What Is Foreclosure? Can You Still Sell the House?

- Published on

- 8 min read

-

Richard Haddad Executive EditorClose

Richard Haddad Executive EditorClose Richard Haddad Executive Editor

Richard Haddad Executive EditorRichard Haddad is the executive editor of HomeLight.com. He works with an experienced content team that oversees the company’s blog featuring in-depth articles about the home buying and selling process, homeownership news, home care and design tips, and related real estate trends. Previously, he served as an editor and content producer for World Company, Gannett, and Western News & Info, where he also served as news director and director of internet operations.

The very word “foreclosure” can evoke a sense of trepidation. As a homeowner, you may have been taking steps to avoid this outcome and a last-resort decision. But it’s come time to ask, “What is foreclosure? What happens next? Can you still sell the house?”

Whether you work with an experienced real estate agent or explore cash buyer options, acting quickly can help you regain some control of the situation. In this guide, we’ll walk through what foreclosure is, how it works, and the options available to homeowners looking to sell before losing their home to the bank.

What is foreclosure?

Foreclosure is the legal process that allows a mortgage lender to take possession of a property after the homeowner fails to make mortgage payments for an extended period. Foreclosure proceedings typically begin 3 to 6 months after the first missed payment, which is known as defaulting on the loan. In most cases, the lender will try to sell the home to recover the outstanding loan balance.

While foreclosure laws vary by state, most lenders must follow a structured process that includes notifying the homeowner, providing opportunities to catch up on payments, and eventually repossessing the property if the debt remains unpaid.

If you’re facing foreclosure, it’s important to understand that this process doesn’t happen overnight. You may have options to avoid losing your home, including negotiating with your lender, selling the home, or exploring alternatives like a short sale or a deed in lieu of foreclosure. Before moving forward with a sale, it’s best to consult an attorney.

Are there different types of foreclosure?

Foreclosure isn’t a one-size-fits-all process. The rules and procedures vary by state, but foreclosures generally fall into three categories and — depending on the type you’re facing — can impact how the lender handles the loan default, eviction, and repossession. They are:

- Judicial foreclosure: This type requires a court process. The lender must file a lawsuit against the homeowner, and the case goes through the legal system before the home can be sold at auction. Judicial foreclosure is required in many states and provides homeowners with more opportunities to challenge the foreclosure. Even if not required, all states allow this type of foreclosure.

- Power of Sale (nonjudicial) foreclosure: Some states allow lenders to foreclose without going to court. Instead, the lender follows a process outlined in the mortgage contract, which typically includes issuing a notice of default and notice of sale before the home can be auctioned. Because there’s no court involvement, Power of Sale foreclosures tend to move faster, giving homeowners less time to stop the process. There are around 30 states that allow this type of foreclosure, and the mandatory waiting periods can vary.

- Strict foreclosure: Only two states, Connecticut and Vermont, allow strict foreclosure. There’s a reason this is a rare proceeding because it allows the lender to take ownership of the property outright without an auction if the borrower doesn’t pay within a court-appointed time frame. The title to the home transfers directly to the lender. This type of foreclosure typically happens when the amount of outstanding mortgage debt exceeds the value of the house.

The most common type is judicial foreclosure, particularly in states that require court approval before a lender can repossess and sell the home. However, in states like Alabama, Arizona, California, Colorado, and Texas where it’s allowed, Power of Sale (nonjudicial) foreclosures are more common. This is because they move faster and involve fewer legal hurdles.

How does foreclosure work?

In most cases, a foreclosure proceeding isn’t a sudden surprise. It’s a multi-step process that begins when a homeowner falls behind on mortgage payments. Throughout the process, you may still have options to stop the foreclosure, whether by catching up on payments, negotiating a short sale, or selling quickly to a cash buyer.

Here’s a general timeline of what to expect:

1. Missed payments: Once you miss a payment, your lender may charge late fees and send a notice reminding you to pay.

2. Notice of default: After 90 days of missed payments, the lender typically sends a formal notice of default, warning that foreclosure is approaching.

3. Pre-foreclosure period: This is the window where you may have options to catch up on payments, negotiate with your lender, or sell the home to avoid foreclosure.

4. Foreclosure filing: In judicial foreclosure states, the lender files a lawsuit. In nonjudicial foreclosure states, the lender posts a notice of trustee sale.

Auction or repossession: If the foreclosure proceeds, the home is either auctioned off to the highest bidder or taken back by the lender.

Can you sell a house in foreclosure?

Yes, you can still sell your home while it’s in foreclosure — as long as you do so before the foreclosure sale takes place. Selling before the auction can help you avoid the long-term consequences of foreclosure, such as credit damage and legal complications.

Here are your main selling options:

- Traditional sale: Listing with a real estate agent experienced in foreclosure sales can help you get the best possible price. However, this option may take longer, and time is limited.

- Short sale: If your home is worth less than the remaining mortgage balance, your lender might approve a short sale, allowing you to sell for less than you owe. This requires lender approval and can be a complex process.

- Cash buyer sale: If you need to sell fast, a vetted cash buyer can close quickly — sometimes in as little as a week — helping you avoid foreclosure and move on to your next life chapter without lengthy delays.

Which option is best for you? If you’re unsure about the best path forward, consulting with a foreclosure-experienced agent can help you explore all available options. There are also innovative platforms that allow you to get an agent’s expert opinion and an all-cash offer so you can compare your choices. (More on this after the next section.)

What happens after foreclosure?

Once the home has been sold at auction, you typically lose the right to sell it yourself. However, some states offer a redemption period, giving you a limited time to buy back the home.

If your state does not have Right of Redemption laws, and the foreclosure process is completed, what happens next depends on whether your home was sold at auction or taken back by the lender.

- If the home is sold at auction: The highest bidder at the auction becomes the new owner, and you’ll need to vacate the property. Depending on state laws, you may receive an eviction notice or have time to leave voluntarily.

- If the lender takes ownership: If the home doesn’t sell at auction, the lender takes possession, and it becomes a real estate-owned (REO) property. Lenders typically sell REO properties through agents or auction sites.

- Potential deficiency judgment: If the foreclosure sale price doesn’t cover your remaining mortgage balance, your lender may pursue a deficiency judgment, requiring you to pay the difference. Some states have laws that limit or prohibit deficiency judgments, particularly for primary residences or certain loan types.

How can you sell a house fast to avoid foreclosure?

If time is running out, selling quickly may be your best option to avoid foreclosure. While some top real estate agents can sell a house fast for higher proceeds, and a short sale may also be an option, the fastest way to sell is through an all-cash offer from an investor or a house-buying company.

The proceeds will be less than an agent-assisted sale, but a cash-offer deal may be the solution you need — allowing you to close in as few as 7-10 days. Below are examples of companies that provide cash offers for homes. Some operate nationwide, while others focus on specific regions.

- Simple Sale by HomeLight

- We Buy Houses

- We Buy Ugly Houses

- Clever Offers

- HomeGo

- Sundae

- Homeward

- Mark Spain Real Estate

- OfferPad

- Opendoor

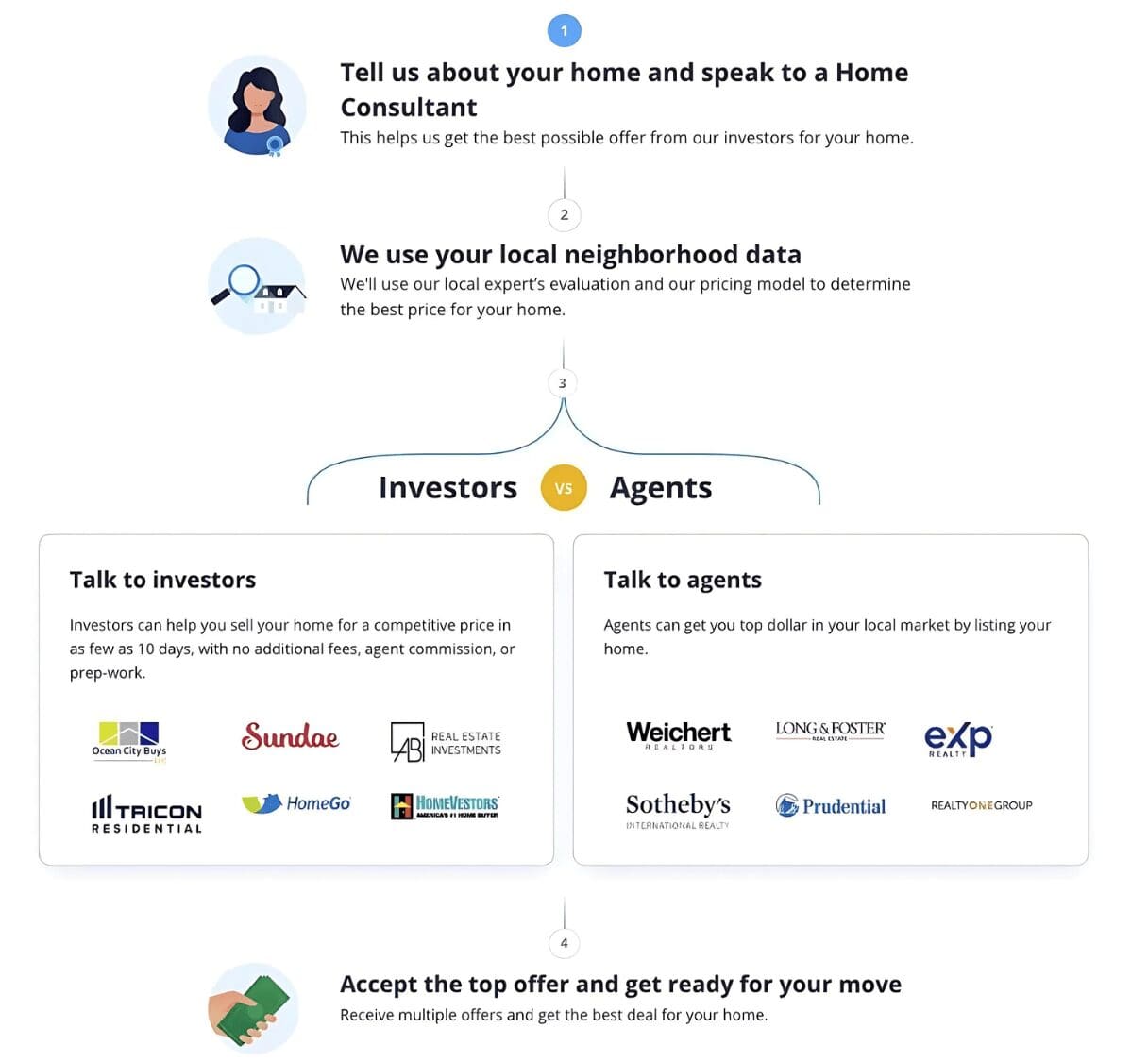

How does HomeLight Simple Sale work?

HomeLight’s Simple Sale platform connects you with the largest network of trusted cash buyers in the country. With Simple Sale, you can receive a no-obligation cash offer in 24 hours and can close in days rather than months.

Here is the 4-step Simple Sale process:

HomeLight’s Simple Sale can provide cash offers for homes in almost any condition nationwide. To get started, fill out this short questionnaire.

Moving forward from foreclosure

Foreclosure can be a stressful experience filled with apprehension, but it doesn’t have to define your financial or homeownership future. If you act early, you may still have options to sell your home, pay off your mortgage, and move forward with a fresh start.

If you’re looking for the fastest way to sell and avoid foreclosure, consider a cash offer through Simple Sale. Or, if you’d rather list with a foreclosure-experienced agent, HomeLight’s Agent Match can connect you with the right professional to guide you through the process.

Time is key in foreclosure situations, so exploring your options today can help you avoid long-term financial consequences and move on with confidence.

Header Image Source: (Roger Starnes Sr/ Unsplash)

- "What is a deficiency judgment?", Bankrate (March 2025)

- "Real Estate Owned (REO) Properties: A Complete Guide", QuickenLoans (February 2024)

- "What to Know About the 3 Different Types of Foreclosure", Experian (February 2022)

- "repossession", LII (July 2021)

- "What Happens if I Default on a Loan?", Experian (January 2024)