Is the Money From Your Home Sale Taxed Like Income, Or What Can You Expect?

- Published on

- 5-6 min read

-

Jedda Fernandez Associate EditorClose

Jedda Fernandez Associate EditorClose Jedda Fernandez Associate Editor

Jedda Fernandez Associate EditorJedda Fernandez is an associate editor for HomeLight's Resource Centers with more than five years of editorial experience in the real estate industry.

You finally made it to closing and successfully sold your house — and you’ve got plenty of ideas for what to do with the money once it’s wired into your bank account. Maybe a little spending, a little saving, perhaps wiping out some debt…

But then a thought occurs to you: This windfall, as great as it is, feels a lot like income. Does that mean it will be taxed like income? Will you need to set aside a chunk of the profits to cover a hefty tax bill?

The good news, in a nutshell: You most likely don’t need to worry. But it’s a good idea to understand how the process works so you can have complete peace of mind going into the sale.

How does the government tax home sale profits?

Here’s how it works: Your home sale proceeds are considered a “capital gain,” in other words, the profit you made from the sale of a capital asset. The capital asset, in this event, is your home.

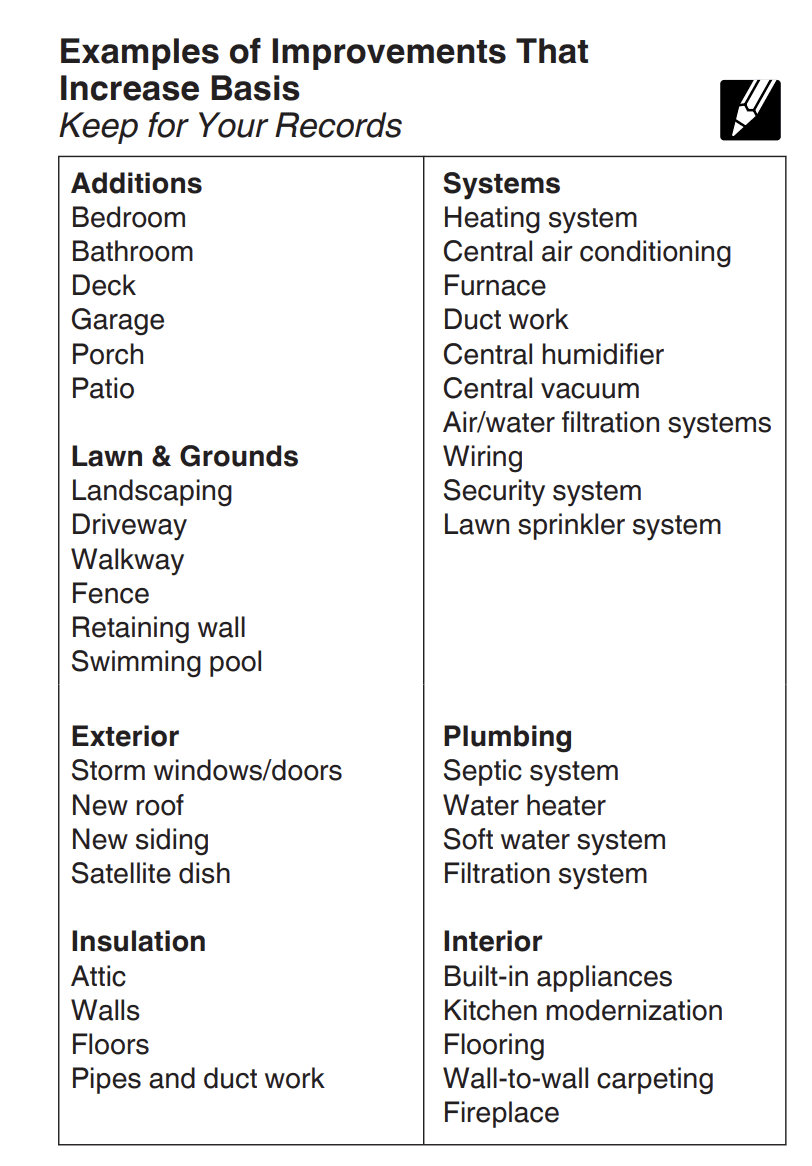

To roughly calculate the size of that gain, you’d take the sales price of your property (minus selling expenses), a figure known as your amount realized. From there, you’d subtract your adjusted cost basis. In general, your adjusted cost basis is what you originally paid for the home, plus the cost of any major renovations (called capital improvements).

Let’s illustrate with an example:

You bought your home in the year 2004 for: $250,000

You sold it in 2024 for: $450,000 (marking 4.2% yearly appreciation)

Prior to selling, you invested in the following improvements:

Kitchen refresh: ($20,000)

Bathroom remodel: ($30,000)

New hardwood floors: ($2,000)

Landscaping: ($3,000)

Your settlement costs amounted to:

$26,000 in agent commissions

$18,000 in other closing fees

From here, you can calculate your capital gain like so:

$406,000 (sale price – settlement costs)

–

$305,000 (cost basis, i.e., the original price + the total cost of capital improvements)

=

A capital gain amounting to $101,000*

Even when factoring in your capital improvements to raise your cost basis, that’s quite a profit! And you’re thinking: I’m going to be taxed out the wa-zoo for this money. And it’s true that in many cases, with capital gains yielded from investments such as stocks and bonds, the government wants to take a cut of whatever you earned.

But most homeowners won’t have to fork over capital gains taxes — at least when they sell their main house.

That’s because — under the current tax code (as of this writing) — when a homeowner sells a primary residence, they’re eligible to exclude capital gains recognized on the sale for the first $250,000 if they are single and up to $500,000 if they are married.

There are some eligibility requirements, however, called the “ownership” and “use” tests:

- You can only claim this exemption once every two years.

- You need to own the house for at least two years to qualify.

- You must have lived in the residence for at least two of the previous five years.

Thankfully, those two years don’t have to be consecutive, so you have a little flexibility if you decided to rent out your house for a year or fulfill your dream of spending a year in Paris, for example.

So long as you met these conditions, and regardless of whether you were a single or joint filer, you’d be selling your home tax-free in the example above. Why?

The gain of $101,000 falls beneath that exclusion cap.

For illustrative purposes, let’s say the gain had been $255,000 because you lived in an area with skyrocketing appreciation or owned the home for even longer. If you were a single-filer, you’d need to pay capital gains taxes on the excess $5,000.

Why are home sale profits taxed so favorably?

It may sound too good to be true. After all, the government makes no qualms about taxing people’s incomes: According to the IRS’ 2024 tax rate tables, taxpayers have to hand over anywhere from 10% to 37% of their taxable income. So why doesn’t the same rule apply to profits from a home sale, which feels a lot like income in itself?

The exemption is a means of making homeownership seem more desirable. Uncle Sam views homeownership as a wealth-builder and stabilizer for the U.S. economy and therefore incentivizes Americans to own real estate with tax breaks. Think about it — if you sold your home only to hand over half the proceeds to the government, would you even invest in a house in the first place?

What happens to your tax exclusion if you get divorced?

Divorce is not only a lifestyle and relationship change. There are also tax implications for divorced individuals who want to sell their home. Thankfully, there are ways for you to maintain the highest tax deduction ($500,000) when you’re selling your house during a divorce, such as staying officially married throughout the end of the year, buying out the other spouse, and both spouses continuing to co-own. Each of the possible situations has been outlined here.

What if you earn more than the limit?

We asked Robert McGarty, a top Seattle real estate agent, just how often his seller clients end up paying taxes on their home sale. And in his experience (good news!) a vast majority of sellers don’t exceed the exclusion cap.

When they do exceed the cap, it usually happens if the homeowner has been there for a long time, and in most cases they’ve done a lot of improvements to help offset that gain. (Please note that standard home repairs typically do not increase your gain.)

What if you haven’t lived in the home for at least two out of five years?

Even if your profits are less than the maximum exemptable amount, if you haven’t lived in the home as your primary residence for at least two of the past five years, you will be required to pay a capital gains tax on whatever you earn when you sell.

- If you’ve lived in the home for less than a year, you’ll be on the hook for short-term capital gains tax. This is based on your federal income tax rate, depending on whatever bracket you fall into.

- If you’ve lived in the home for more than one year but less than two years, you’ll have to pay long-term capital gains tax. This one isn’t quite as painful: Single filers earning an adjusted gross income (AGI) up to $47,025 and married couples earning up to $94,050 will pay no long-term capital gains tax in 2024. Those earning between $47,026 to $518,900 ($94,051 to $583,750 for married couples), will pay 15%, and those who earn more than those levels will pay the top capital gains tax rate of 20%.

Do you have to report your home sale profits to the IRS?

Wondering about reporting requirements for home sales? In most cases, a homeowner isn’t required to report the profits from the sale of a home on their tax returns. It is required only in the following scenarios:

- The capital gains exceed those thresholds mentioned earlier ($250,000 for single homeowners and $500,000 if married),

- The homeowner has owned the property for less than two years, or

- The homeowner has claimed a tax exemption for another property in the last two years.

If you fall into any of these three categories, you would have to report the sale on a Schedule D Form 1040 or 1040-SR.

According to IRS Publication 523, you’d also need to report any other income from your home sale related to:

- Selling personal property, such as furniture, drapes, lawn equipment, or appliances, as part of the property sale

- Sales of expired options

- Forgiven mortgage debt

For some home sales, the real estate closing agent will submit a Form 1099-S to the seller and to the IRS, although the IRS doesn’t require that form if the capital gains are less than the $250,000 or $500,000 cap.

If you do happen to receive a copy of the form but you meet the criteria for the tax exclusion, it’s still not necessary to report the sale on your income tax return. However, make sure to keep all of your paperwork so you’re prepared if the IRS contacts you about the 1099-S.

There are countless details involved in selling a home, including the tax implications. To avoid any unpleasant surprises, speak with your real estate agent or CPA to find out what, if any, taxes you will have to pay on any profits earned.

*This is a simplified calculation and could vary based on other factors. Please review IRS publication 523 for further details.

Editor’s note: As a friendly reminder, information in this blog post is meant to be used as a helpful guide, not legal or professional tax advice. For assistance on calculating your home sale taxes, please consult a skilled CPA.

Header Image Source: (Rick Lobs / Unsplash)