10 Real Estate Negotiation Tactics to Sell Your House from a Position of Power

- Published on

- 8 min read

-

Christine Bartsch Contributing AuthorClose

Christine Bartsch Contributing AuthorClose Christine Bartsch Contributing Author

Christine Bartsch Contributing AuthorFormer art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Desperate to sell your house? Unless you want buyers to sense your weakness from a mile away and take you to the cleaners for it, it’s time to put on your game face and show power, even if it’s all in your head.

According to a snippet from Harvard Law’s Negotiation Briefings newsletter, “being powerful and feeling powerful have essentially the same consequence for negotiations.”

If the thought of playing hardball with your most valuable possession scares you, use these real estate negotiation tactics to help you approach the situation from a position of strength. With these strategies in hand, anyone can learn how to—as they say—“fake it ‘til you make it.”

1. Use time and silence to rattle the other side

One of the most powerful tools a negotiator has is silence.

“After the buyer’s inspection is the stage that we call the Request for Remedy, and it is the number one area where transaction fall apart,” says Brandon Prewitt, a top performing real estate agent in Columbus, Ohio.

“Negotiations go back and forth between the buyer and seller as they renegotiate the price, or request that repairs be completed before closing, or offer credits instead of making those repairs. If an agreement can’t be reached, the sale falls through and the house goes back on the market.”

After the buyer send you their Requests for Remedy, the ball is in your court. In some cases, taking several days before responding could be wise. The longer your buyer waits without word of your reaction to their requests, the more nervous they will get that you’re willing to walk away. As time passes, your buyer may begin to doubt the reasonableness of their requests.

When in doubt, consult your real estate agent on whether this aggressive approach could be beneficial. They’ll know what buyers respond to in your market, whether it’s friendly communication or the mystery of remaining aloof.

2. Counter aggressive asks with small, slow concessions

Has your buyer brought you a lengthy laundry list of things they want done? They may be employing the negotiation tactic of asking for more than you expect to get.

In actuality they expect you to say “no” to a lot of the items, in the hopes of using your guilt to their advantage. By forcing you to say “no” to a whole lot, they’re anticipating you’ll say “yes” to a few extras that you would’ve rejected had they simply asked for what they really wanted.

So how do you counter this crafty tactic? By responding to the list a little at a time, sprinkling in a few “yes’s” amongst all the “no’s” so it’s less obvious how little you’re conceding as a whole.

And since you’ve taken the time to know your buyer and their lender, you’ll be able to make sure those “yes’s” are mainly to must-do items, rather than the unrealistic requests.

“I always tell sellers that it’s unrealistic for buyers to expect you to make cosmetic improvements, like replacing the flooring, but if it’s a health and safety issue, those are things that we should consider fixing,” advises Prewitt.

Making small, slow concessions does two things: 1) it shows your willingness to work with your buyer, and 2) it prevents you from conceding too much.

Going slow also gives you time to consider your options. For example, nothing is off the table in negotiations—even if some items have already been agreed to.

For example, maybe you’ve agreed to make a few repairs, or pay for a home warranty as part of the deal—but in the eleventh hour, your buyer suddenly requests that you also cover closing costs, too. In that scenario, everything becomes negotiable again.

“If a buyer asks the seller to cover closing costs at the last moment, then we’d look back over the contract,” says Prewitt. “Things we offered to do, like repairs, or credits, or paying for a home warranty—those things are the first to come off the table if we’re now going to cover the closing costs.”

3. Offer alternatives instead of giving “yes” or “no” answers to requests

When your buyer presents you with their Request for Remedy list, your natural response will be to say: “I will do this, but I won’t do that.”

But nothing halts negotiations faster than a flat-out no. Responding in the negative ends the conversation, eliminates options, and comes across as confrontational.

Instead of saying “no,” savvy sellers offer alternatives that keep the conversation going, and signal that you’re willing to work towards a viable resolution. One way to do that, is to offer credits in lieu of making repairs.

“When the buyer comes back with a list of repairs, I prefer to try to negotiate a credit versus having my seller get the repair done themselves—because we want the buyer to know that the work will be done to their satisfaction with contractors that they trust,” says Prewitt.

“We don’t want to get into a situation where the buyer isn’t satisfied with the work my seller had done. That sets us up for a stalemate right at the end of the process when emotions are running high. So, if there’s a situation where I can offer a credit versus do the repairs, I’m offering the credit.”

But how do you get a buyer who wants a move-in-ready house to accept credits for repairs instead? This is where knowing your buyer comes in handy again.

If you’ve taken the time to learn what your buyer loves about your home and neighborhood, you can use that knowledge to trigger a “that’s right” response.

By expressing your understanding of their wants and needs in regards to your house, you remind them of all they’re gaining by buying your home.

And as they are agreeing with you on how well your home meets their needs, they’re more apt to agree to customize it even further to their liking via the credits.

4. Know your BATNA (best alternative to a negotiated agreement)

There’s a lot of uncertainty while the terms of your real estate contract remain up in the air. Uncertainty leads to nervousness—which leads to bad judgement.

And if you’re looking at the possibility of the buyer backing out as the “worst case scenario,” you’ll always be nervous, uncertain, and in the weaker bargaining position.

If you want to avoid these fear-driven bad judgement calls, you simply need to make your peace with your alternatives if the deal does fall through.

Professional negotiators refer to this as the “Best Alternative to a Negotiated Agreement” or BATNA. In other words, what is your best option if the deal falls through?

The first step to determining your BATNA is to list all possible options. Look at things like your days on market, your monthly housing expenses, and current market conditions to come up with all the possible outcomes if you do need to relist your home.

“If we received an offer within 24 hours and have several other buyers lined up, we can let this buyer walk and accept an offer from those buyers waiting in the wings,” says Prewitt. “But if we were on the market 120 days and had 30 showings prior to receiving this offer, then you’ll need to do what it takes to keep it.”

Once you’ve identified all your options, rank them. As you put them in order from best to worst, you’re looking for two things.

The first, best option is your BATNA—it’s the first plan you’ll put into action if the deal goes south.

The second thing you need to identify is your reservation point. This is the point at which the alternative, or BATNA, is going to be better for you than sticking with the current deal.

Knowing your BATNA and your reservation point gives you a solid bargaining range, so that you never have to worry that the pressure of negotiations will lead you to accept a bad deal simply to salvage the sale.

5. Frame your counter as a win-win for both parties

Buying or selling a house is the most expensive financial transaction the majority of people will make in their lifetimes—so it makes sense that both parties want to come out the winner. The buyer wants to get the best bargain on the house, and the seller wants to make as much profit from the sale as possible.

That’s why Prewitt says, “Negotiating a win for both parties is easier said than done.”

With both parties vying for the best financial outcome for themselves, it’s easy to let a matter of a few thousand dollars sabotage the whole sale.

Finding the win-win requires drawing on your research into both your BATNA and your buyer’s desires.

For example, maybe you’ve negotiated to pay closing costs if the buyer agrees to purchase the property as-is, without any additional repairs. But now your buyer is getting cold feet, worried that the age of the water heater and H-VAC system means they’ll soon be shelling out thousands to replace them.

If your BATNA shows that letting this buyer walk will cost you several thousand dollars in housing expenses while you wait on another offer, it’s worth spending an extra $300 to $600 on a home warranty to put your buyer’s mind at ease.

It’s also important to remember that a win-win doesn’t always have to be financial for the buyer.

Let’s say you’ve learned that one reason your buyer loves your home is the custom Koi pond in your backyard. A gentle reminder that most homes won’t have that beloved feature may be enough incentive to accept a deal that slightly favors you financially.

If that alone isn’t enough, let them know how much that Koi pond is really worth. While the appraisal may not have accounted for its added value, it does have a perceived value to the buyer.

You can point this out to your buyer by sharing that having a Koi pond installed in another home without one will cost them an average of $1,193 to $4,838.

6. Study your opponent

Knowing your BATNA is all about knowing yourself, but if you follow the wisdom of famed military leader and strategist Sun Tzu in The Art of War, removing fear from the negotiation battle requires knowing your opponent, too.

In fact, the Program on Negotiation taught at Harvard Law School teaches perspective taking as one of four ways to find power in negotiation. Fail to consider your opponent’s position, and you’ll overplay your hand.

While some requests are frivolous cosmetic fixes that your buyer wants, chances are that the biggest repair requests are deal breakers they need done—not because the buyer is insisting on those major repairs, but because their lender is.

Some loan types, like FHA, VA and USDA home loans have appraisal repair requirements that must be completed before they’ll approve the loan. These repair requests are typically related to health, safety, and the structural soundness of the property.

Keep in mind that killing the deal because your buyer’s inspector or appraiser found major plumbing problems, or roof issues won’t get you out of making those repairs.

“When negotiating, I instruct my sellers to consider whether or not the repair requests cover things that we’ll have to disclose moving forward,” advises Prewitt. “If they do, then the next buyer will either want them fixed, or they’ll ask for a repair credit.”

If you know your buyer—and the repair requirements of their specific loan type—you’ll be able to identify which requests are deal-killing non-negotiables.

7. Make sure your buyer has skin in the game

Do you know why mortgage companies require their borrowers to put a down payment on the home they’re buying? It’s so that your buyer has something to lose if they were to default on the loan.

Savvy home sellers also use money as a motivator to keep their buyers at the negotiating table, by requiring buyers to put down 1-3% of the purchase price in earnest money as part of the initial purchase contract.

The seller doesn’t automatically get to keep the cash if the deal falls through. There are situations where the buyer can get their earnest money back—such as, if the house appraises for less than the sales price or if major flaws are found during the home inspection.

However, if the buyer violates the sales contract by backing out without a legit reason, this earnest money is forfeited to the seller as compensation. With money on the line, your buyer is less likely to back out simply because of cold feet.

8. Keep your emotions in check

You’ve probably invested a lot of time, effort and even money in prepping your home before listing it, so it can feel pretty insulting when your buyer comes to you with a long list of things you “missed.”

Worse yet, maybe they dislike the results of fixes you already spent money to make. For example, let’s say you spent a couple grand putting in new lighting, faucets and cabinet pulls with an oil-rubbed bronze finish—but your buyer wants you to replace it all with brushed nickel fixtures.

If you let these requests trigger an emotional response rather than a logic-based response, you’ll be letting your emotions sabotage your negotiations.

“I remind my sellers to not get emotional about the buyer’s requests for repairs. It’s not personal,” advises Prewitt. “We need to do our best to take the emotion out of the equation and look at the requests objectively.”

Of course, emotions don’t always have to be a negative thing in negotiations. Skilled negotiators learn to identify and redirect their own emotions, while simultaneously eliciting positive emotions from the other party.

9. Be willing to call your buyer’s bluff by walking away

Unfortunately, there are some buyers out there who are die-hard bargain hunters. Buyers obsessed with getting the best deal push and push with concessions and requests until they’re certain they’ve squeezed every possible penny out of you.

When this type of buyer learns that you’re desperate to sell because you’ve already made an offer on another house, they’ll bargain you right up against your BATNA—all the while bluffing that they’re willing to walk away from the sale.

It’s situations like these that make knowing your BATNA absolutely vital. Instead of succumbing to the pressure, you’ll know that it’s in your best interest to walk away from the deal instead.

Once you do, one of two things will happen. Your buyer will realize they’ve pushed things too far and back off of their most unreasonable demands, or they’ll let the deal fall through.

If that happens, don’t panic. You’ve already got your best alternative plan in place.

10. Still stressed about negotiation stalemates? Get expert help

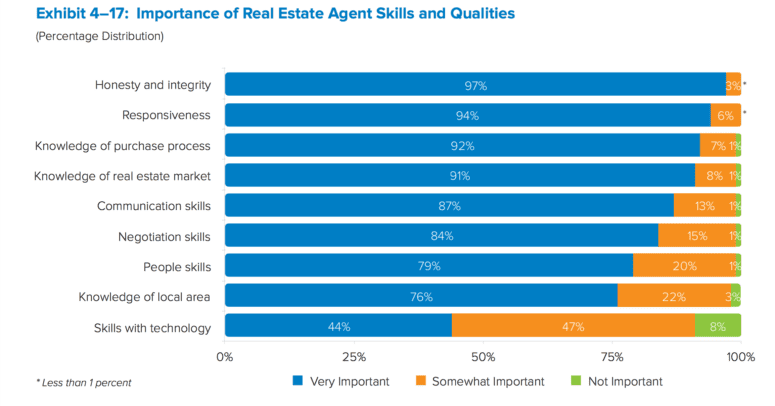

Don’t go it alone at the negotiation table. The continuing need for negotiation skills is why hiring a top real estate agent should be priority. According to the National Association of Realtors (NAR) in their 2018 Profile of Home Buyers and Sellers, 84% of respondents ranked an agent’s negotiating skills as very important.

“When it comes to making decisions during negotiations, you really have to rely upon your agent’s advice,” says Prewitt.

“Your agent knows best how to weigh all of your options and the factors that impact your decision, like accepting a slightly lower offer, versus paying your mortgage and housing expenses for several months while you wait for another offer.”

Unfortunately, not all agents have the same negotiating experience. Statistics in that same NAR report showed that only 46% of all buyers believe their agent helped negotiate better contract terms, and only 36% felt their agent helped negotiate a better price.

Before you settle on an agent, ask them how they help their seller clients negotiate on price, seller concessions, and repair requests and check to see how many transactions they’ve handled in the past.

Stats like an agent’s sale-to-list price ratio is also a good indication of whether they’re consistently achieving the highest price points possible. If you need any assistance connecting with a top performing agent in your area, start with HomeLight’s agent matching service so you can head to the bargaining table with confidence.

Header Image Source: (areebarbar/ Shutterstock)