Contributing AuthorValerie Kalfrin is a multiple award-winning journalist, film and fiction fan, and creative storyteller with a knack for detailed, engaging stories.

-

Taryn Tacher, Senior EditorClose

Taryn Tacher, Senior EditorClose Taryn Tacher Senior Editor

Taryn Tacher Senior EditorTaryn Tacher is the senior editorial operations manager and senior editor for HomeLight's Resource Centers. With eight years of editorial and operations experience, she previously managed editorial operations at Contently and content partnerships at Conde Nast. Taryn holds a bachelor's from the University of Florida College of Journalism, and she's written for GQ, Teen Vogue, Glamour, Allure, and Variety.

Selling a house can be quite a hassle. Knowing that a potential buyer is coming to view your home the next day means there’s no time to relax. Instead, you find yourself grabbing the vacuum and rushing to tidy everything to ensure the house looks its best. Sometimes, you even have to spend a significant amount on repairs for the furnace or roof just to attract a decent offer.

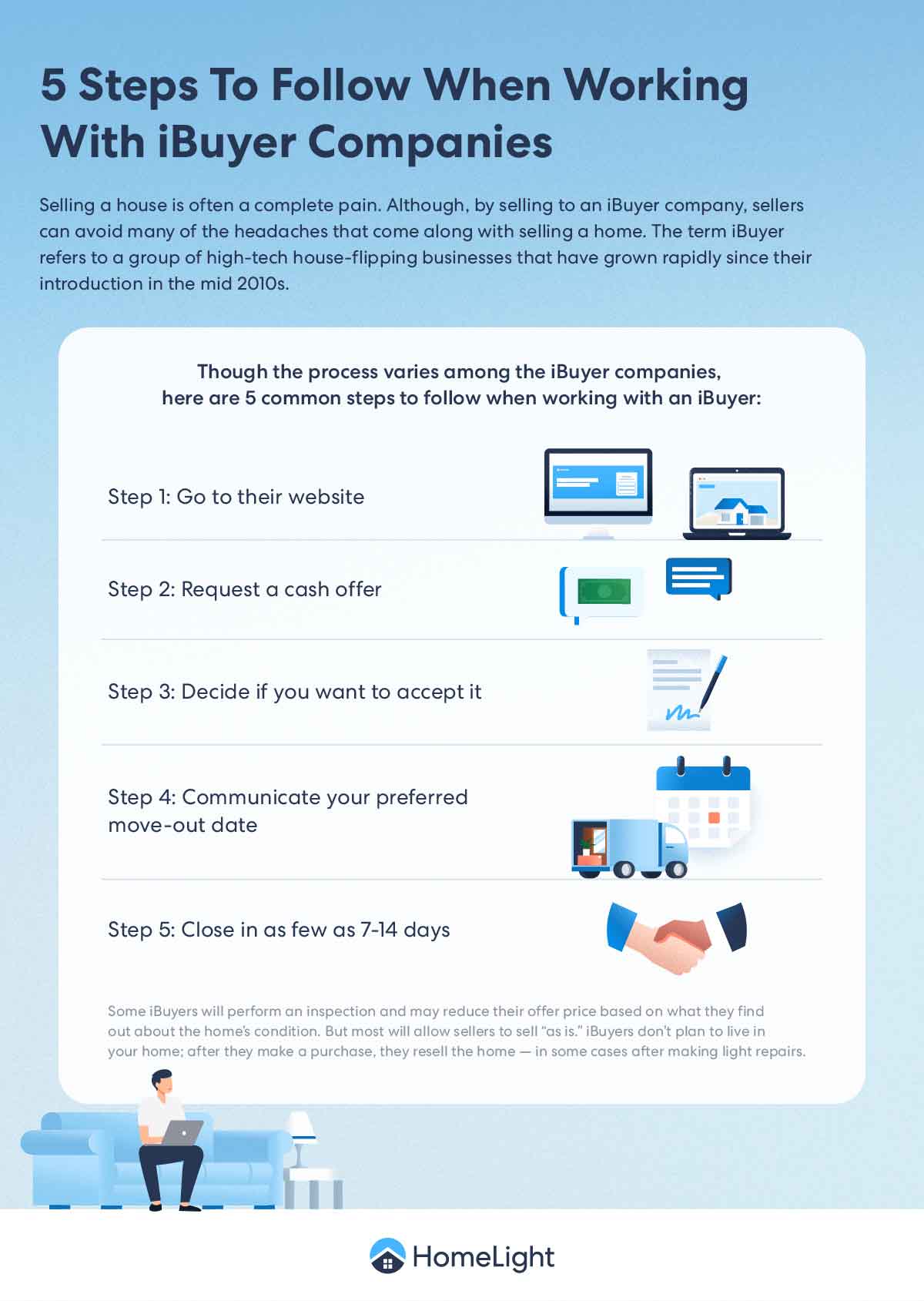

By selling your house to an iBuyer company, you can avoid many of these headaches. The term iBuyer refers to a group of high-tech house-flipping businesses that cropped up in the mid-2010s. Before you work with one, you’ll have to weigh the pros of convenience and speed against the possibility of receiving less than fair market value and paying service fees.

To assist you in selecting an iBuyer, we’ve put together a roundup featuring some of the leading iBuyers in 2026 and comprehensive details about working with each one.

Who are the iBuyer companies?

The term iBuyer encompasses a list of companies, including Opendoor and Offerpad. We also include information about HomeLight’s Simple Sale platform, which provides you with a competitive all-cash offer to buy your home. Although Zillow was once a top-three iBuyer, it shuttered its iBuyer program in 2021. In early November 2022, Redfin announced the shuttering of its iBuyer arm, RedfinNow, after launching in 2017.

Though each business operates a little differently, iBuyers generally provide a near-instant cash offer for houses, allowing you to sell your home mostly or entirely online, and can facilitate much faster closings than a more traditional or financed buyer.

“The biggest advantage is ease,” says Lynn Carteris, a top real estate agent with the Oldham Group serving the San Francisco Bay area in California. “You don’t have to prepare the house; you don’t have to repair the house.”

Working with iBuyers

Though the process varies among iBuyer companies, to work with an iBuyer, you would typically:

- Go to their website

- Request a cash offer

- Decide if you want to accept the instant cash offer

- Communicate your preferred move-out date

- Close in as few as 7-14 days

Some iBuyers will perform an inspection and may reduce their offer price based on what they find out about the home’s condition. But most will allow you to sell as-is. iBuyers don’t plan to live in your home; after they make a purchase, they resell the home — in some cases, after making light repairs.

How do iBuyers make a cash offer for my home?

iBuyers leverage online appraisal technology and other methods to determine a home’s value and what they’re willing to pay. They usually buy and resell homes at a higher volume than other types of real estate investors, so their goal is to flip more homes to make up for a lower profit margin per flip. As such, their offers tend to be closer to market value than what you’d see from a flipper who uses the 70% after-repair-value standard.

Some of the top iBuyer companies in 2026

Now that you have an idea of how iBuyers work, let’s review some of the top iBuyer companies of today, how they differ, and what to expect from working with each.

1. Simple Sale

With Simple Sale, HomeLight provides an all-cash offer for homes in almost any condition through our network of cash buyers. Our platform enables you to sell your home in as few as 7 days rather than what can be weeks or months.

You can skip staging and repairs and sell without agent commissions or upfront selling costs. Answer a few basic questions about your home’s condition, how much work it needs, and your selling timeline to get started with Simple Sale today.

Locations: Available across most of the nation — input your address to see if we could provide a cash offer for your property.

Service fee: Some transaction fees apply. No hidden fees or agent commission costs, and requesting a no-obligation offer is free.

Closing window: After we’ve collected key details about your home, we’ll provide a cash offer within 24 hours, with the ability to close in as little as 7 days. You have the flexibility to pick a moving day that works for your schedule, typically within 30 days of closing.

Simple Sale is a HomeLight platform. HomeLight was founded in 2012 and is BBB accredited with an A+ rating. The company has 4.8 stars on Google based on hundreds of user reviews.

844-488-8455

2. Opendoor

Launched in 2014, Opendoor is considered the nation’s pioneering iBuying platform. It buys homes directly from sellers, and the company’s online platform makes it easy to receive a no-obligation offer in minutes.

According to the company’s FAQ page, Opendoor typically buys homes in the range of $100,000 to $600,000, but in some cases, it will consider homes valued much higher, depending on the location.

Opendoor buys homes of varying conditions, but criteria like a short sale, unpermitted work, or dated materials may impact whether the company is willing and able to purchase a home.

Locations: Opendoor has grown rapidly since its launch. It currently operates in over 50 metropolitan areas and counting, including Atlanta, Dallas-Fort Worth, Denver, Las Vegas, Los Angeles, Nashville, Portland, and Tampa.

Service fee: As of Sept. 30, 2020, and current as of December 2025, Opendoor charges a 5% service fee.

Closing window: As little as two weeks, or longer if the seller needs more flexibility to stay.

Opendoor’s BBB business profile shows it has an A+ rating with 1.15 out of 5 stars. Sellers were pleased with the strength of Opendoor’s offers compared to some other companies and the feedback provided by its customer service team.

3. Offerpad

Launched in 2015, Offerpad is one of the largest iBuyers by transaction volume, alongside Opendoor. It collects information about a property with a three-minute questionnaire for sellers to fill out, according to the company website. Sellers also have the option to take Offerpad on a short virtual walkthrough of the home to inform the company’s offer. Offerpad provides no-obligation cash offers to sellers in 24 hours.

Locations: As of this writing, Offerpad is buying homes in the metropolitan areas of 9 states, including Arizona, Florida, Georgia, Indiana, Nevada, North Carolina, Ohio, South Carolina, and Texas.

Service fee: 5% of the sale price.

Closing window: Anywhere from a few days to 60 days if the seller needs more time. Offerpad often cushions the closing timeline by a few days if there’s an HOA involved in the sale.

Offerpad holds an A+ rating and BBB accreditation. With an average of 1.83 out of 5 stars, it impresses many of its customers. A recent review highlighted a smooth transaction and effective communication. A potential obstacle involving home exterior paint was swiftly resolved, leading the reviewer to express willingness to work with Offerpad again.

Trade-in or buy before you sell programs

Some iBuyer programs are specifically tailored to help people who are buying and selling a home at the same time. Let’s review some of the main iBuyer companies in this space.

4. Buy Before You Sell

With Buy Before You Sell, HomeLight evaluates your existing property using a proprietary algorithm to figure out how much of your home equity you can unlock to put toward the down payment of your new home, moving expenses, closing expenses, or property repairs.

This allows you to make a contingency-free offer on a home, even though your current home has not yet been sold. Once you move into your new home, your agent will list your previous, now vacant, home to attract the strongest offer.

With Buy Before You Sell, you can avoid potentially paying two mortgages or rental fees, and you won’t have to move twice.

Locations: Available across most of the nation — input your address to see if your home qualifies.

Service fee: 2.4% of the home’s sale.

Closing window: Once you close on your new home, you can move in immediately. Your agent will work to prepare your old home for sale, listing it on the market and getting it under contract within 120 days.

Buy Before You Sell is a HomeLight platform. HomeLight was founded in 2012 and is BBB accredited with an A+ rating. The company has 4.8 stars on Google based on hundreds of reviews. Customer reviews speak to the ease of the real estate transaction while using HomeLight’s Buy Before You Sell program.

5. Knock Bridge Loan

The Knock Bridge Loan program is touted as “a bridge to a mortgage” for homeowners looking to buy before they sell. As described on its website, the program “makes you more attractive to lenders and sellers, giving you greater certainty and convenience” and “Knock enables you to use the money ‘tied up’ in your current home to purchase your next one.”

Knock works with buyers, sellers, agents, and lenders to help homeowners build a buy-before-you-sell bridge to a new home.

Locations: According to Knock, the program is available in 25 states, including Alabama, Arizona, California, Colorado, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Maryland, Michigan, Minnesota, Nebraska, New Hampshire, New Jersey, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Washington state, Wisconsin, and the District of Columbia.

Service fee: A 2.25% fixed fee on the new home’s purchase price. In addition, you’ll pay an estimated closing cost of $1,850, which will vary depending on factors such as the state-specific requirements and loan amount, according to the Knock FAQ page.

Closing window: According to the company website, clients can close on the new home before selling their old one. If the old home doesn’t sell within six months, Knock will provide a non-contingent offer to purchase it.

Knock has a Trustpilot rating of 4.7 stars based on over 180 reviews. A recent client shared that the team went above and beyond to secure financing for their new house after their old house didn’t sell in time. They noted that the process was smooth, and they found the team great to work with.

6. Orchard

Since 2017, Orchard has been helping sellers make stronger offers by allowing them to unlock their home value upfront to put toward their next home, according to the company’s website. Orchard then handles cleaning, listing, and showing a seller’s previous home and manages updates to help the home sell for maximum value. Sellers only pay Orchard a service fee once their old home is sold.

Locations: Orchard currently operates in metropolitan areas in eight states, including Atlanta, Austin, Dallas-Fort Worth, Denver, Houston, Nashville, Orlando, Phoenix, San Antonio, San Diego, and Seattle.

Service fee: On its website, Orchard explains that its Move First program typically costs 6% of your home sale plus a 2.4% program fee.

Closing window: 35 days on average, according to Orchard’s FAQ page.

Orchard is a BBB accredited company with an A+ rating and 3.84 out of 5 stars. They facilitate home sales and purchases, catering to various markets. A satisfied client describes their professionalism, recounting the swift contract placement of their house within four days during a buyer’s market and impending recession. The client attributes this success to Orchard’s team expertise, highlighting their profound impact.

Zillow shuttered its iBuyer program (Zillow Offers) in 2021

Zillow is known as the place to shop for a home. But, in 2018, the real estate company launched its own iBuyer services for sellers called Zillow Offers. The program was short-lived. In November 2021, Zillow announced the end of Zillow Offers, citing the inability to forecast home prices and balance sheet volatility.

RedfinNow closed in 2022

Redfin is an online real estate brokerage company launched in 2005. In 2017, the company started RedfinNow, its iBuyer business. Faced with the rapid downward shift in the housing market in response to higher interest rates, the company announced it was winding down its iBuyer operations while laying off approximately 13% of the company’s workforce.

iBuyer company FAQs

iBuyer companies had big plans to shake up the real estate market with immediate cash offers and quicker closing timelines when they hit the scene about 10 years ago. But, as the housing market cooled after the pandemic-triggered housing boom, iBuyer companies are struggling to stay afloat. The ones that remain are having to adjust their models.

In 2025, iBuyer revenues showed a significant decrease. The nation’s largest iBuyer, Opendoor, announced that it generated 33.5% less revenue in the third quarter of 2025 compared to the same period in 2024. In October 2025, Opendoor pivoted to become an AI-powered technology platform that helps others transact real estate, rather than just being a house flipper.

Do iBuyers make fair market offers?

While iBuyers often offer more than house flippers, you likely won’t receive the full fair-market value for your home when selling to an iBuyer. This is because iBuyer companies typically purchase homes as-is, saving you the time and money to deal with repairs, showings, and prepping your home for sale.

How much does it cost to sell to an iBuyer?

Although iBuyer companies do not charge a commission like a real estate agent, they do charge a service fee, typically around 5%-6%. The national average real estate commission is 3%-5.8%, which reflects the change in commission fees in the U.S. following the implementation of NAR’s lawsuit settlement terms in August 2024.

Key takeaways about today’s iBuyers

We’ve gone over a lot in this guide, including who the major iBuyers are, what they do, and some of the differences among them. If you’re weighing whether to sell your home to one of the iBuyer companies, consider these key takeaways:

- An iBuyer company runs property data through an algorithm to determine how much they are willing to pay for your home and to provide you with an instant all-cash offer. Some will take additional steps to see your home virtually or in person to adjust their offer.

- You won’t have to deal with staging or showing the home when you sell to an iBuyer. You can also skip repairs, though an iBuyer may reduce their offer price based on an inspection.

- You can close within weeks or even days due to a lack of lender involvement, which is a huge help if you’re dealing with a major life change or need cash quickly.

- Current market conditions have made it difficult for iBuyers to stay in business, and the iBuyer companies that remain have had to adjust their business models.

- iBuyer companies may offer a fair but lower sales price in exchange for the convenience they provide.

- In exchange for purchasing your home, most iBuyers charge some kind of service fee, often to the tune of 5%-6%, rather than a commission you’d pay for a real estate agent’s services.

FAQs on the top iBuyer companies that want to buy your home

iBuyer companies are real estate companies that use technology and data analysis to make instant cash offers on homes. They streamline the home-selling process by providing fast offers, often without the need for traditional showings or open houses. Unlike house flippers, iBuyers typically purchase homes in good condition. Like other cash buyers, iBuyers are able to provide a quick closing by eliminating the need for financing.

iBuyer companies use proprietary algorithms that consider various factors, such as recent sales data, market conditions, and property details, to calculate the offer price. They analyze comparable sales and adjust for factors like location, condition, and market demand. This data-driven approach helps iBuyers determine competitive cash offers for sellers.

Selling to an iBuyer company offers several advantages, including speed and convenience. iBuyers provide fast cash offers, allowing sellers to avoid the traditional listing process. Additionally, iBuyers typically have streamlined closing processes, enabling sellers to close quickly and receive cash proceeds.

While iBuyers offer convenience, there are potential downsides. The offer price may be lower compared to the traditional market value to account for the iBuyer’s costs and potential risks. Sellers may also incur additional fees or charges associated with the iBuyer transaction. It’s important to carefully evaluate the offer, consider alternative selling options, and assess the overall financial implications.

To choose the right iBuyer company, consider its reputation, track record, and customer reviews. Evaluate their offer terms, fees, and the level of transparency provided throughout the process. It’s also wise to compare multiple iBuyer offers to ensure you’re getting a fair price. Consulting with a real estate professional recommended by HomeLight can help you navigate the iBuyer landscape and make an informed decision.

Lastly, while some clients relish the speed and ease of an iBuyer sale, the iBuyer experience might not suit everyone. If you have a more flexible timeline and are eager to see how your home would perform on the open market, you can always talk to a top real estate agent in your area to explore your options. If you aren’t sure who to contact, HomeLight would be happy to make an introduction through our agent-matching service.

Header Image Source: (Evelyn Paris / Unsplash)

Editor’s note: This blog post provides a high-level overview of some of the top iBuyer companies and programs for educational purposes only. Program details can frequently change. Please visit each iBuyer’s website for the most up-to-date information on program fees, market coverage, business model, and more.