Sell Your House for Cash: For Some, the Convenience Can’t Be Beat

- Published on

- 14 min read

-

Taryn Tacher, Senior EditorCloseTaryn Tacher Senior Editor

Taryn Tacher is the senior editorial operations manager and senior editor for HomeLight's Resource Centers. With eight years of editorial and operations experience, she previously managed editorial operations at Contently and content partnerships at Conde Nast. Taryn holds a bachelor's from the University of Florida College of Journalism, and she's written for GQ, Teen Vogue, Glamour, Allure, and Variety.

-

Sam Dadofalza, Associate EditorCloseSam Dadofalza Associate Editor

Sam Dadofalza is an associate editor at HomeLight, where she crafts insightful stories to guide homebuyers and sellers through the intricacies of real estate transactions. She has previously contributed to digital marketing firms and online business publications, honing her skills in creating engaging and informative content.

It wasn’t long ago that the decision to sell your house for cash was associated with a neglected or foreclosed property whose value had plummeted, as an investor swooped in to snatch it up for a bargain.

While that still happens in scenarios where a seller can’t afford repairs or is facing serious issues with a property, cash sales have expanded beyond the distressed homes market as sellers benefit from new technologies, instant sale platforms, and a competitive housing environment that has increased the percentage of cash offers.

Let’s take a look at what it means to sell your house for cash in today’s market.

Cash’s continued clout

With the competitiveness of the market, cash has persisted. Buyers who can make all-cash offers are doing so to avoid higher mortgage rates, and that’s good news for sellers. Cash deals typically move faster and come with fewer obstacles, like financing approvals or last-minute appraisal issues. They also reduce the chances of a deal falling through, giving you more peace of mind.

Plus, in some instances, cash buyers are often willing to purchase homes as-is, saving you time and money on repairs. That’s why cash still carries serious weight in today’s market.

In June 2025, all-cash purchases accounted for 29% of all home purchases, according to the National Association of Realtors (NAR), roughly 1 in 3 homes.

“For buyers who have the means, paying in cash is a way to get a leg up against other offers, because sellers will almost always prefer a cash offer to an equivalent financed offer and will sometimes even prefer it to a higher financed offer,” says Eric Hughes, founder and CEO of Rental Income Advisors, which educates aspiring investors on acquiring and managing profitable rental properties.

Who’s paying cash for houses?

Cash buyers generally fall into a few camps: high-tech iBuyers, rental investors, house flippers, and individuals who pay cash on the open market. Here are some of the most common sources of cash offers in 2025:

iBuyers

Instant buyers, or iBuyers, are the newest players in the cash sale game, popping up around the mid-2010s.

What’s an iBuyer?

An iBuyer is a company that purchases properties primarily online, often sight unseen, using algorithmic technology to determine what they’re willing to pay for homes.

Unlike house flippers, iBuyers tend to target homes in fair to good condition, and they purchase a higher volume of homes than flippers, who do a few properties per year.

iBuyers offer a mostly online home-selling experience that puts seller convenience at the center in exchange for a service fee that’s typically around 5% to 6% of the property’s sale price.

Who are the top iBuyers in 2025?

Some of the most popular and reputable iBuyers include Opendoor and Offerpad. Opendoor bought 3,609 homes in the first quarter of 2025, up 4% from the first quarter of 2024 and 22% from the fourth quarter of 2024. Meanwhile, Offerpad acquired 454 homes in Q1 2025, an 18% increase from Q4 2024.

Another popular iBuyer is HomeLight’s Simple Sale. Simple Sale connects sellers with a network of pre-approved cash buyers. It’s designed to provide a fast, no-obligation offer—often within 24 hours—without the need for repairs, showings, or agent commissions.

Another well-known iBuyer is HomeLight’s Simple Sale platform, which matches sellers with a network of pre-approved cash buyers. Designed for speed and convenience, Simple Sale offers a streamlined process that lets sellers receive instant cash and bypass repairs, showings, and agent fees, making it an efficient option for those seeking a hassle-free sale.

How do iBuyers work?

When working with an iBuyer, sellers generally fill out some information online and receive a cash offer for their home within a week, and sometimes as quickly as 24 hours.

If the seller accepts, the iBuyer may perform an in-person or virtual home condition assessment and determine if they’ll collect a repair credit or reduce their offer price based on the findings.

iBuyers then allow the seller to close in as little as 7 to 10 days, but can also provide longer move-out timelines for those who need the flexibility.

Why sell to an iBuyer?

People who need to sell fast, hate the idea of showing their home, or don’t want to deal with home prep may be inclined to pursue an iBuyer offer. For sellers facing a tight timeline, job relocation, or financial pressure, the simplicity and speed of an iBuyer can be especially appealing.

Buy-and-hold investors

In real estate, a buy-and-hold investor is someone who buys a house and plans to keep it for a while — typically to collect rental income. They can be a real estate beginner who’d like to try their hand at becoming a landlord or a large Wall Street-backed institution such as Invitation Homes.

These types of buyers usually have more capital than the typical buyer due to their real estate portfolio, enabling them to pay for properties with all cash.

“Many of those buy-and-hold investors will still finance the properties later, using a cash-out refinance to pull money out to fund further investments — but paying cash upfront gives them a meaningful advantage in the current competitive market,” Hughes says.

Generally, buy-and-hold investors will look for certain location cues that would make a property easy to rent and result in strong cash flow. A home located near a university, for example, could become an in-demand student rental. Properties located in great school districts or provides easy access to businesses, amenities, public parks, grocery stores, restaurants, public transportation, and shopping centers may also be in the buying parameters of the buy-and-hold investor.

House flippers

House flippers typically buy homes as-is for cash at a sharply discounted rate, with the intent to make improvements and repairs and then resell at a profit. One of the most well-known house-flipping companies is the We Buy Ugly Houses® franchise.

Flippers generally have the loosest standards for the types of projects they’re willing to take on, whether a house looks like it’s straight out of the 1970s or has expensive issues to remedy like code violations, making them good candidates for owners of difficult properties looking to sell their house for cash. Flippers often embrace a home or situation that other buyers find unattractive.

A flipper’s cash offer is usually going to be dramatically lower than market value to account for rehabbing expenses. Flippers often follow the 70% rule, which means they will offer no more than 70% of what they anticipate a home will be worth after it’s fixed up.

This model allows a house flipper to buy homes as-is, reducing the burden on the seller to make pricey fixes that a traditional buyer would usually require.

Individuals with cash on hand

While rental investors, iBuyers, and house flippers do account for a decent portion of cash sales, they aren’t the entire story. Robert Taylor, a seasoned property investor in Sacramento, California, notes that a large portion of cash buyers in his market are not investors.

This could stem from an increasing number of retail buyers choosing to make cash offers as a means of winning bidding wars.

Below are some of the types of non-institutional buyers who may have the cash on hand to transact without a financing contingency:

The creative buyer

Creative buyers who would traditionally use a mortgage are finding ways to pay cash however they can. Options include leveraging their own retirement or securities funds, taking out a home equity loan or home equity line of credit (HELOC), or even receiving short-term loans from family members in order to buy a house with cash.

The extreme saver

Although these types of buyers are rare, Travis Steinemann, a property investor and rehabber in the Baton Rouge area, does sometimes see people who live frugally, have never had a credit card, and pay for everything in cash.

“These people may offer close to full list price since they aren’t trying to make a profit on the property,” he says.

Buyers who reinvested their equity

An increasing number of people will sell their homes, make a significant amount of profit, and then put that money toward the purchase of their next home.

“Think of all the people downsizing from $500,000 houses in the suburbs and buying $300,000 townhouses — they’re cash buyers,” says Kyle McCorkel, a Pennsylvania real estate investor with Safe Home Offer.

These might also include retirees who have little to no debt and excess savings.

Out-of-state buyers

Steinemann notes that some investors in expensive markets that don’t produce enough rental income will opt to go to other states, usually in the Midwest and the South, to invest in buy-and-hold properties.

“People in San Francisco and New York City are good examples of this type of cash buyer,” he says. “They usually have higher incomes and want to invest in real estate, but can’t do so in their markets.”

Can I get a cash offer if I’m working with an agent?

If you like the convenience of a cash offer but would prefer to work with a real estate agent, that is also an option. Some real estate agents routinely connect with iBuyers and other types of investors to help their sellers field cash offers.

If you’d like to get in touch with an agent today who’s connected to local cash buyers, HomeLight makes it easy and fast to find a top real estate agent near you with your preferred qualifications.

Reasons to sell your house for cash

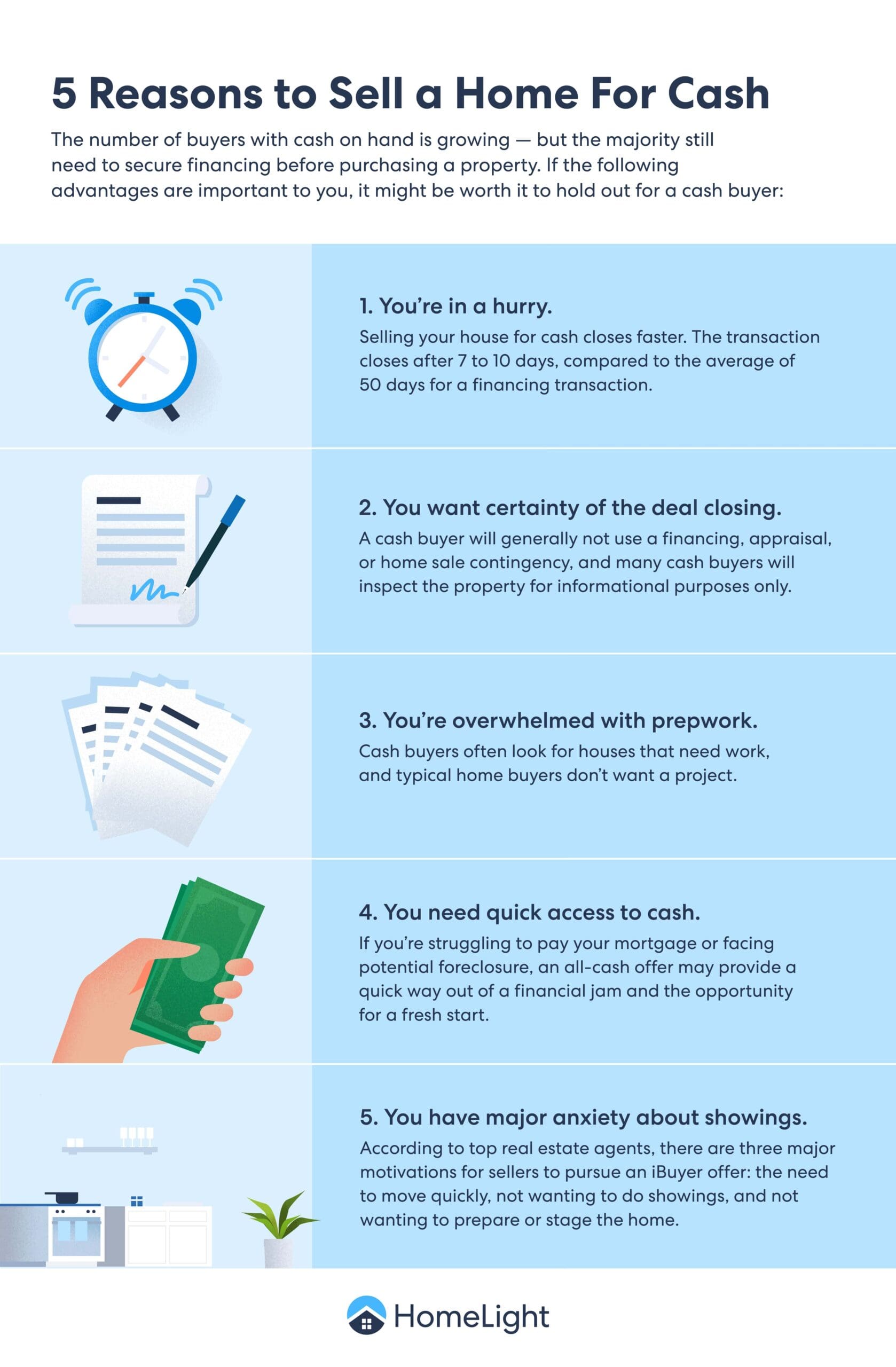

The number of buyers with cash on hand has grown in recent years, but the majority of buyers still need to secure financing before purchasing a property. However, if the following advantages are important to you, it might be worth it to sell your house for cash.

You’re in a hurry

One of the most commonly cited advantages of selling for cash is that the transaction usually closes faster — as quickly as seven to 10 days, compared to the average 42 days for a transaction involving financing. This can be a huge benefit for a seller who is facing foreclosure or needs the funds to close quickly on their next house.

In addition to the time it takes to underwrite and process a mortgage loan, one of the biggest time savings with a cash sale is the elimination of the appraisal step, according to Owen Dashner, a partner at Red Ladder Property Solutions.

Lenders almost always require an appraisal to fund a property purchase, and this step has become more time-consuming since the pandemic due to a backlog of appraisal requests.

“This means an appraisal could take 30 to 60 days or more, depending on the type and location of the property,” Dashner says. “This is obviously not ideal if you are looking to close on a sale quickly or on a specific timeline.”

You want certainty of the deal closing

When a buyer adds contingencies to a real estate contract, the risk of a delayed or canceled settlement increases. A cash buyer will generally not use a financing, appraisal, or home sale contingency, and many cash buyers will inspect the property for informational purposes only.

Taylor summarizes the “what ifs” with a financed transaction:

“The appraisal could come in under contract, making it likely that the seller would need to reduce their price,” he explains. “Your inspection could reveal a big repair that you did not anticipate, forcing a renegotiation. Or the house that the buyer needed to sell first hasn’t sold yet, causing a delay.”

Cash buyers, on the other hand, typically do their own inspections and don’t have to worry about contingencies, so they’re often ready to close as soon as the title is clear.

You’re overwhelmed with prep work

When selling on the open market, sellers typically must complete a flurry of tasks to get their house ready for showings: clean, declutter, paint, repair this or that.

“Cash buyers often look for houses that need work, and typical home buyers don’t want a project,” notes Steinemann. “If your house needs updating or a lot of repairs, a cash buyer will be your best friend.”

You need quick access to cash

If you’re struggling to pay your mortgage or facing potential foreclosure, an all-cash offer may provide a quick way out of a financial jam and the opportunity for a fresh start.

“Often, the [foreclosure] process has already started, and the homeowner only has a few weeks to a month before they lose their house to the bank and their credit score is destroyed,” says Steinemann. “They need an out immediately.”

Dashner adds that cash buyers are much less likely to include requests for seller assistance with closing costs compared to offers with certain types of financing, which can also help improve the seller’s cash position.

Some cash buyers may go so far as to help cover a seller’s closing costs, knowing that a seller facing financial hardship doesn’t always have the funds to do so.

You have major anxiety about showings

You’re not alone in dreading the lack of privacy and added stress of showings. For many, the hassle of last-minute cleaning and the discomfort of having strangers walk through their home make the idea of skipping showings and accepting a cash offer from an online platform all the more appealing.

Should you ever avoid selling your house for cash?

If you want to get the absolute maximum amount of money for your home, it likely makes sense to widen your pool of prospects to include non-cash buyers. Here are a few reasons why sellers would want to consider working with buyers who will use financing for their purchase.

You’ll likely see higher offers

On average, buyers using a mortgage tend to pay more than those who purchase with all cash.

“Even in a retail bidding war scenario, a financed offer will typically be higher than a cash offer to compensate for the chance that it might fall through due to lender contingencies or appraisal contingencies,” explains Andy Kolodgie, real estate investor and owner of Cash Home Buyers Georgia.

“Offers that use financing are almost always higher, which is why a cash offer doesn’t make sense for homeowners who don’t want to leave any money on the table.”

However, be sure to factor the costs of home prep and real estate agent commissions into the equation. If you have to invest a lot of money in the home and then pay agent fees of 5% to 6%, you may end up with a similar amount of money from a cash buyer as you would with a traditional listing process. HomeLight’s net proceeds calculator can be a useful tool in helping you make the right decision for you.

Your home is in impeccable condition

If your home is in great shape with little risk of potential inspection repair requests, you may not want to miss out on the chance to list on the open market and see what happens. You might start a bidding war and receive an offer that’s more than you were looking for.

You’re able to find workarounds with your agent

A real estate agent can help you negotiate contract terms that make sense for your situation, such as arranging for you to stay in a home past closing in a low-inventory market and finding solutions where they are available.

“Seventy percent of the sales I do have a long rent-back. The sale closes, and a seller has up to 60 days, which is what conventional lenders are allowing people to do,” says Jordan Matin, a top real estate agent in Portland, Oregon.

“So once a seller has an offer on their place, they can write an offer on a new house. If it takes one month or two months to find the right property, they have time.”

The magnetic draw of cash

People today can order food to their doorstep and have virtually any product under the sun delivered to their house in 48 hours. It stands to reason that a trend toward more convenience in real estate would follow suit.

When weighing the possibility of a cash offer, consider what your top priorities are and run some back-of-the-napkin math on your net proceeds. If you’d ultimately prefer to skip showings, staging, and home prep and recognize the possibility of selling at a lower value, consider requesting a cash offer from HomeLight’s Simple Sale platform, which provides cash offers for homes nationwide in almost any condition.

Header Image Source: (Roger Starnes Sr / Unsplash)