6 Ways to Get a Real Estate Price Estimate for Your House

- Published on

- 14 min read

-

Lindsey Bergeron, Contributing AuthorCloseLindsey Bergeron Contributing Author

Lindsey Bergeron is a Hartford-based freelance writer and editor who writes about small business, lifestyle and real estate.

-

Richard Haddad, Executive EditorCloseRichard Haddad Executive Editor

Richard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

As a homeowner, you may be wondering if the current value of your home may be more than what you paid for it — and whether you’re in a good position to tap into that growing equity for home repairs, to refinance into a lower mortgage payment or sell your home for a nice profit. Whatever your goal, the first step is to get an accurate real estate house price estimate.

Here are six ways to determine that estimate — as well as the pros and cons of each.

1. Use a reputable online home value estimator

An automated valuation model (AVM) provides an instant value estimate by analyzing real estate transactions and home data on existing properties. Using data collected from property transfers, tax assessments, and other public records, these online platforms compare the value of similar properties to estimate a home’s worth.

It’s important to keep in mind that while online assessments can give you a ballpark estimate (and present it fast), these online tools won’t be able to account for recent home upgrades — such as a newly renovated kitchen, a recently installed pool, or new windows.

Because of this, online assessment tools have their limitations. Companies like Zillow and Redfin have reported that their AVM median error rates are approximately 2% for homes that are on the market. For off-market homes, the error rate is reported to be around 7%.

On-market homes tend to have more up-to-date information so AVMs can produce a more accurate value estimate.

Rachel Massey, a certified residential appraiser in Ann Arbor, Michigan, agrees that online valuators can be reasonably reliable or wildly inaccurate, depending on the type of housing and the location.

“For a condominium unit that is in average condition in an area with many sales, the tool should be quite reliable,” she says. “On the other hand, a lakefront property will probably be very inaccurate, because the tool will pick up houses that don’t have frontage and include them in the algorithms.”

Christie Wilkins, a top real estate agent in Duluth, Georgia, echoed that sentiment. “An online assessment won’t be able to tell if a home has hardwood versus laminate, or whether the basement is finished or has other upgrades.”

In the upscale neighborhoods where many of Wilkins’ listings are located, most of the homes use different builders. That means even if they’re comparable in size, two homes can differ by up to $1 million in value based on what’s on the inside. In that case, the online valuator may not have enough information to come up with an accurate number.

HomeLight’s Home Value Estimator helps create a more accurate estimate by asking homeowners seven questions about their property before providing a real estate house price estimate.

Here are some of the times an online valuator might be a good choice:

- The property is in a subdivision where the houses are all similar in size, age, and features.

- You’re considering remodeling your home and want to gauge its current value prior to making upgrades.

- There have been multiple sales of comparable properties in the area.

- You want to run some baseline calculations of what your house might sell for, so you can then subtract the projected selling fees and current mortgage balance to get an idea of your estimated net proceeds.

- You want to confirm or refute a valuation that was made based on comparable sales (called comps).

2. Do your own comps analysis

If you’re looking for a more reliable home value estimator and are willing to put some work into the process, you can run your own comparative market analysis (CMA), otherwise known as a “comps analysis.”

A comps analysis has historically been completed by real estate agents to determine a property’s market value prior to listing it for sale. With much of the information needed to complete the analysis available online to the public, it is possible for enterprising homeowners to get a fairly accurate estimate by doing the research themselves.

At a high level, the process of coming up with an estimate involves comparing your home with three to five comparable homes in the area. You’ll want to consider factors such as each home’s size, condition, style, and location when assessing the data and coming up with an estimate. Some factors you’ll want to look at include:

- Home description (location, floor plan, number of bedrooms and bathrooms)

- Square footage of the property

- The sales price (both the total and price per square foot)

Benjamin Shrauner, a Kansas City-based real estate investor, advises homeowners to look for similar properties that have sold in the last six to 12 months that are within a mile of their home and are in similar condition. “It’s also important to avoid crossing dividing lines, like highways or vastly different neighborhoods, as those would not be included in a bank appraisal,” he says.

According to Wilkins, she isn’t against her clients running their own comps, as having them do some preliminary research can sometimes make her job easier. If a homeowner has already gotten an idea of what’s going on in the market and how their house fits in, it can help strengthen Wilkins’ case when it comes to making pricing recommendations.

“When a seller has already looked at comps, it can help take some of the emotional aspect out of it, and I may not have to fight them to accept a more realistic price based on the market,” she says.

That said, agents specializing in certain areas may have some inside scoop that the general public may not know about, says Wilkins. And, of course, running sales comps won’t take into account any interior details that can influence a home’s value — that’s where working with a top agent in your area comes in.

3. Partner with a top real estate agent

While technology certainly makes it easier for homeowners to get an estimate of their home’s worth online, if you want the most accurate estimate possible, you’ll need to call in the professionals.

Wilkins says that in some cases, homeowners have contacted her after getting a real estate house price estimate themselves, only to find that their estimate was 20% higher than the fair market value. In this case, she comes up with a well-researched CMA based on market conditions and comp sales in the area. “We work as a team with the seller to make sure we select the right price,” she says.

There are a few key reasons why working with a top real estate agent adds value to the process.

- Access to the multiple listing service (MLS): Agents have access to the local MLS, which provides data points that you can’t find elsewhere — and will help your agent come up with the best real estate house price estimate for your property.

- Local insights and experience: Working with a top real estate agent in your area provides a level of knowledge and area expertise to the process that simply can’t be replicated by technology alone. This knowledge includes local market trends, buyer preferences, and the condition and characteristics of each unique property that impact its value.

- Valuable contact for future plans: Working with an agent on a home estimate can also put you in a good position if or when you’re ready to put your house on the market. Especially if a home sale is in the back of your mind, you might want to contact a few qualified agents for estimates and then compare the CMAs before making up your mind.

HomeLight’s agent finder will connect you with top agents in your area and help you come up with an estimate based on area trends, the market, and your home’s features.

4. Calculate what a cash buyer would offer

Yet another option for gauging your home’s potential value is to find out what a cash investor would pay for it off-market. At HomeLight, you can request an estimated offer from our Simple Sale platform, which is typically around 90% of the home’s market value.

You can contact a local investor to get a cash offer, as well. As a professional investor, Shrauner often purchases homes for cash. After providing an evaluation of the property, he determines what repairs need to be made and then calculates an overall after-repair value (ARV).

He also looks at comparable sales in the area before making a cash offer. “Keep in mind that an investor’s offer will reflect the expected cost of the needed repairs and profit required,” he says.

Finding investors in your area is as easy as a quick online search for “we buy homes in X,” “X” representing the city where your home is located. For example, “We buy homes in Kansas City” or “We buy houses in Seattle.”

The cash offers you receive will likely be lower than what your home will be worth on the market. But while you won’t get the full market value for your home if you sell to a cash buyer, what you’ll benefit from is a quick, no-hassle sale.

When you sell to an investor, you won’t have to stage your home, arrange your schedule around showings, or make any repairs or renovations prior to listing the property. There’s also much less chance of the sale falling through — and you often have much more flexibility in choosing a closing date.

5. Check the FHFA House Price Index Calculator

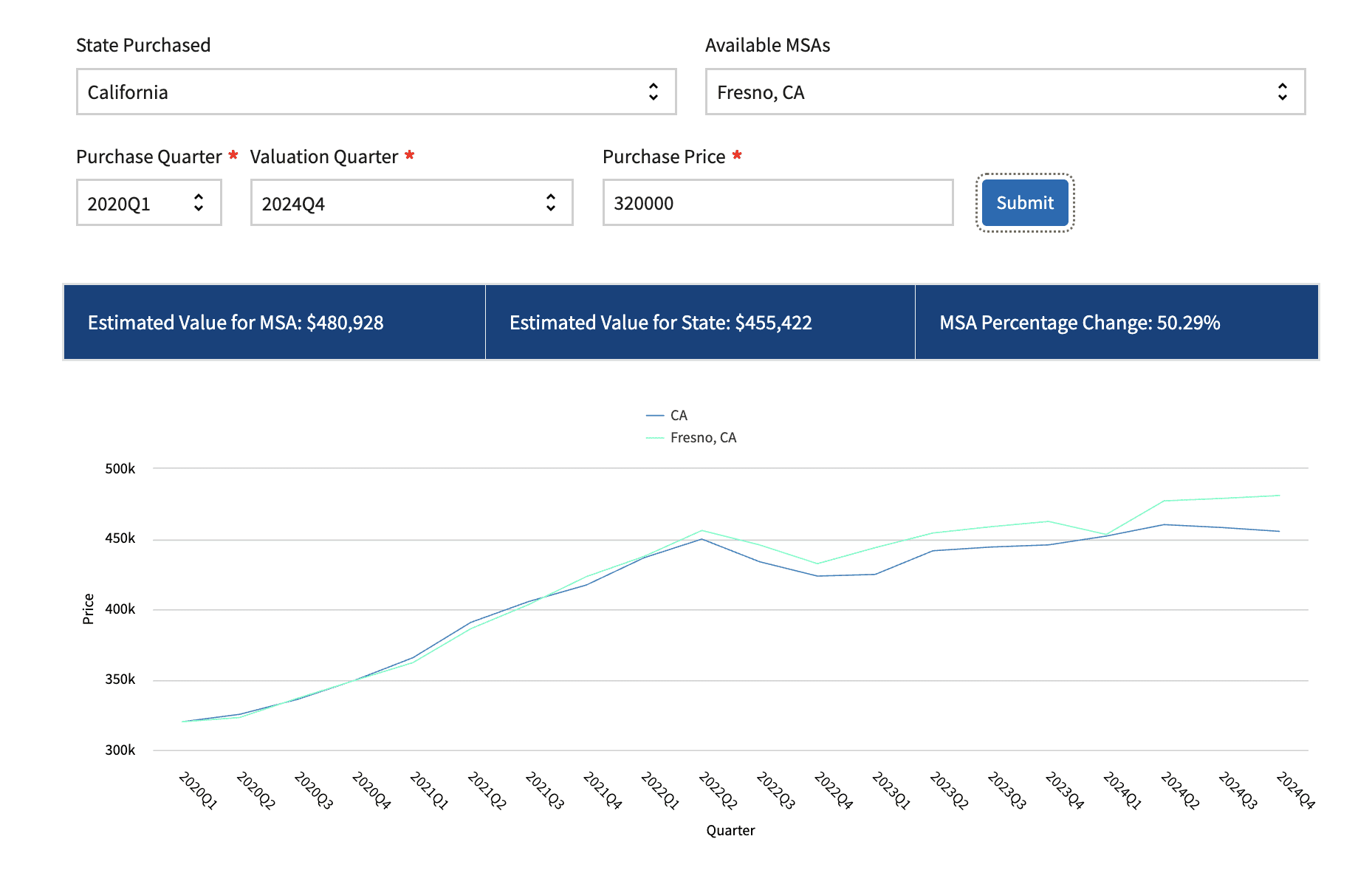

Another online method of researching your home’s value is to use the Federal Housing Finance Agency’s (FHFA) Price Index Calculator. This free tool is publicly available and easy to use by punching in the following data:

- State/region

- Purchase quarter

- Valuation quarter

- Purchase price

For example, a house purchased in the first quarter of 2020 for $320,000 in the region of Fresno, California, would have an estimated value of $480,928 in the fourth quarter of 2024. As you can see in the image below, this is a 50.29% increase in the property’s value since the time it was purchased.

In addition to providing a rough estimate of your home’s value, the calculator and dataset reports can be a helpful resource for a homeowner to reference prior to listing their house for sale. You’ll easily be able to see the rate of appreciation in your area, as well as recent trends in house prices.

Keep in mind that the calculator doesn’t look at individual properties, but overall trends. So while the data is useful, it won’t be as accurate in helping you determine your real estate house price estimate as running comps or getting the assistance of a real estate professional.

6. Order an appraisal

While all of the other home value estimator options we’ve outlined can be completed for free, an appraisal will cost $350-$550 on average, depending on the size and location of your home. It is also the most accurate way to understand your home’s value.

Despite the cost, there are a few key reasons why you might want to move forward with an appraisal for your home:

- Selling via For Sale By Owner (FSBO): You may be considering selling your house without the assistance of a real estate professional. Since you won’t be able to rely on an agent’s experience to help you determine the best listing price for your property, an appraisal can ensure that you aren’t listing the price too far above or below market value.

- Selling a unique home: Perhaps you’re selling a home that has unique features that you don’t think are being reflected in the estimated price. This may also be a good way to decide between agents if they have different ideas about the value of your home.

- Refinancing your home loan: An appraisal can also be wise if you are considering a refinance and want to see how much equity you have in your home. However, keep in mind that a lender will require an appraisal if you apply for a refinance, so you could end up paying for two appraisals if you decide to get one prior to working with a lender. If the equity in your home exceeds 20 percent, and you currently pay private mortgage insurance (PMI), this could also be a good way to drop that monthly expense from your mortgage.

Wilkins agrees that sometimes it’s profitable to order an appraisal for selling house when selling a property that is unique, or when there aren’t many local comps. “We want to make sure we’re not leaving any money on the table, but we don’t want to price too high, either,” she explains.

Having an appraisal already in hand can help boost the seller’s credibility, justify the listing price, and help prevent lowball offers.

For pre-listing appraisals, Massey suggests that the seller seek the opinions of a local professional appraiser and a few real estate agents.

“The agent is going to look at pricing a house for sale related to the current offerings, which may be stratospheric and unrealistic, while the appraiser will look at sales that have closed and are verifiable, as well as pay attention to current activity,” she explains. “The more complex the situation, the more important the appraisal and the higher fee the seller should expect to pay.”

Q&A: Assessing your home’s value

What’s the difference between market value and appraised value?

A home’s market value is determined by what a buyer would be willing to pay for the property. This figure is heavily influenced by the local real estate market: how desirable the area is, how much inventory is available, and the unique features of your home.

A real estate professional will do a comp analysis prior to listing a house for this very reason — by comparing a house to those that have similar features and have recently sold, they’ll be able to come up with a market value for the property.

Meanwhile, the appraised value is a home valuation by a state-licensed appraiser. These professionals will do their own comp analysis using homes in your neighborhood but will combine that with a thorough walkthrough inspection of the property. This allows them to account for major upgrades or home renovations that might be missed during other estimates.

Why is there such a difference between the market value and the assessed value of my home?

Homeowners often wonder why the market value of their home is so much higher than the assessed value. The market value is the amount a buyer would pay for your home, and will fluctuate depending on the current market conditions. Generally speaking, market values have increased considerably over the past few years as demand for housing surpassed inventory levels in many areas.

The assessed value is what town and city assessors use to determine property taxes. Because an assessor is responsible for a large area, the level of detail that goes into a full appraisal isn’t possible. They also may not take into consideration the attractiveness of a particular neighborhood or how desirable a location is for prospective home buyers.

What is the best method of estimating the value of your home?

The answer here is that it depends. If you’re looking for the most accurate valuation of your property (because you’re preparing to list your house for sale, for instance), you can’t beat the accuracy of an appraisal. As we discussed above, there is a price to pay for this accuracy, however.

Otherwise, there are many advantages to having a top real estate agent in your corner as you work through a house estimate — especially if you may need an agent in the near future. Their knowledge of the local real estate market and what buyers are looking for is a huge asset for homeowners.

Bottom line? You have options

Depending on your motivations, homeowners have a number of reliable tools at their disposal to gauge their home’s worth. A simple real estate house price estimate using an AVM tool, along with the FHFA House Price Index Calculator, can be used anytime for a quick, free estimate and to get a clearer picture of whether your home’s value is trending up or down.

If you’ve got clear motivations in mind — as in you’re considering a full kitchen renovation, a mortgage refinance, or a home sale, you might want to take things a step further and run a comp analysis to help inform your decision further.

If questions come up during the process, or you need help with the comp analysis, we highly recommend that you connect with a top real estate agent. When you’re ready, HomeLight can help connect you with a proven professional in your area.

Header Image Source: (WHYFRAME / Shutterstock)